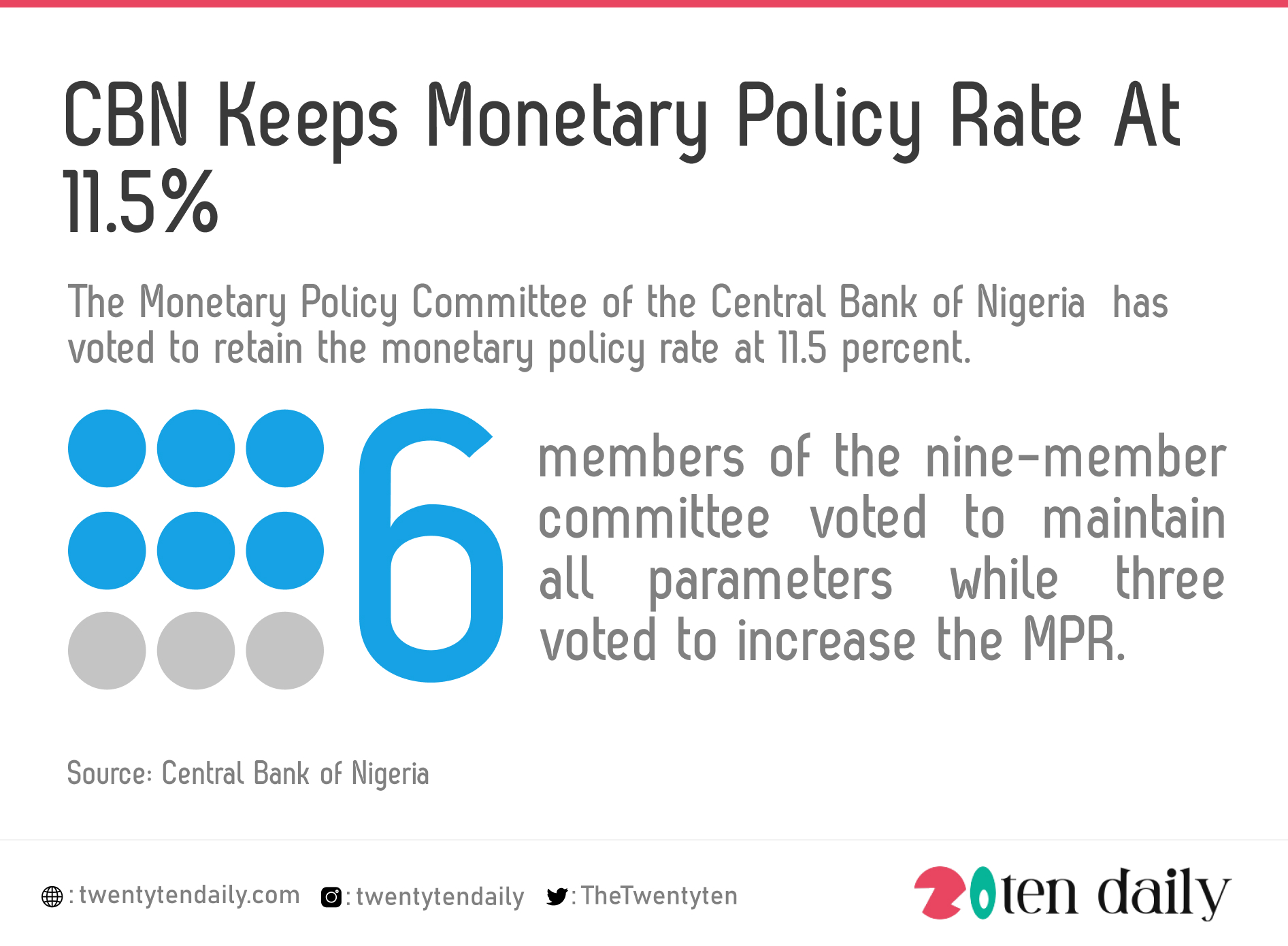

CBN Keeps Monetary Policy Rate At 11.5%

The Monetary Policy Committee of the Central Bank of Nigeria has voted to retain the monetary policy rate at 11.5 percent.

The committee also retained the liquidity ratio at 30 percent and cash reserve ratio at 27.5 percent.

The CBN governor, Godwin Emefiele said of the nine-member committee, six members voted to maintain all parameters while three voted to increase the MPR.

“The committee decided by a vote of three members to increase MPR by 60, 75 and 50 basis points, respectively, while six members voted to hold all parameters constant.

“The dilemma that confronted the committee relates to whether to continue to focus on efforts to stimulate output growth.

“It was also to decide whether to focus on reigning in inflation, which at 17.5 per cent, is almost attaining the January 2017 inflation level of 18.72 per cent,’’ Emefiele said.

The committee had earlier in September 2020 agreed to reduce the benchmark interest rate to 11.5 percent from 12.5 percent.

At the last MPC meeting for last year, it was decided that the rate and others should be left intact so as to monitor its full impact on the economy, which officially slipped into recession in the third quarter of the year.

The MPR is the baseline interest rate in an economy and every other interest rate used within an economy is built on the MPR.

Explaining further, Emefiele said that increasing the MPR will increase the cost of borrowing and reduce access to credit for businesses which he said might reverse the growth trend of the economy.

On the nation’s rising inflation rate, the CBN boss said it was triggered by insecurity and a rise in the prices of petroleum and electricity.