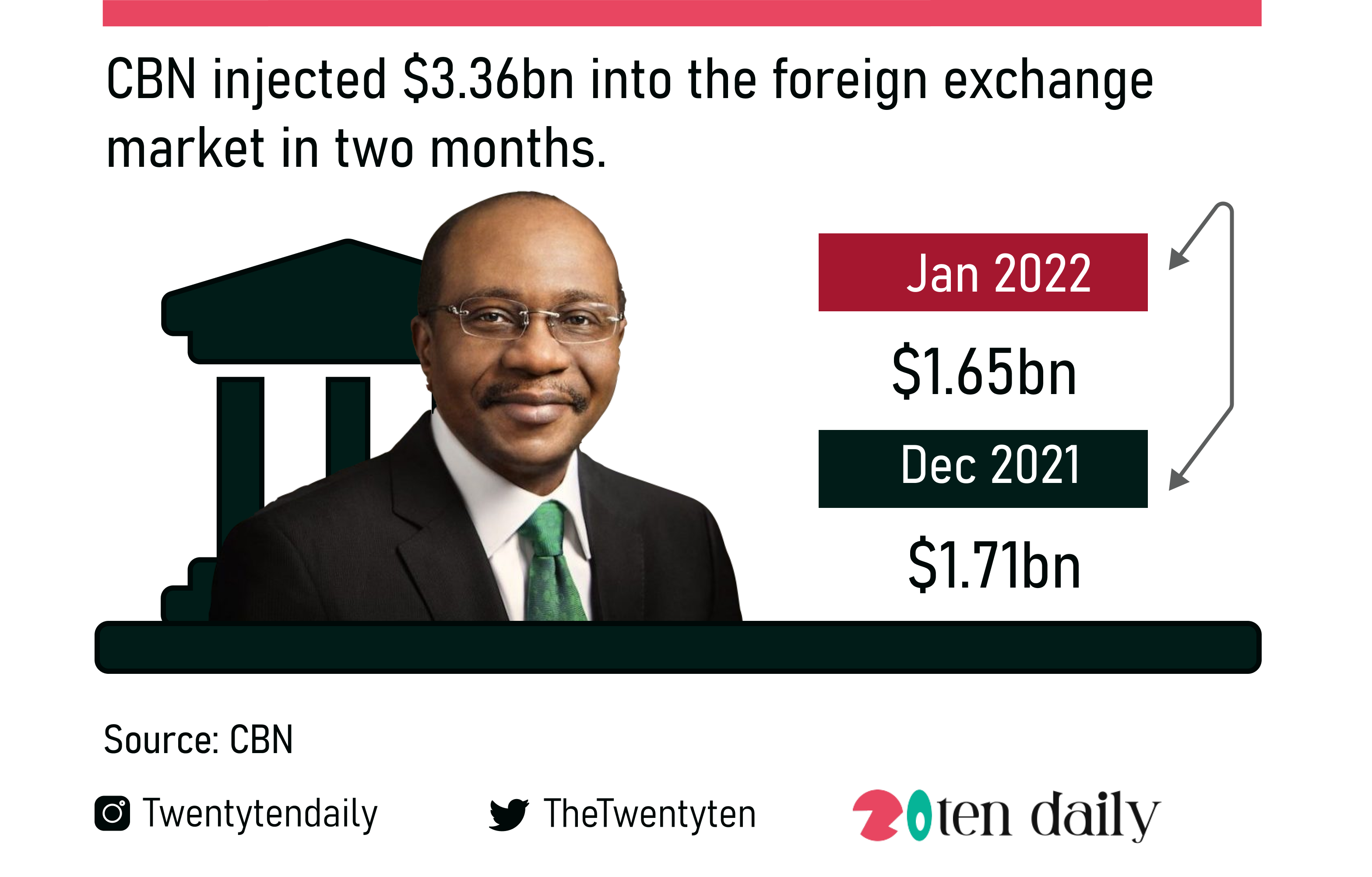

Figures obtained from the Central Bank of Nigeria’s January monthly report on ‘Foreign Exchange Market Developments’ showed that $1.71bn and $1.65bn were injected in December 2021 and January 2022 respectively.

This is part of efforts to ensure the stability of the naira. In total CBN injected $3.36bn into the foreign exchange market in two months.

The report said, “Total foreign exchange sales to authorised dealers by the Bank was $1.65bn in January, representing a decrease of 3.1 per cent, relative to $1.71bn in December 2021.

“A breakdown shows that foreign exchange sales at the Small and Medium Enterprises window, interbank/invisible foreign exchange sales and matured swaps contracts rose by 24.4 per cent, 25.9 per cent, and 60.8 per cent to $0.14bn, $0.18bn and $0.21bn, respectively, in January, relative to the amount in December 2021.

“However foreign exchange sales to the Investors and Exporters and Secondary Market Intervention Sales windows fell by 13.7 percent and 16.3 per cent to $0.58bn and $0.54bn, respectively, in the month under review.”

The CBN stopped forex intervention through the Bureau de Change segment of the market in 2021 and said it would stop further interventions through the banks by the end of 2022.

The CBN Governor, Godwin Emefiele, after a meeting with the Bankers’ Committee recently, said to boost forex supply in the country through the non-oil sector in the next three to five years, it had launched the ‘RT200 FX Programme’.

Emefiele said after careful consideration of the available options and wide consultation with the banking community, it launched the Bankers’ Committee RT200 FX Programme which stood for the “Race to $200bn in FX repatriation.