Non-performing Loans Decline 0.1%

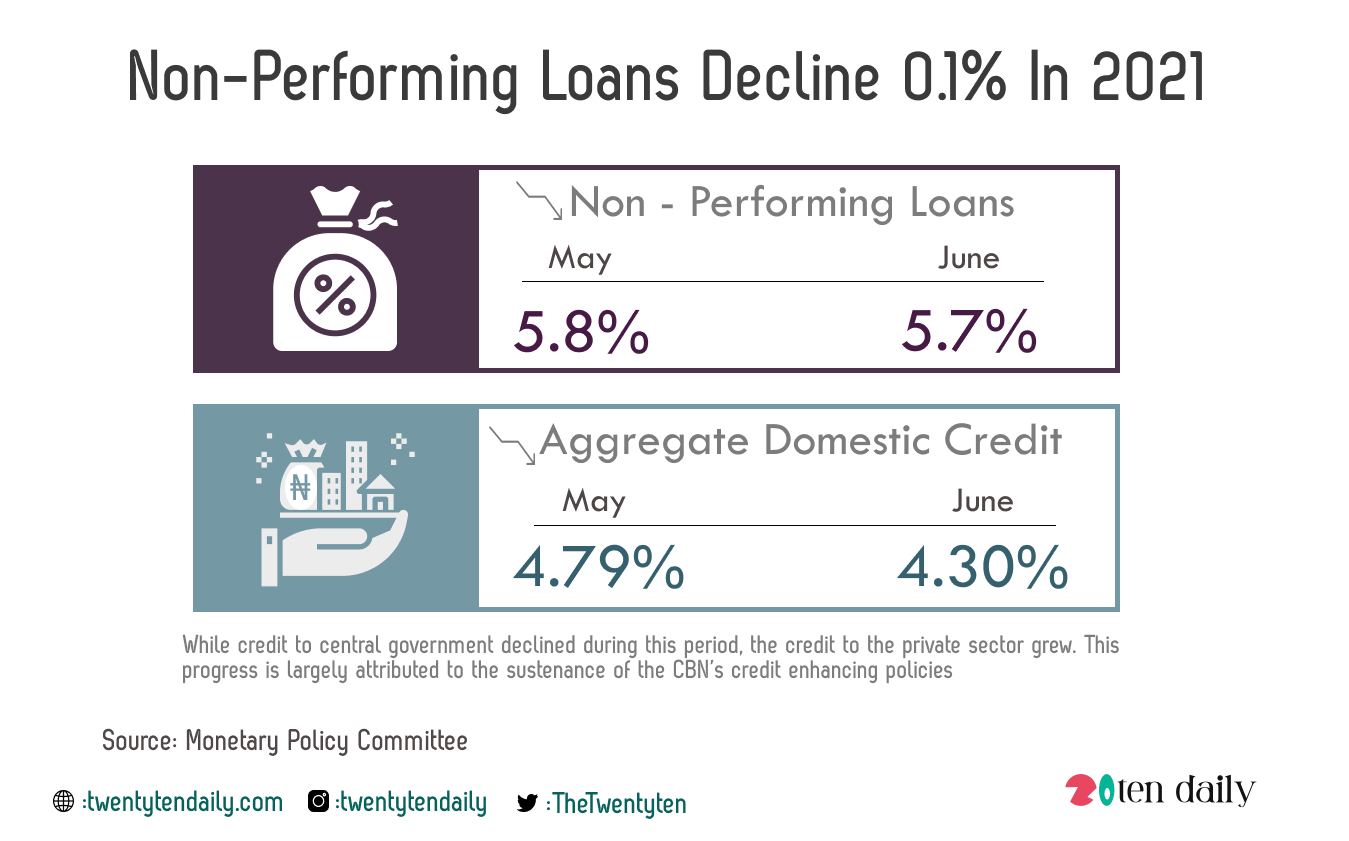

The non-performing loans in the banking sector have slightly declined from 5.8 per cent in May to 5.7 per cent in June.

This, according to the Central Bank of Nigeria showes more resilience in the banking sector.

CBN disclosed this in the personal statements of members of the Monetary Policy Committee.

According to a member of the MPC, Robert Asogwa, the banking sector remained stable with strong liquidity.

He stated, “System liquidity remained ample even though aggregate domestic credit grew by only 4.30 per cent in June 2021 compared with 4.79 per cent in May 2021.

“While credit to central government declined during this period, the credit to the private sector grew. This progress is largely attributed to the sustenance of the CBN’s credit enhancing policies.

“The banking sector itself remains stable and resilient, with strong liquidity and capital adequacy ratios.

“The ratio of gross nonperforming loans to total loans further declined from 5.8 per cent in May to 5.7 per cent in June 2021.”

He added that the repayments and recoveries were noted in key sectors including, oil and gas, manufacturing, construction and agriculture.

Also, Folashodun Shonubi, another member of the MPC, said the banking sector remained resilient and continued to be the major channel for supporting the domestic economy.

“The non-performing loan ratio improved marginally to 5.7 per cent, though it was slightly above the prudential maximum of five per cent.

“Monetary aggregates developments and money market rates reflected the impact of the bank’s liquidity management measures”, he said.