-

Banks’ Income Tax Rise By 35%

Nigerian banks have paid N75.4 billion as Company Income Tax (CIT) in the first half of the year, (H1’22), representing a 35 per cent rise when compared to N55.67 billion paid in H1’21. Meanwhile, the Federal Government tax revenue rose by 31 percent to N2.44 trillion in H1’22 from N1.86 trillion in H1’21. The banks…

-

Nigeria’s FIRS Grows VAT by 20%

The Federal Inland Revenue Service has grown its proceeds of Value of Added Tax by 20 percent to N1.2tn in the first six months of 2022. According to different reports by the National Bureau of Statistics, the total sum generated through VAT stood at N1.008tn in the first two quarters of 2021. NBS data also…

-

Nigeria Generates N127.03bn Tax From Calls, SMS

According to data from the National Bureau of Statistics, the Federal Government made N127.03bn from Value Added Tax on calls, SMS, data, and other information and communication services in the first six month of the year. This is 10.69 per cent of the total N1.19tn that was collected as VAT within the period under review. …

-

Tax Revenue Rises 30% To N2.85trn

Revenue into the Federation Account from Value Added Tax, VAT, and Company Income Tax, CIT, rose by 30.1 per cent, year-on-year, YoY, to N2.85 trillion in nine months ended September 30th, 2021 (9mths-21) from N2.19 trillion in the corresponding period of last year (9mths-2020). Findings in the VAT and CIT data for Q3 ‘2021 released…

-

VAT Allocation Between January & August 2021 In Nigeria

-

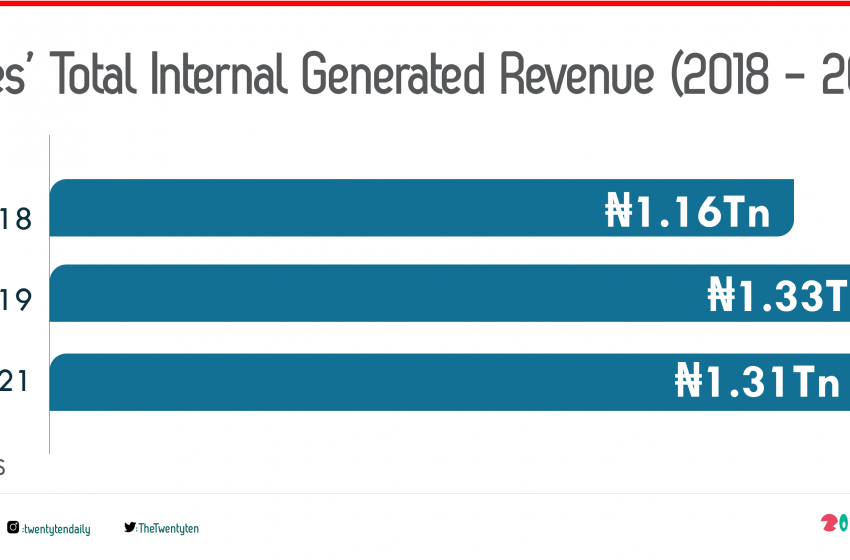

Explainer: VAT War Might Crush States Revenue

Value Added Tax, according to the Federal Inland Revenue Service, is a consumption tax paid when goods are purchased and services rendered. It is borne by the final consumer; that is all goods and services, both produced within or imported into the country, are taxable- except those exempted by the VAT Act. The VAT charge…

-

VAT Generation Hits N512.25b In Q2

The National Bureau of Statistics has said the Federal Inland Revenue Service (FIRS) generated N512.25 billion Value Added Tax (VAT) in the second quarter of 2021. This is higher than the revenue generation of N496.36billion in the first quarter of 2021 and N327.20 billion in the corresponding period of 2020. The sectoral distribution of Value…

-

FAAC Shares N605bn In May 2021

A total sum of N605.958 billion has been shared by the three tiers of government as revenue from the federation accounts allocation committee in May 2021. In a statement, Charles Nwodo, spokesperson of the federal ministry of finance, budget and national planning, said the disbursed fund is lower by N11 billion when compared to the…

-

Federal Government Earned 1.5 Trillion From VAT In 2020

The Federal Government has generated a sum total of N1.531 trillion from Value Added Tax in 2020. This was disclosed in the latest report published by the National Bureau of Statistics on Sectoral distribution of Value Added Tax for the fourth quarter of 2020. The report reads: “Sectoral distribution of Value Added Tax data for…