The Central Bank Of Nigeria recently disclosed it had so far recovered N89.2 billion excess and illegal charges slammed on customers by banks in Nigeria following several reports from aggrieved customers.

After the creation of the Consumer Protection Department in 2012, the Director for the unit revealed that between 2010 and 2014, CBN refunded N14.69 billion of excess charges to banks customers.

In 2015 alone, Nigerian banks were compelled to refund over N6.2billion excess charges deducted from bank customers. Also, between January and June 2016, the sums of N4.63billion, $80,415.46 and E19, 263.62 were refunded to bank customers respectively. This implies that between 2010 till June 2016, an estimated sum of N25.25billion excess charges was refunded to aggrieved bank customers.

The CBN also received 6,000 complaints relating to arbitrary, and in some cases, illegal bank charges levied on customers by Deposit Money Banks (DMBs) in Nigeria in 2015. Six years after, the CBN in very clear terms exposed the fact that it has seemingly failed to put an end to the corporate robbery of unsuspecting bank customers. How so? The Central Bank of Nigeria ceremoniously revealed that it’s Consumer Protection Department had received over 23,526 complaints – more than triple the figure recorded in 2015.

What are these excessive and illegal bank charges? how do you know you are being defrauded by your bank and what is the CBN doing about this issue?

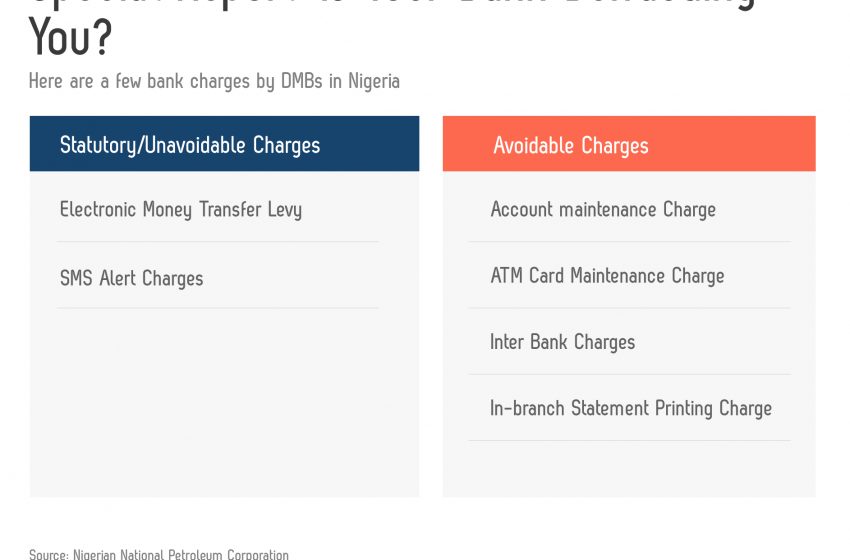

In Nigeria, commercial deposit banks charge on every service rendered as it should be. However, over time, this has plagued their customer’s experiences as the supposed charges are mostly hidden, unnecessary and sometimes against the guidelines stipulated by the CBN.

Bank Charges Explained

Electronic Money Transfer Levy: This is a one-off charge of N50 on electronic receipt or transfer of money deposited on sums of N10,000 or more on any type of account in a deposit money bank.

The EMT levy was introduced in the Finance Act 2020, which amended the Stamp Duty Act. It is shared based on the derivation and distributed at 15% to the Federal Government (FG) and 85% to the state governments.

Note that this statutory charge may reoccur when if your account is credited multiple times in a month.

SMS Alert Charges: SMS alerts are notifications of transactions on all accounts. A text notification is sent to a registered phone line after every activity on an account. At least N4 is charged per notification.

Inter-Bank Transfers: As recently directed by the CBN, all interbank transfers must carry a fee depending on the volume of the amount being transferred. All intra-bank transfers are free, according to CBN.

| 0 – 5,000 | N10 |

| 5,001 – 50,000 | N25 |

| 50,001 – Infinity | N50 |

| Intra-bank transfers | Free |

Account Maintenance Fee: This is one of the very popular but avoidable charges by DMBs in Nigeria. It is calculated on the total amount of debit transactions or withdrawals on an account at a given interval. This means that your account should not be charged AMC if there are no withdrawals electronically via instant transfer, online or physical withdrawal with your cheques in the banking hall. Ideally, the charge is only taken from current and corporate accounts. The AMF is charged at N1/Mille, i.e One Naira is deducted from your account per One thousand naira withdrawal.

The charge for N10,000 is N10 and N1,000 for N1m. If your account is a high debit turnover account, this charge will become very frequent on your current corporate account. It is taken monthly.

ATM Card Maintenance Charges: This is a monthly charge the bank takes on new and existing debit and credit cards.

These bank charges may seem ideal especially when accounts are debited less than N100 per charge. However, for accounts with high debit turnover, these charges can run into thousands of naira when summed up.

ATM Card maintenance Charge and Account Maintenance Charge are among popular avenues DBMS can illegally or unnecessarily debit a customer.

On the other hand, Account Maintenance Charge(AMC) are not be charged on accounts that are purposed for savings. This means that if a customer continues to build an account balance without making withdrawals, the account should not be charged an AMC. This is why savings accounts are not debited for AMC.

Viz Breakdown of AMC

For Card Maintenance Charges, a customer is at liberty to instruct the bank on how to charge his/her account. Oftentimes, unsuspecting customers are unaware that expired cards or lost cards are still being charged for by some DMBs. Customers can do well to instruct the bank to unmap all lost/expired cards from their accounts.

Other unethical practices through which banks short-changed their customers

1) Delay in booking customers’ request for term deposits and other investments as at when due and subsequent refusal to back-date the booking of such investments to the date the customers submitted the requests

2) Deliberate delay in carrying out customers’ requests for interbank transfers

3)Failure to roll over fixed deposits and other investments as at when due

4) Changing of agreed rate on fixed deposits without informing the customer

5)Non-compliance with fees concession agreements

6) Failure to promptly treat ATM cash withdrawal refund requests.

CBN Intervention

The Central Bank of Nigeria (CBN) on April 21, 2017, released a Guide to Charges by Banks and other financial institutions in Nigeria. The guideline which replaced the Guide to Bank Charges issued on April 1, 2013, took effect on May 1, 2017. The above action is in line with Section 2(d) of the CBN Act 2007 which stipulates the promotion of a sound financial system in Nigeria.

The Guide also stipulated that banks would obtain approval from CBN before applying any charge that is not captured in the new Guide. Further, banks and other financial institutions (OFIS) were mandated to inform the customers of their right to negotiate if a charge is identified as ‘” Negotiable” in the Guide. A stipulation some banks ignore.

While the CBN has gone further to establish the Consumer Protection Unit to stop arbitrary charges and illegal deductions, the unit can still do more. The Customer Protection department (CPD) needs to be strengthened to carry out a periodic review of banks and other financial institutions’ operations, with the view of identifying illegal deductions and excess charges on customer’s accounts rather than wait to receive complaints before facilitating refunds. This would compel the banks to make prompt refunds to customers. This way, complaints would reduce rather than increase.