-

Net Forex Inflow Rose To $2.77bn In July

The Central Bank of Nigeria said in its report on forex flows the net foreign exchange inflow into the Nigerian economy rose slightly to $2.77bn in July from $2.27bn in June. Despite the contraction in autonomous inflow, the apex bank added that the upward trajectory in crude oil prices improved forex inflow through the bank,…

-

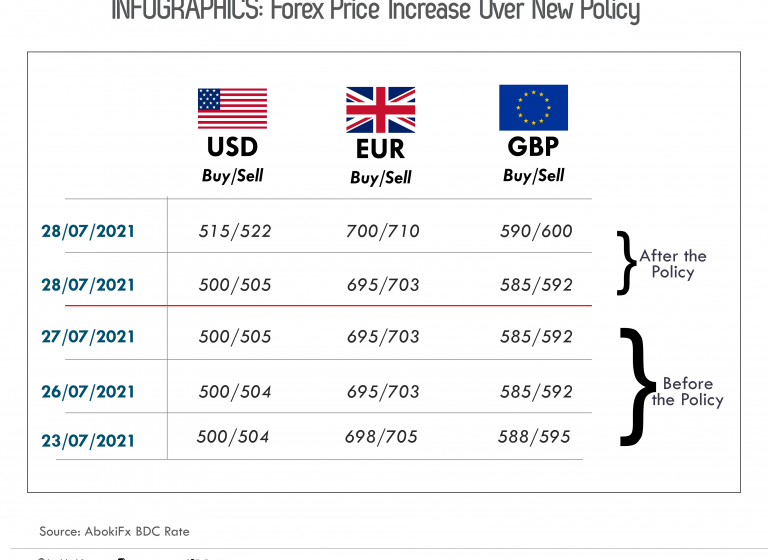

INFOGRAPHICS: Forex Price Increase Over New Policy

The Central Bank of Nigeria, last week, announced the discontinuity of forex supplies to the Bureau de Change Operators in the country. The end of forex sales and new licence was approved after the Monetary Policy Committee two-day meeting. BDCs were set up to receive a weekly supply of FX from the CBN for onward…

-

Nigeria Spent $160m forex On Food Import In January

The Central Bank of Nigeria has revealed that the country spent $160m from its foreign exchange on food importation in January. According to figures obtained from CBN’s economic report on ‘Sectoral utilisation of foreign exchange’ for January showed that this was lower than $310m spent in December. The report reads: ‘“Total foreign exchange utilisation by…

-

Foreign Reserves Rise To $34.85 Billion

The foreign reserves, on April 1, stood at $34.85 billion, representing $404 million increase compared to $34.41 billion on March 11. This rose has been attributed to the Central Bank of Nigeria ‘Naira for Dollar’ policy which led to positive accretion to the foreign reserves exactly one month after takeoff. The policy has seen dollar…

-

CBN Disburses $80m Weekly For School Fees, BTAs

The Central Bank of Nigeria has said it disbursed at least $80m on a weekly basis to enable Nigerians meet their forex responsibilities. This was as part of an effort to address lingering foreign exchange scarcity in the country. The CBN Governor, Godwin Emefiele, in its 278th Monetary Policy Committee, urged Nigerians not to panic,…

-

CBN Introduce N5 for $1 Rebate

Nigeria’s Apex Bank has introduced a rebate of ₦5 for every $1 of funds remitted to Nigeria, through International Money Transfer Organisations in its new forex policy. The Central Bank Governor, Godwin Emefiele, who disclosed in a virtual event at its inaugural webinar on the impact of the new forex policy on diaspora investments, said…