A Nigeria-based Access Bank has announced it is set to unveil a new contactless payment technology that leverages facial recognition and AI.

The face recognition payment system allows the platform to identify and verify the user without inputting passwords. The recognition system matches the unique facial dimensions of the customer against the BVN image to authenticate the customer.

While this might seem new to Nigeria, bank transactions and payments are already happening millions of times a day across China’s major cities and some parts of the US.

The two biggest mobile payment apps in China, Alipay (owned by ecommerce giant Alibaba) and WeChat Pay – both are racing to install their facial recognition systems across the country.

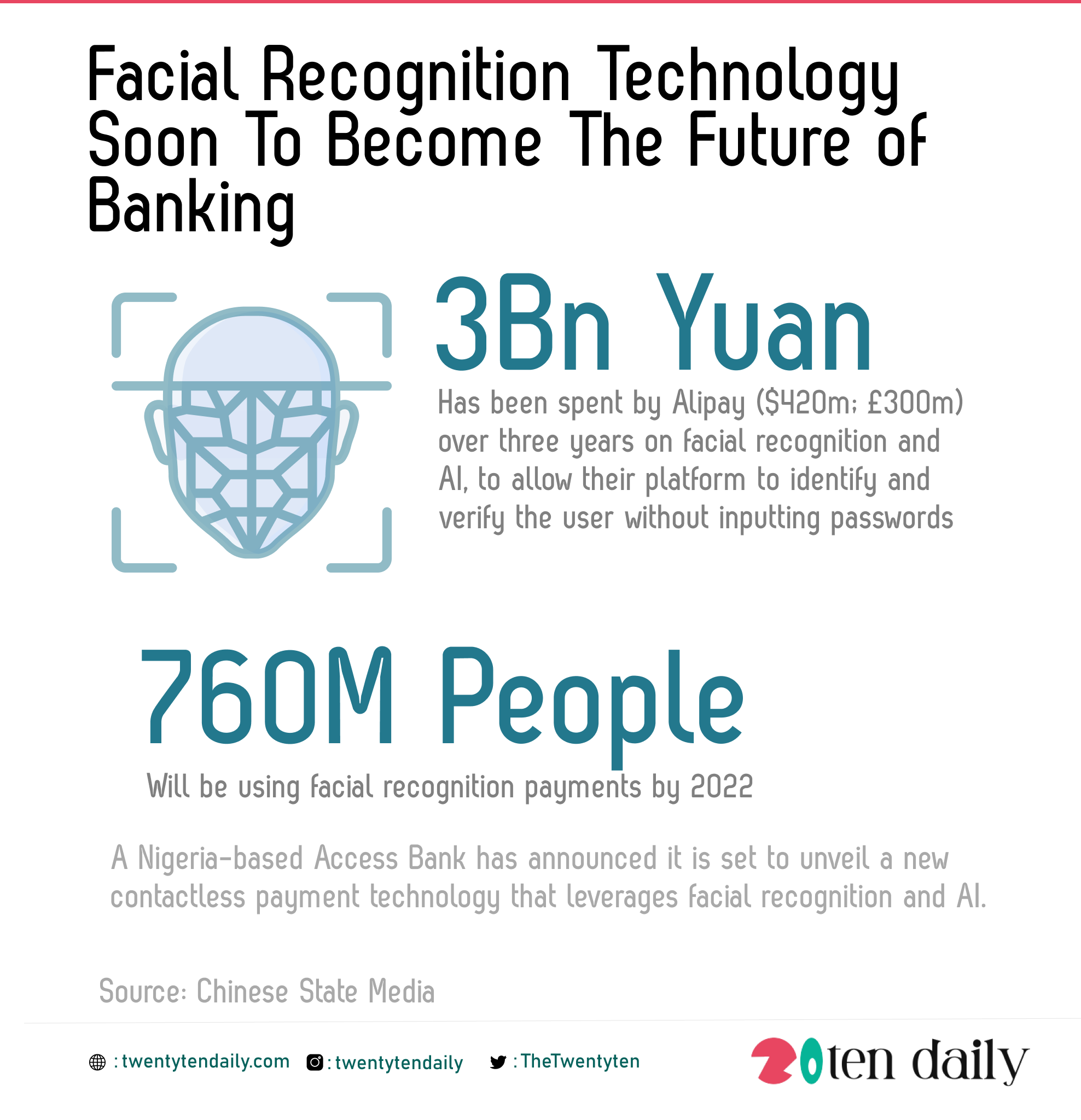

Alipay is spending three billion yuan ($420m; £300m) over three years, and according to Chinese state media, 760 million people will be using facial recognition payments by next year.

In the US, a start-up firm called PopID, based in Los Angeles is currently used by about 70 independent restaurants and cafes across a handful of US cities, mainly on the West Coast.

How Does The New Technology Work?

For any bank related transactions or for payments, the customer is required to look at their reflection in a small LCD screen attached to the cashier’s counter and the machine instantly matches the facial features with the customer’s bank details and payments is processed. The entire process takes not more than 5 seconds.

The process does not require mobile phones or bank cards , any form of identification, or even a pin number.

PopID’s CEO John Miller says: “Our view is that using your face to pay is no different than using your phone.

“It’s just another way to identify yourself. The digital picture taken at point of sale is destroyed immediately, and the data isn’t shared with anyone.”

In fact, he argues that it’s less intrusive than paying by your mobile phone because a phone can track your location at all times via GPS. He adds that the photos stored by PopID are mathematical maps of unique facial vectors, not actual photographs.

Speaking on the safety of the technology, Wang Bing, from the Luoyang Vocational College of Science and Technology, in Henan Province, says that the software and camera systems are so advanced that they are impossible to trick, such as by stealing someone’s photograph. The technology can also differentiate between identical twins.

While the author of the book Banking 4.0, says that the exact measurements and features of your face are actually more secure than your account passwords.

“Facial payment is part of the growing digital identity structure… I appreciate the concerns about privacy, but the reality is that a [face-based] digital identity structure is inevitable for safety and security.

“Digital payments, transactions and services are becoming more and more embedded in our lives, and in our world, and that’s definitely going to require biometrics because passwords are simply not secure enough,” he added.

Experts believe that this new tech trend is driven by the coronavirus pandemic in a bid to reduce contact as much as possible.