The International Monetary Fund has warned that debt servicing may gulp 100 percent of the Federal Government’s revenue by 2026.

The IMF predictions are hinged on if the government fails to implement adequate measures to improve revenue generation.

The IMF’s Resident Representative for Nigeria, Ari Aisen, disclosed this while presenting the Sub-Saharan Africa Regional Economic Outlook report.

According to him, based on a macro-fiscal stress test that was conducted on Nigeria, interest payments on debts may wipe up the country’s entire earnings in the next four years.

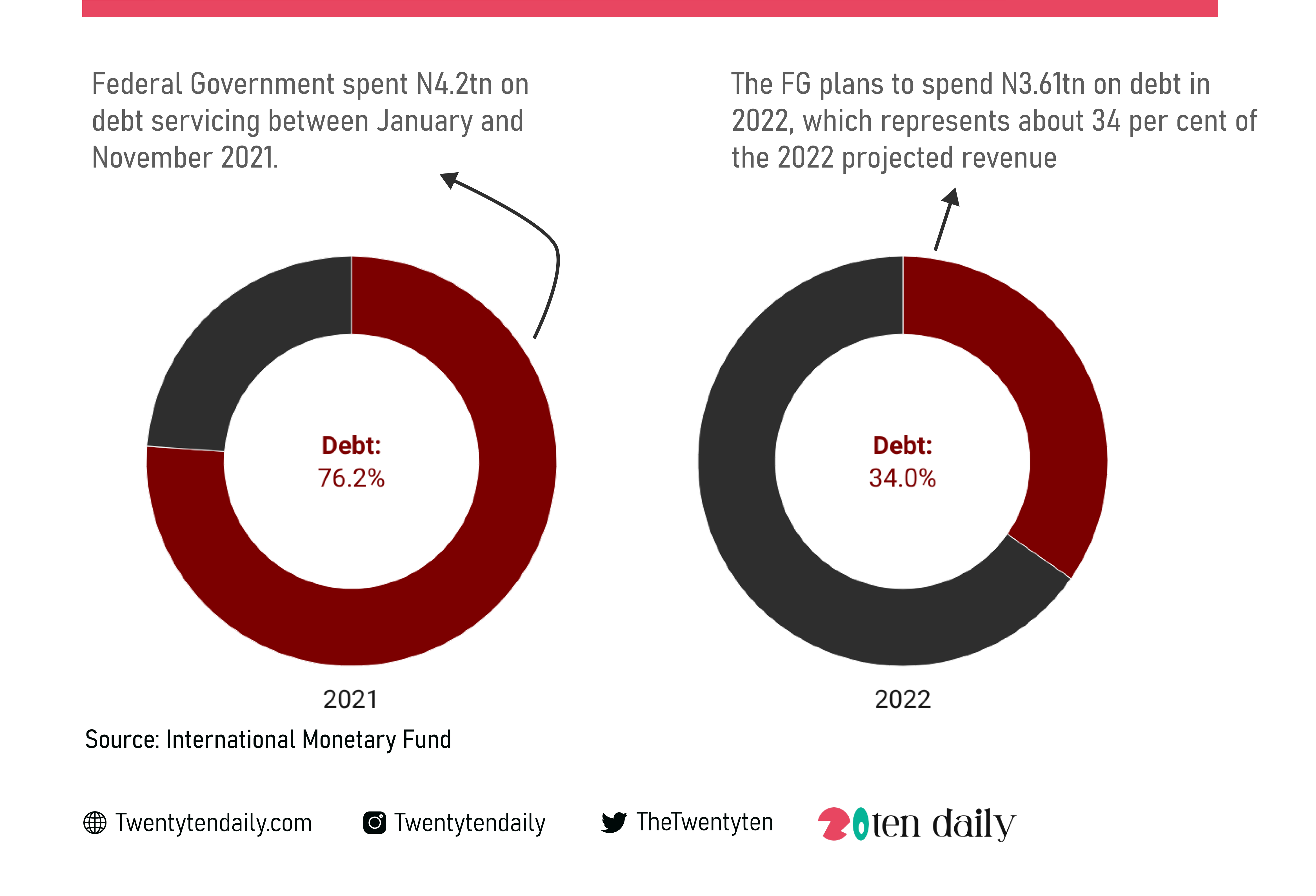

It was disclosed earlier this year that the Federal Government spent N4.2tn on debt servicing between January and November 2021.

This represents 76.2 per cent of the N5.51tn revenue generated during the period.

The Federal Government plans to spend N3.61tn on servicing Nigeria’s debt burden in the 2022 fiscal period, which represents about 34 per cent of the 2022 projected revenue of the Federal Government.

Nigeria’s debt stock, which is about N39.56tn as of December 2021, is likely to reach N45.95tn following plans by the Debt Management Office to borrow an additional N6.39tn to finance the 2022 budget deficit.

Aisen expressed worry that many African countries, including Nigeria, risk sliding into a critical debt servicing problem unless urgent actions were explored to significantly raise revenue.

Aisen said, “The biggest critical aspect for Nigeria is that we have done a macro-fiscal stress test, and what you observe is the interest payments as a share of revenue and as you see us in terms of the baseline from the federal government of Nigeria, the revenue almost 100 per cent is projected by 2026 to be taken by debt service.

“So, the fiscal space or the amount of revenues that will be needed and this without considering any shock is that most of the revenues of the federal government are now, in fact, 89 per cent and it will continue if nothing is done to be taken by debt service.

“It is a reflection of the low revenue of the country. The country needs to mobilise more revenue to be able to have macroeconomic stability. It has become an existential issue for Nigeria.”

He further lamented that being an oil exporter, Nigeria was not only unable to take advantage of the current global high oil prices to build reserves due to the subsidy on petroleum products.

According to him, Nigeria’s subsidy bill would likely hit N6tn by the end of this year at the current monthly subsidy bill of N500bn.

Aisen, however, expressed optimism that the Dangote Refinery would reduce fuel importation when completed, in order to reduce the subsidy burden and warned that soaring food prices and next year’s general election are threats to the country’s economy.