Nigeria Suffers N1.4tn Shortfall In Five Months

An analysis of the Medium Term expenditure framework and Fiscal Strategy paper for 2022-2024 has shown that between January and May 2021, the Federal Government recorded a revenue shortfall of N1.4trillion.

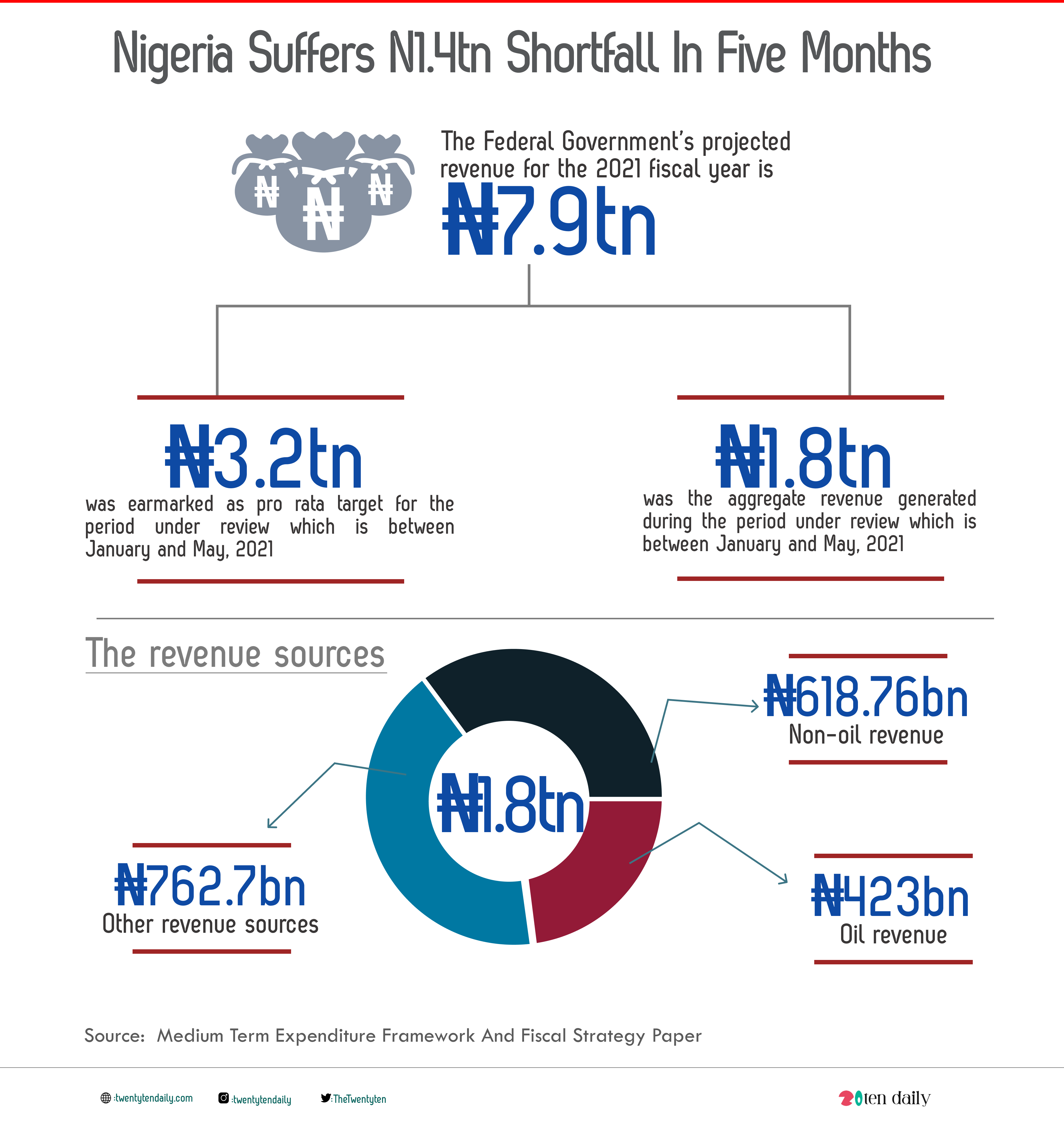

The report obtained from the Budget Office of the Federation said the Federal Government’s projected revenue for the 2021 fiscal year is N7.9tn, of which N3.2tn was earmarked as pro rata target for the period under review.

However, as at May 2021, the government had only generated N1.8tn – a 56.25 percent of the pro rata estimate.

This translates into a revenue gap of N1.4tn.

Also, during the review period, the aggregate revenue of N1.8tn consisted of oil revenue of N423bn, non-oil revenue of N618.76bn and N762.7bn from other revenue sources including independent revenue of N487.01bn.

“As at May 2021, FGN’s retained revenue was N1.84tn, 67 percent of pro rata target. FGN share of oil revenues was N423bn (which represents 50 per cent performance), while non-oil tax revenues totalled N618.76bn (99.7 percent of pro rata).

“Companies Income Tax and Value Added Tax collections were ahead of the budget targets with N290.90bn and N123.85bn, representing 102 percent and 125 per cent respectively of the pro rata targets for the period. Customs collections was N204bn, 86 percent of target.

“Other revenues amounted to N762.7bn, out of which independent revenues accounted for N487.01bn”, the report reads.

Further analysis of the report revealed that within the same timeframe, the government recorded a budget deficit of N3trillion.

It showed that the Federal Government released N4.8trillion to cover expenditures made between January and May, representing 92.7 percent of the prorated budget excluding the GOEs’ and project-tied debt expenditures.”

“Out of this amount, N1.5tn was spent on personnel costs, including pensions; N973.13bn was spent on capital projects while N1.8tn, the total revenue generated within the stated period, was plunged into debt servicing.

“Of the expenditure, N1.8bn was for debt service (37 per cent of FGN expenditures); and N1.5tn for personnel cost, including pensions (31 per cent of FGN expenditures). As at May, N978.13bn had been released for capital expenditure,” it stated.