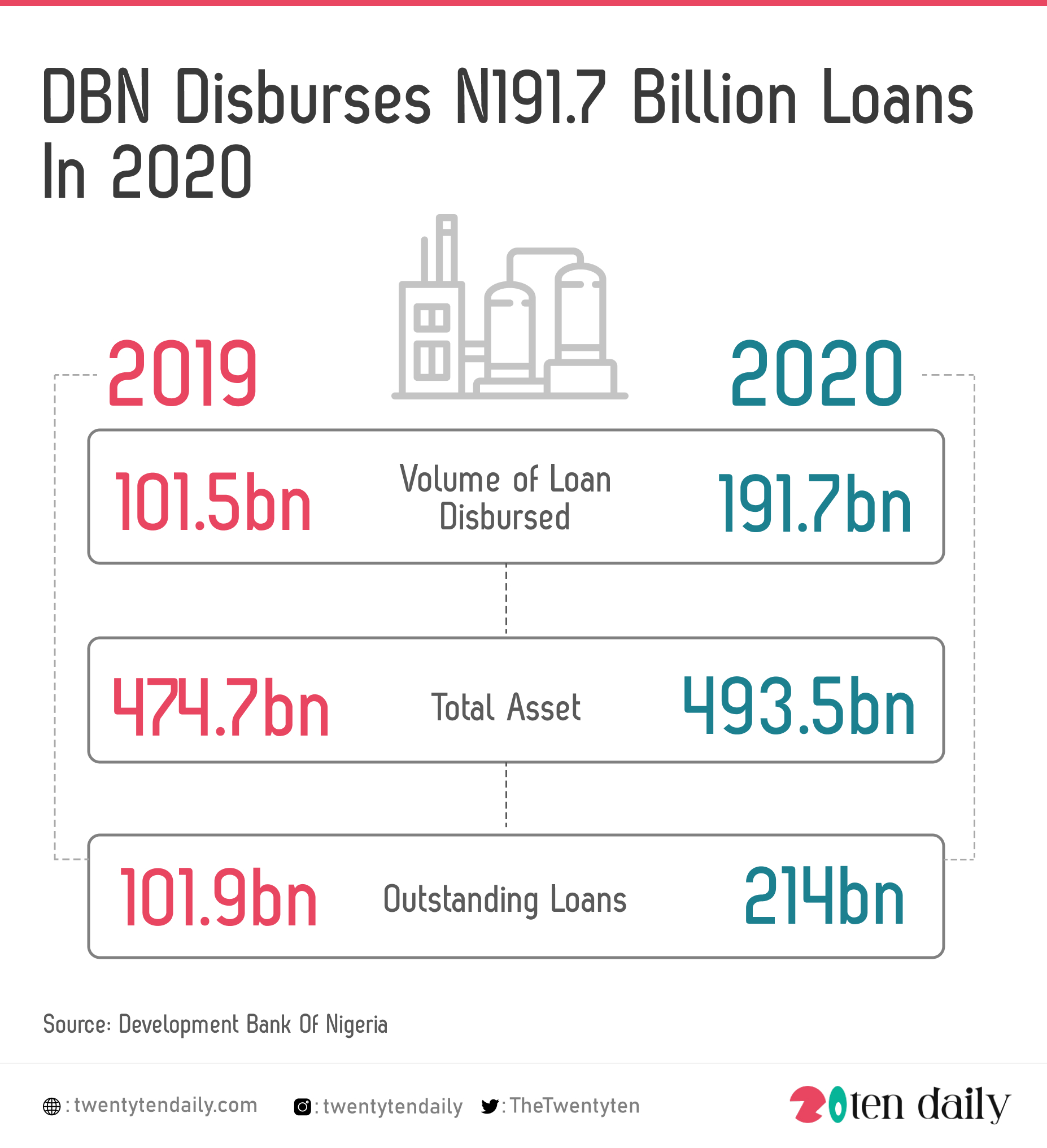

The Development Bank of Nigeria has said that it the volume of loans disbursed rose from N101.5billion in 2019 to N191.7billion in 2020, a 89 percent increase recorded.

It said this in its 2020 financial report explaining that the growth was in line with its mandate of facilitating socioeconomic development by improving financial access for micro, small and medium enterprises.

DBN Plc is a wholesale development finance institution, established by the Federal Government in collaboration with global development partners to address the major financing challenges facing MSMEs in Nigeria.

DBN recorded a growth of four percent in total assets from N474.7bn in 2019 to N493.5bn in 2020, while outstanding loans increased by 110 percent from N101.9bn in 2019 to close at N214bn in 2020.

According to the report stated that income from loans also grew by 60 percent year-on-year from N6.6bn in 2019 to N10.5bn in 2020.

Also, the return on assets and return on equity stood at four and 11 percent respectively for the year ended December 31, 2020.

The bank stated that it deployed several cost containment strategies resulting in a 12 per cent decrease in operating expense year-on-year, while its earnings stood at N34.6bn.

The Managing Director, DBN, Tony Okpanachi, said the bank worked through its Participating Financial Institutions to facilitate increased lending to MSMEs, thereby accelerating economic growth.

“We appreciate the full cooperation of our board, management, staff, and other stakeholders as we were able to operate within strict health and safety guidelines, while increasing our reach to our target market.

“By onboarding more PFIs, we were able to deepen financial inclusion for more MSMEs whose businesses were adversely affected by the pandemic, thereby injecting a new lease of life and providing the right environment for their sustained growth” Okpanachi said.