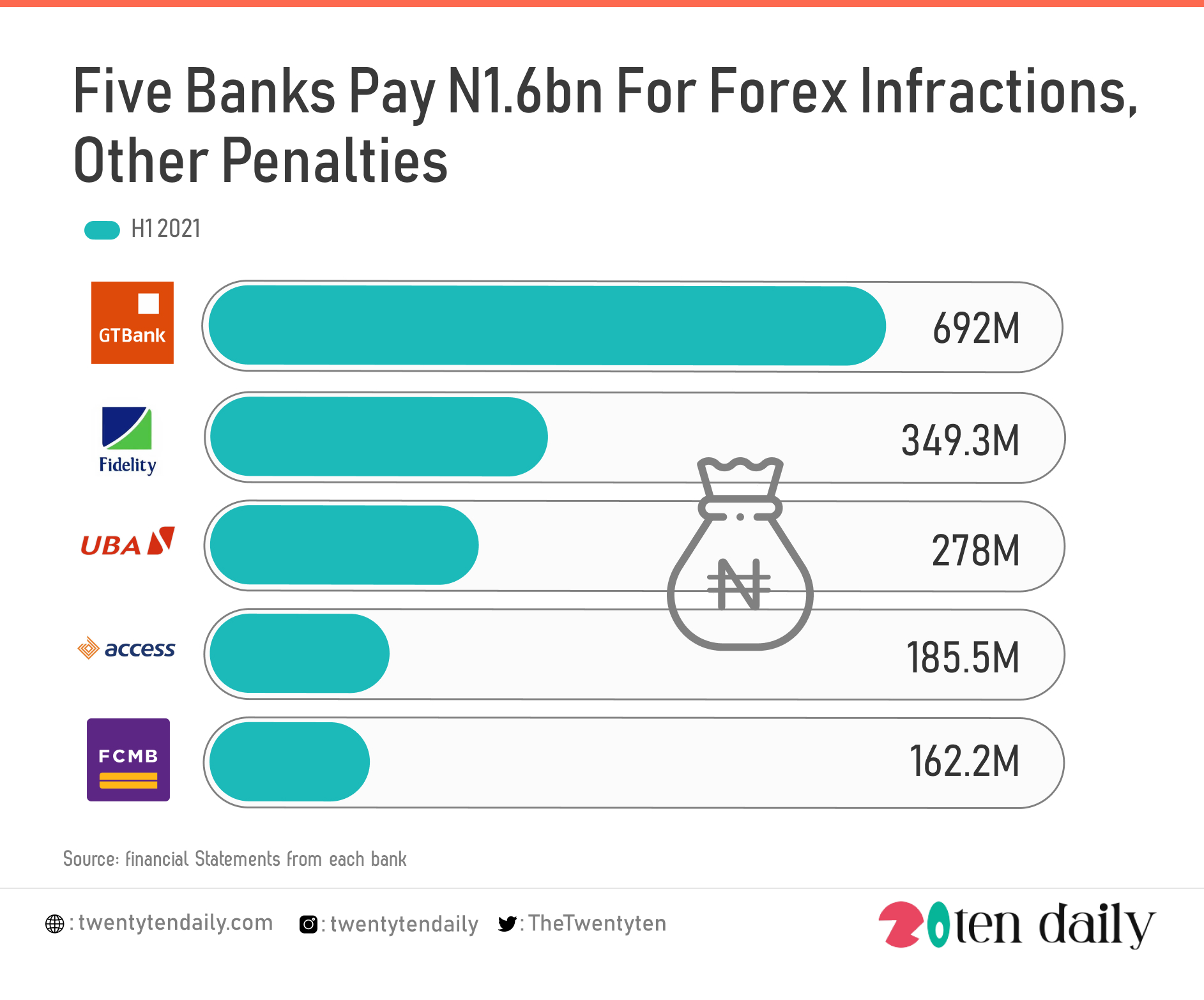

In the first half of the year, five banks in Nigeria paid a total of N1.4 billion as penalties to financial regulatory bodies such as the Central Bank of Nigeria, Security Exchange Council and Financial Reporting Council of Nigeria.

The banks include UBA , Fidelity Bank, Access Bank, GTBank and First City Monument Bank.

This figure was arrived from analysis of the H1 2021 financial statements of the banks obtained from their websites.

These penalties were as a result of contraventions and infractions of guidelines instituted by the Federal Government through the Banks and Other Financial Institutions Act, relevant CBN circulars and other regulatory requirements.

The BOFIA Act is a regulatory framework that was introduced to guide the financial industry. The Act which was first enacted in 1997 empowers the CBN to implement its provisions.

The president, Major General Muhammadu Buhari (retd.), had in November 2020, signed the amended BOFIA Act 2020 which repealed the erstwhile BOFIA 2004.

Breakdown Analysis

In the period under review, GTB paid a total sum of N692 million as penalties to regulators for two major infractions bordering on foreign exchange transactions carried out by Betting and Gaming Companies (N690m) and non-refund of interest on debit of non-interest related charges to non-funded accounts (N2m).

Fidelity bank paid the sum of N64.1m to the CBN during the period under review for forex trade infractions and other forex infractions, risk based supervision between 2018 and 2019 and late returns. Also, SEC sanctioned the bank to the tune of N1.1m for late filing of its December 31 2020 Audited Financial Statement.

The total sum paid for infractions by Fidelity bank in H1 2021 was N349.3 million. This is lower than the aggregate sum of N414.5 million paid as penalties in H1 2020.

For Access Bank, N184.5 million was fined by the CBN while SEC fined the bank N1m during the review period.

UBA incurred regulatory sanctions of N278 million in H1 2021. This is N287 million lower than the sum of N565 million incurred in H1 2020.

Meanwhile, FCMB Group’s penalties dropped to N162.3 million in H1 2021. This is from N150.2 million paid to regulatory bodies in H1 2020.