-

Net Forex Inflow Rose To $2.77bn In July

The Central Bank of Nigeria said in its report on forex flows the net foreign exchange inflow into the Nigerian economy rose slightly to $2.77bn in July from $2.27bn in June. Despite the contraction in autonomous inflow, the apex bank added that the upward trajectory in crude oil prices improved forex inflow through the bank,…

-

Fuel Imports Gulp $690m In Eight Months

Latest data from the Central Bank of Nigeria has shown that the foreign exchange used for fuel imports from January to August in 2021 fell by 34.79 percent from $930.31m in the same period of 2020. This development is coming despite the idleness of the refineries to produce fuel and forex scarcity in the country…

-

Foreign Exchange Inflow Drops To $4.97bn

Figures obtained from the Central Bank of Nigeria has shown that the foreign exchange inflow into the economy fell by 59.8 percent in April. This is according to the bank’s monthly report on ‘Foreign exchange flows through the economy’. Part of the report read, ‘Aggregate foreign exchange inflow into the economy declined sharply, reflecting tepid…

-

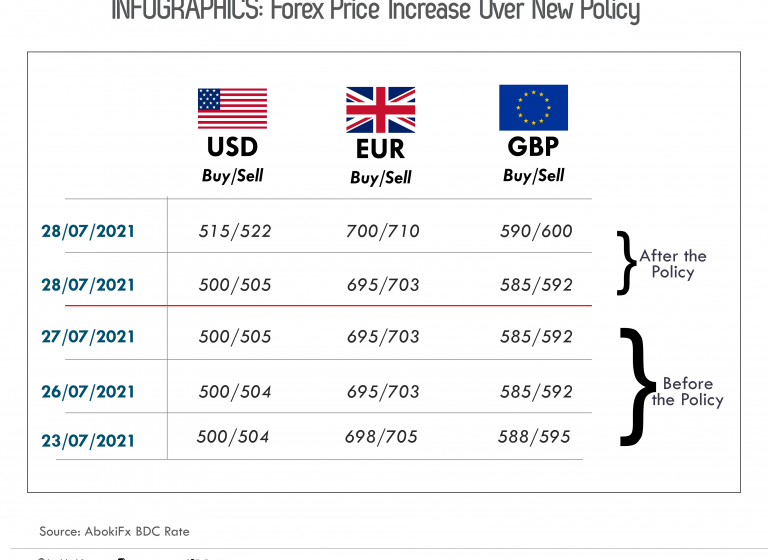

INFOGRAPHICS: Forex Price Increase Over New Policy

The Central Bank of Nigeria, last week, announced the discontinuity of forex supplies to the Bureau de Change Operators in the country. The end of forex sales and new licence was approved after the Monetary Policy Committee two-day meeting. BDCs were set up to receive a weekly supply of FX from the CBN for onward…

-

Naira Falls to N525/$1 As CBN Stops Forex Sale to BDCs

Nigeria’s naira has dropped to N525 to a dollar at the parallel market as the Central Bank of Nigeria (CBN) discontinued the sale of foreign exchange (FX) to Bureaux De Change (BDCs) operators in the country. The local currency, which opened today’s trading at N505/$1, lost N20 or 3.9 percent, according to data on abokiFX.com. At…

-

Foreign Stock Investors Withdraw N99.94bn

Foreign investors from the Nigerian stock market pulled out a total of N99.94bn in the first four months of 2021. According to data from the Nigerian Exchange Limited, the foreign portfolio investors injected N78.31bn into the market from January to April. Foreign portfolio investment outflow includes sales transactions or liquidation of portfolio investments through the…

-

Foreign Reserves Rise To $34.85 Billion

The foreign reserves, on April 1, stood at $34.85 billion, representing $404 million increase compared to $34.41 billion on March 11. This rose has been attributed to the Central Bank of Nigeria ‘Naira for Dollar’ policy which led to positive accretion to the foreign reserves exactly one month after takeoff. The policy has seen dollar…

-

CBN Disburses $80m Weekly For School Fees, BTAs

The Central Bank of Nigeria has said it disbursed at least $80m on a weekly basis to enable Nigerians meet their forex responsibilities. This was as part of an effort to address lingering foreign exchange scarcity in the country. The CBN Governor, Godwin Emefiele, in its 278th Monetary Policy Committee, urged Nigerians not to panic,…

-

CBN Keeps Monetary Policy Rate At 11.5%

The Monetary Policy Committee of the Central Bank of Nigeria has voted to retain the monetary policy rate at 11.5 percent. The committee also retained the liquidity ratio at 30 percent and cash reserve ratio at 27.5 percent. The CBN governor, Godwin Emefiele said of the nine-member committee, six members voted to maintain all parameters…

-

Nigeria Adopts New Flexible Exchange Rate Policy

In a move that effectively marks the third devaluation of the naira in a year, Nigeria has adopted a new flexible exchange-rate policy for official transactions. The Federal Government will begin to use the flexible rate– that has until now applied to investors and exporters– for government transactions too, Finance Minister Zainab Ahmed said. The…