For the first time in 10 years, the UK government has announced that more has been borrowed in January than collected through tax and other income.

January is usually a key revenue-raising month as it is when taxpayers submit their self-assessment returns.

Tax income fell by less than £1bn, but the government spent £19.7bn more than last year on measures such as furlough.

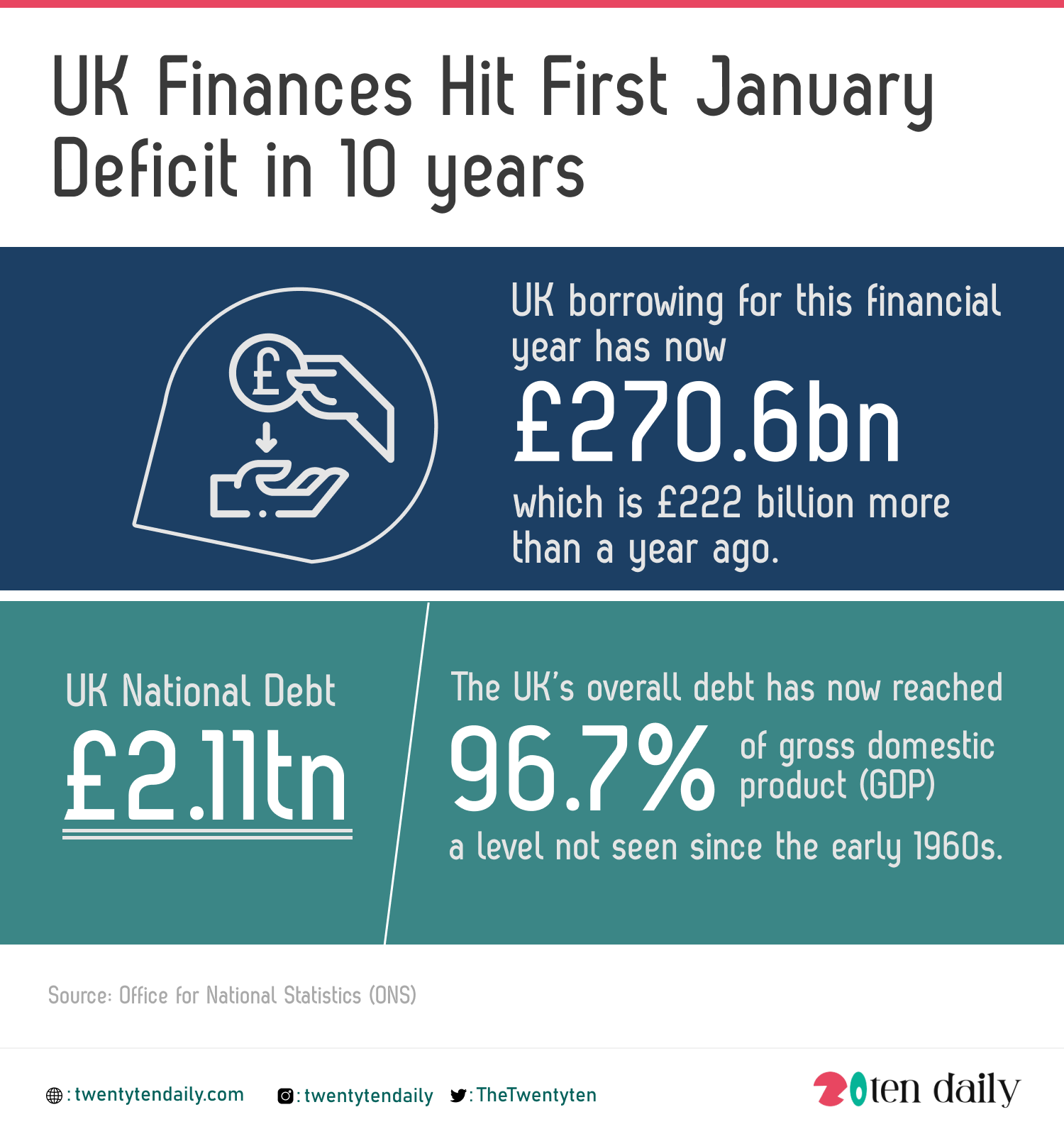

According to data provided by the Office for National Statistics (ONS), Government borrowing for this financial year has now reached £270.6 billion, which is £222 billion more than a year ago.

The independent Office for Budget Responsibility (OBR) has estimated that borrowing could reach £393.5bn by the end of the financial year in March. That would be the highest amount in any year since the Second World War.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics said the borrowing figure was lower than expected but that “should not be interpreted as a signal that the economy is withstanding the third lockdown relatively well”,

“A sharp £2.1bn year-over-year decline in interest payments, and the vanishing of contributions to the EU’s budget, which totalled £2.2bn in January 2020, helped,” he pointed out.

The increase in borrowing has led to a steep increase in the national debt, which now stands at £2.11 trillion.

The UK’s overall debt has now reached 97.6% of gross domestic product (GDP) – a level not seen since the early 1960s.

However, the ONS warned that although the impact of the pandemic on the public finances is becoming clearer, “its effects are not fully captured” in the current data, and that its estimates of tax receipts and borrowing are “subject to greater than usual uncertainty”.