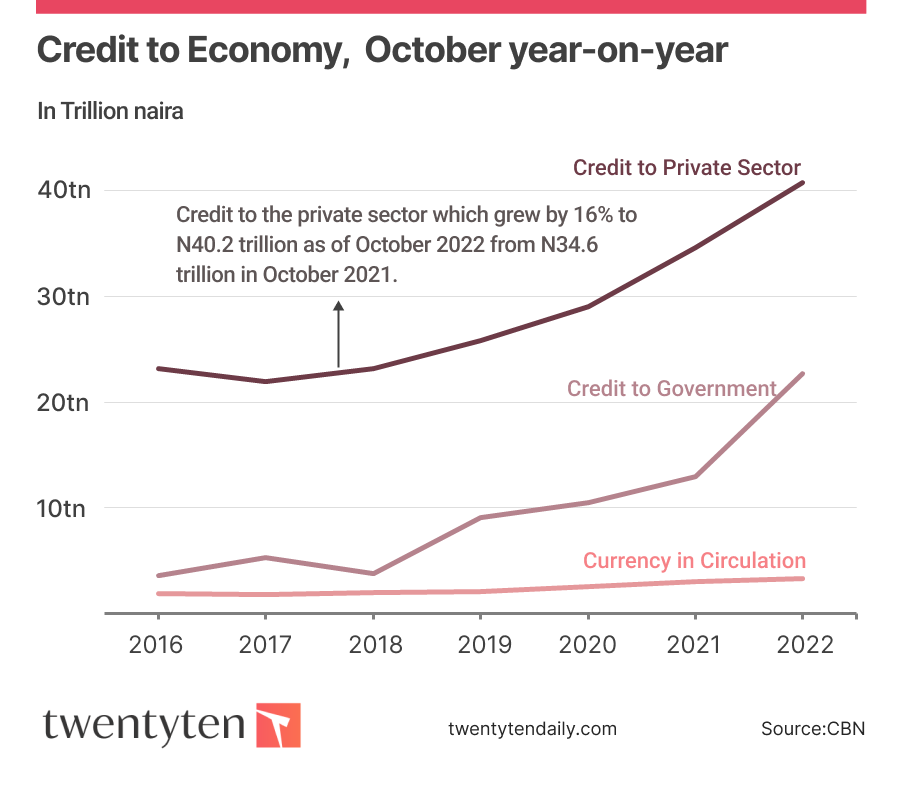

According to data in the Central Bank of Nigeria Money and Credit Statistics for October 2022, Banks’ credit to the economy rose year-on-year (YoY) by 33 per cent to N63.47 trillion.

This is an increase from N47.5 trillion same period last year.

CBN said that the government recorded the highest YoY growth (75 percent) in its share of credit which stood at N22.6 trillion in October 2022 compared to N12.9 trillion in the corresponding period of 2021.

This was followed by credit to the private sector which grew by 16 per cent to N40.2 trillion as of October 2022 from N34.6 trillion in October 2021.

Meanwhile, the CBN data also showed that currency-in-circulation, CIC, grew YoY by 11 percent to N3.9 trillion in October 2022 from N2.9 trillion in 2021. Currency outside banks rose YoY 13.2 percent to N2.83 trillion in October 2022 against N2.5 trillion in 2021.

While defending its decision to redesign the Naira note, the CBN had said some individuals were stockpiling huge amount of cash outside the banking system with statistics showing that over 80 per cent of the CIC outside the vaults of the commercial banks.

According to the CBN Governor, Godwin Emefiele, a situation where a total of N3.2 trillion was in circulation, out of which N2.73 trillion was outside the vaults of the banks, was unacceptable.