-

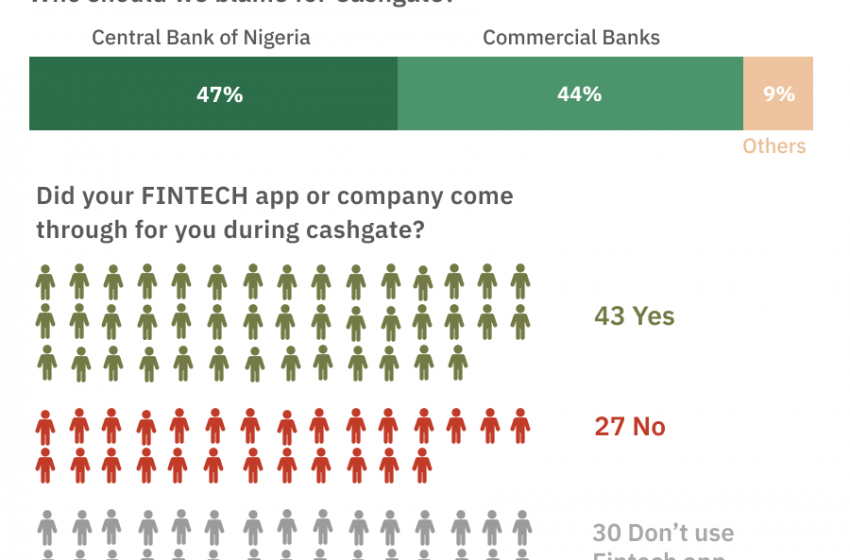

#DailyChart: Nigerians vote on a Twitter poll.

-

#DailyChart: Value and Volume of NIP Transactions

-

Banks Lending Rate Hits 29.13%

Figures obtained from the Central Bank of Nigeria on money market indicators revealed that the maximum lending rate in the banking sector hit 29.13 per cent while savings deposit rates were 4.13 per cent as of the end of December 2022. According to the report, the prime lending rate was 13.85 per cent, while the…

-

FAAC Shares N990bn For December 2022

The Federation Account Allocation Committee shared N990.189 billion to the three tiers of government as revenue from the month of December 2022. The amount is inclusive of gross statutory revenue, value-added tax (VAT), exchange gain and electronic money transfer levies. From the amount, the federal government received N375.306 billion, the states received N299.557 billion and…

-

Is Nigeria’s Inflation Rate The Highest Under Buhari?

Overview: Mr. Festus Kayamo said that Nigeria’s inflation rate under the current administration is not the highest figure when compared to the Obasanjo administration. We looked back at the figures reported to confirm his claim. The spokesperson for the presidential campaign council of the All Progressives Congress standard bearer, Festus Keyamo, has said that the…

-

Bank Borrowing From CBN Rises By 260%

According to the Central Bank of Nigeria’s financial data, Deposit Money Banks borrowed the sum of N5.744 trillion from the CBN via the Standing Lending Facility window and Repurchase Lending platform in 2022. This is a 260 per cent increase when compared to the N21.87tn recorded via the same windows in 2020 and a 19.3…

-

Capital Importation Falls By 24%

Capital importation into Nigeria’s economy fell year-on-year by 24.6 per cent to $4.56 billion in the first 10 months of 2022 (10M’22). This is from $6.05 billion in the corresponding period of 2021. Findings from the Monthly Economic Report of the Central Bank of Nigeria, CBN, also showed that capital outflows declined y/y by 32…

-

FG’s Deficit Spending Falls By 21%

Data from the Central Bank of Nigeria has shown that the deficit spending by the Federal Government fell by 21 per cent, Month-on-Month. This is a drop to N530 billion in October last year from N670.7 billion in September, driven by a decline in interest payments on domestic debts. Meanwhile, revenue into the Federation Account…

-

Consumer Credit Falls By 1.3%

The Central Bank of Nigeria has disclosed that consumer credit fell Month-on-Month by 1.3 per cent. This, according to the bank, is a drop to N2.37 trillion in October 2022 from N2.4 trillion in September 2022. CBN disclosed this in its October 2022 Economic Report, noting that the development in consumer credit was a result…

-

Export Intervention Loans Rise By N44bn

In statements released in the last Monetary Policy Committee meeting in 2022, the Central Bank of Nigeria’s intervention funds under its Export Facilitation Initiative rose to N44.58 billon in October 2022. It said, “Under the Export Facilitation Initiative, the Bank provided support for export-oriented projects to the tune of N5.34 billion, such that the cumulative…