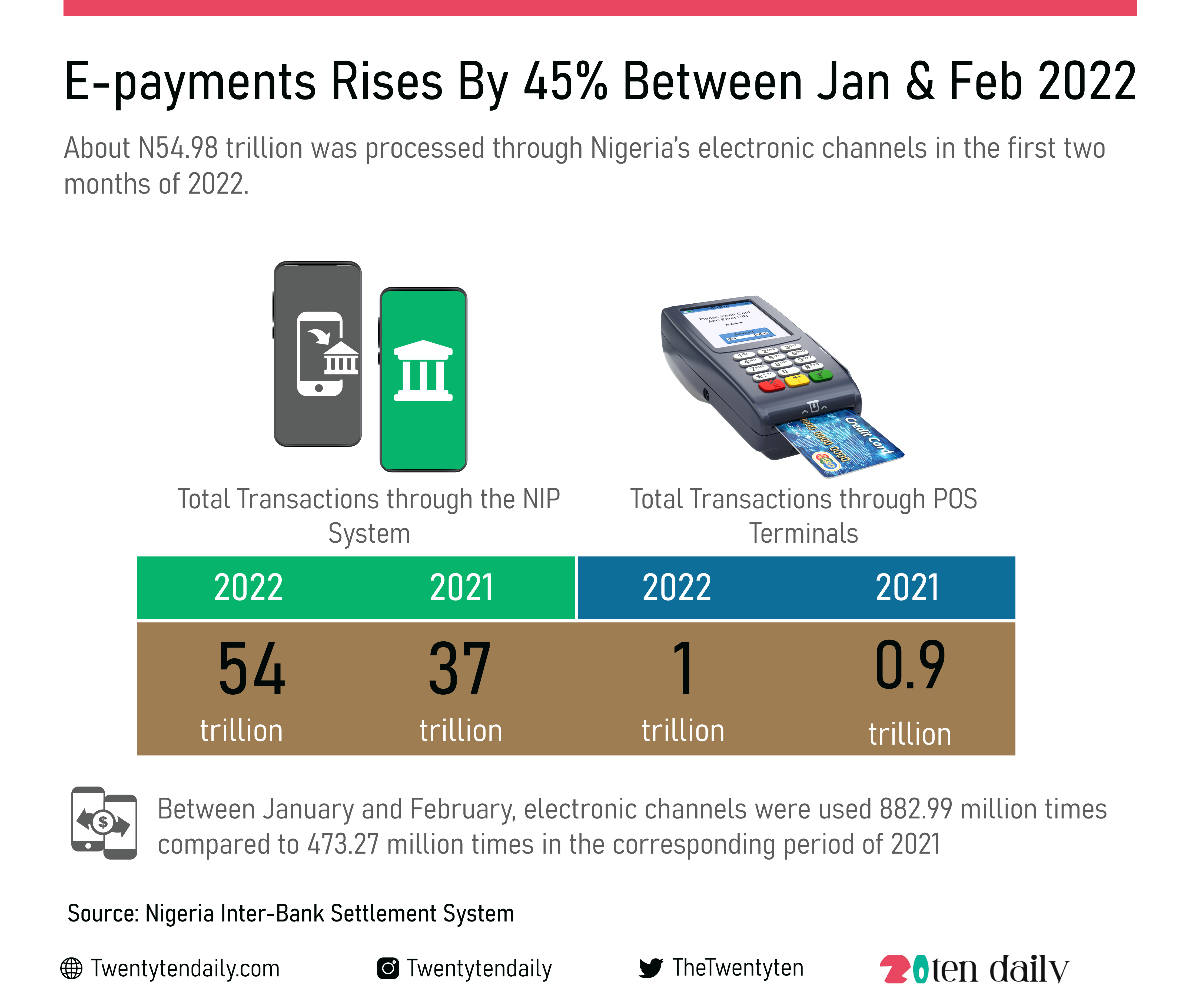

According to data from the Nigeria Inter-Bank Settlement System portal, about N54.98 trillion was processed through Nigeria’s electronic channels in the first two months of 2022.

This is a 45.49 percent increase from the corresponding period of 2021 when N37.79 trillion was processed through the nation’s electronic channels.

The NIBSS tracks payment volumes and value through the Nigeria Instant Payment System and Point of Sales terminals.

In the first two months of 2022, N53.83tn was transferred through the NIP system while N1.15tn was processed through PoS terminals.

In the corresponding period of 2021, N36.83tn was processed through the NIP system, while N958.19bn was processed through PoS terminals.

According to the data on the NIBSS portal, individuals used electronic channels 86.57 per cent more in the first two months of 2022 than they did in the corresponding period of 2021.

In the first two months, electronic channels were used 882.99 million times. In the corresponding period of 2021, they were used 473.27 million times.

The data also revealed that agent banking was on the rise. Of the 986,252 registered PoS in the nation, an all-time high of 955,234 was deployed in January 2022. This is 100.89 per cent from the 475,494 that was recorded in January 2021.

In a report NIBSS titled, ‘Instant Payments – 2020 Annual Statistics’, the NIBSS disclosed that mobile is driving electronic payments in the nation. Accounting for 43 per cent of total transactions in 2020, while 35 per cent of transactions were with USSD, indicating 78 per cent of total transfer transactions were carried out using mobile devices.

According to GSM Association, the global body for telecommunication companies, mobile money transactions hit more than $1tn in 2021.

It added that Nigeria and other countries in the Sub-Saharan region contributed N697.7bn to total mobile money value in 2021.