Tags :CBN

Claim:A text message circulating on WhatsApp claims the Central Bank of Nigeria will reintroduce a new Naira policy by November, 2023. The viral message also claims that the policy, which will take effect by 2024, Read More

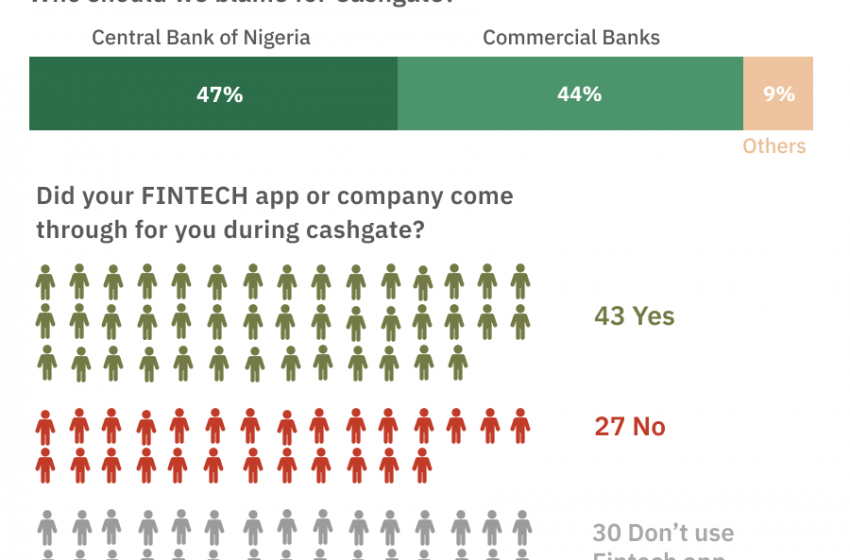

Quadri Yahya The Central Bank of Nigeria and the citizens are in a tug of war as the apex bank wishes to keep the cash in circulation in commercial vaults, but the Read More

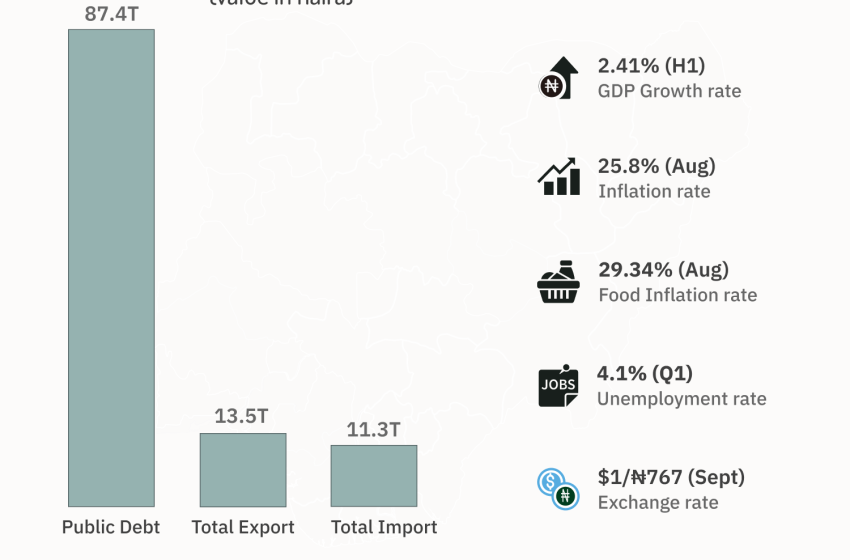

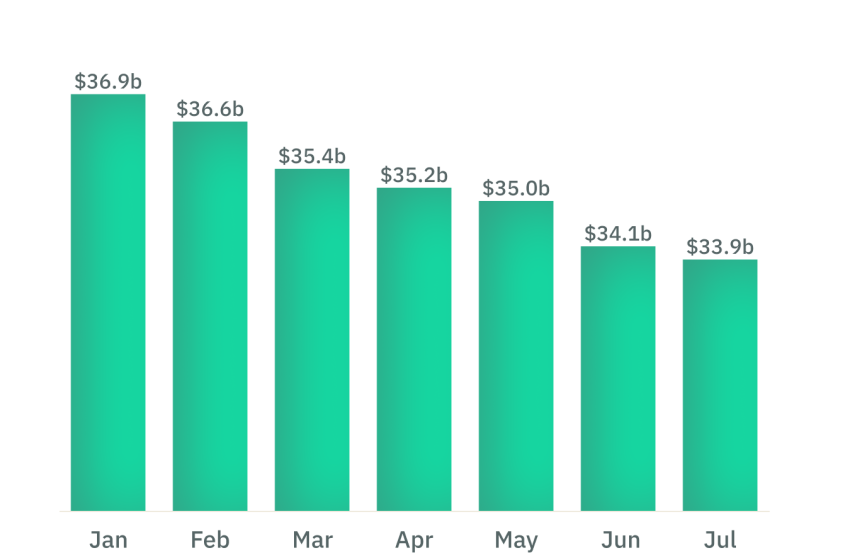

Figures obtained from the Central Bank of Nigeria on money market indicators revealed that the maximum lending rate in the banking sector hit 29.13 per cent while savings deposit rates were 4.13 per cent as of the Read More