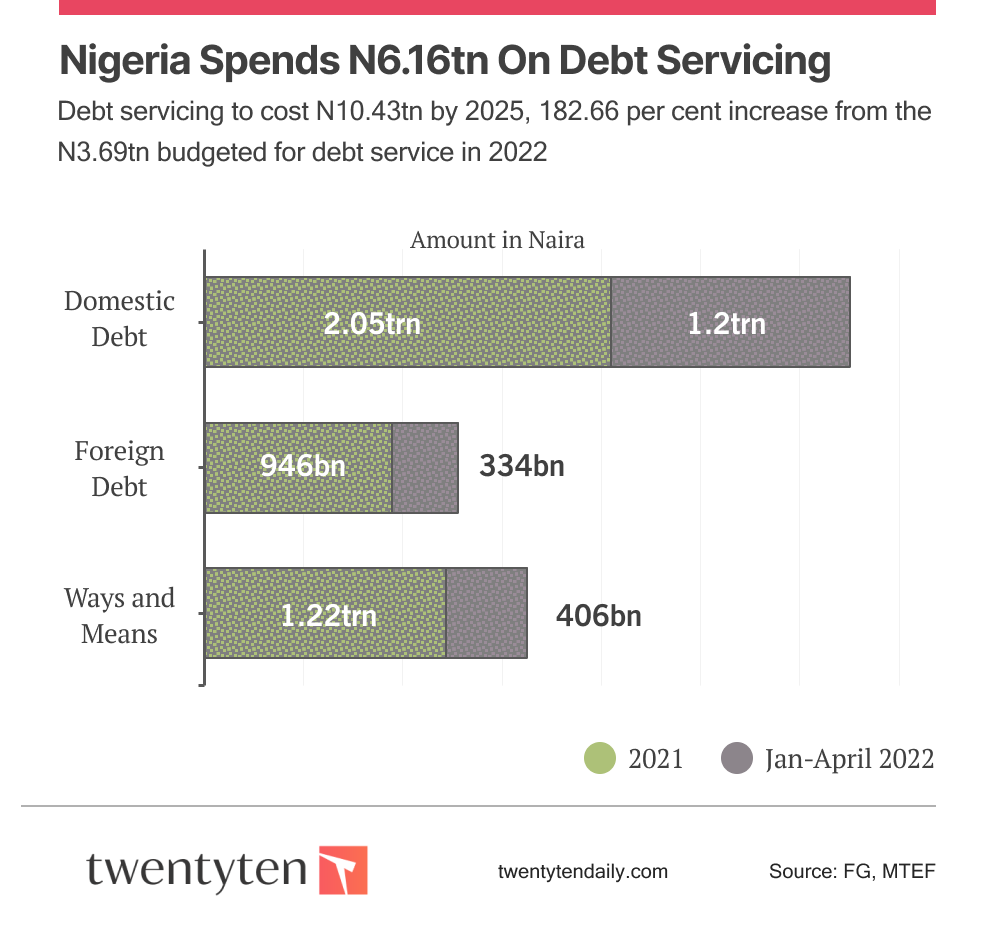

According to the 2023-2025 Medium Term Expenditure Framework & Fiscal Strategy Paper, debt service gulped N6.16trllion in 16 months.

In 2021, the Federal Government spent N4.22trllion on debt service, and further N1.94trllion between January and April 2022.

A breakdown shows that domestic debt service cost N2.05trllion, while foreign debt service gulped N946.29billion in 2021.

There was also N600m sinking fund and N1.22tn interest on ways and means, which is defined as the government borrowing from the Central Bank of Nigeria.

In the first four months of 2022, domestic debt servicing cost was N1.2tn, whereas foreign debt service expenditure amounted to N334.24bn. There was also N405.93bn interest on ways and means.

The Federal Government further projected that debt servicing to cost N10.43tn by 2025, according to the 2023-2025 MTEF/FSP document.

This is a 182.66 per cent increase from the N3.69tn budgeted for debt service in 2022.

Recall that Nigeria’s debt servicing bill increased by 109 per cent, from N429bn in December 2021 to N896bn in March 2022.

The World Bank, also, recently said that Nigeria’s debt, which might be considered sustainable for now, was vulnerable and costly.

According to the Washington-based global financial institution, the country’s debt was also at risk of becoming unsustainable in the event of macro-fiscal shocks.

The World Bank recently said that Nigerian states would likely lose N18.8bn in oil and gas revenues in 2022, as worsening revenue collection at the federation level would increase budgetary pressures for the states.

According to the global lender, the declining revenue from the federation had put many states in a precarious fiscal position.