-

Debt Servicing May Gulp 100% Of FG’s Revenue By 2026

The International Monetary Fund has warned that debt servicing may gulp 100 percent of the Federal Government’s revenue by 2026. The IMF predictions are hinged on if the government fails to implement adequate measures to improve revenue generation. The IMF’s Resident Representative for Nigeria, Ari Aisen, disclosed this while presenting the Sub-Saharan Africa Regional Economic…

-

In Two Months, CBN Defends Naira With $3.36bn

Figures obtained from the Central Bank of Nigeria’s January monthly report on ‘Foreign Exchange Market Developments’ showed that $1.71bn and $1.65bn were injected in December 2021 and January 2022 respectively. This is part of efforts to ensure the stability of the naira. In total CBN injected $3.36bn into the foreign exchange market in two months.…

-

In Three Months, Nigerians Spend $221m On Foreign Education

Data obtained from the Central Bank of Nigeria have shown that Nigerians spent at least $220.86 million on foreign education between December 2021 and February 2022. This is according to the CBN data on the amount spent on educational service under the sectoral utilisation for transactions valid for foreign exchange for December 2021 to February…

-

Cashless Transactions Rise By 44%

According to data from the Nigeria Inter-Bank Settlement System, cashless transactions rose by 44 percent year-on-year to hit N117.33tn in the first four months of 2022. From January 2022 to April 2022, N117.33tn was processed through electronic channels, which is N35.79tn more than N81.54tn that was processed in the corresponding period of 2021. Cashless transactions…

-

Nigeria’s Q1 trade deficit rose by 175%

According to data from the Central Bank of Nigeria, the value of Nigeria’s international trade deficit rose by 175.13 percent from $152.94 million in January 2022 to $420.79 million in March 2022. The International Trade Summary on the CBN’s website shows that the total value of international trade was $28.77bn in Q1 2022. Imports stood…

-

Bank Loans To Govt Rise To N16.32tn

Figures obtained from the Central Bank of Nigeria have shown that the total net credit by the Nigerian banking sector to the government rose by N2.2 trillion in the first quarter. The CBN’s data on ‘Money and credit statistics’ have shown the net credit to the government rose from N14.12tn as of the end of…

-

Forex Remittances Crash By 48%

Figures obtained from the Central Bank of Nigeria have revealed that Nigeria’s total direct remittances dropped by $119.4 million. This is a drop to $130.12 million as of January 2022 from $249.52 million as of December 2021. The development indicates a 48 percent increase over a period of one month. Breakdown Analysis According to the…

-

Bank Deposits Rise To N16.89tn In Three Months

Figures obtained from the Central Bank of Nigeria revealed , banks’ demand deposits rose by N1.1tn in three months to N16.89tn as of the end of March 2022. According to the CBN, the figure, which stood at N15.81tn as of the end of January, rose to N16.17tn as of the end of February. Currency in…

-

Power Firms Owe Banks N861.14bn

According to the Central Bank of Nigeria data, the debt owed to Nigerian banks by operators in the power sector rose by 12.83 per cent in one year to N861.14bn in December 2021. This is coming amidst the lingering problems plaguing the sector since it was privatized over eight years ago. According to figures obtained…

-

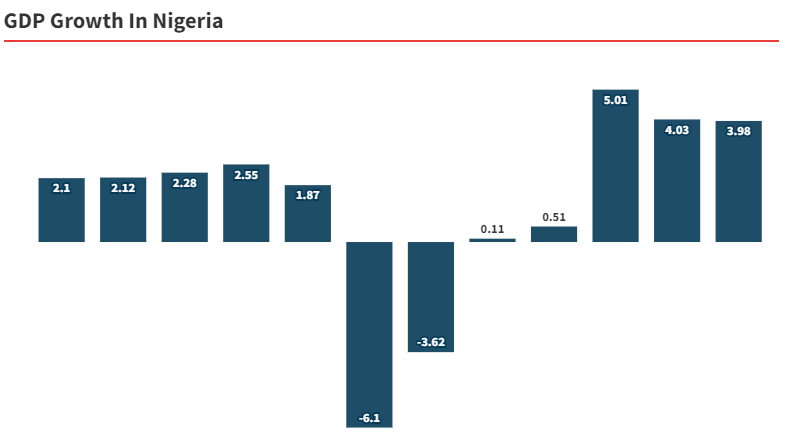

Reviewing Nigeria’s 2021 GDP Growth (1)

The National Bureau of Statistics has reported that the country’s Gross Domestic Product increased by 4.03 percent in the third quarter of 2021. This is contained in its Gross Domestic Product Report Expenditure and Income Approach report for Q3, Q4 2021. According to the report, in the third quarter of 2021, Nigeria’s real GDP at…