CBN To Launch Local Cryptocurrency On Independence Day

The Central Bank Of Nigeria has finalized plans to launch its home-grown digital currency on October 1, 2021. This was disclosed during a private webinar on Thursday in which CBN and its stakeholders outline the digital currency initiative.

Recall that the apex bank in June announced plans to launch its own digital currency before the close of the year.

According to the bank, about 80 percent of central banks globally were currently exploring the possibility of issuing their central bank digital currency (CBDC) and Nigeria could not be left behind.

At a recent press briefing, the Director of IT at the CBN, Rakiya Mohammed, confirmed the new development and noted that the apex bank had studied the digital currency landscape since 2017, and have concluded that certain digital currencies hold some tools to help it achieve its goals as the apex bank of the nation.

The digital currency initiative is tagged Project GIANT, and it will use the Hyperledger Fabric Blockchain.

The Hyperledger Fabric is an open-source project that acts as a foundation for developing blockchain-based products, solutions, and applications using plug-and-play components that are aimed for use within private enterprises.

CBN said the importance of its digital currency will include macro-management and growth, cross border trade facilitation, financial inclusion, monetary policy effectiveness, improved payment efficiency, revenue tax collection, remittance improvement, and targeted social intervention.

If the pilot scheme is eventually launched, Nigeria will join other countries across the globe and Africa racing to develop its CBDC.

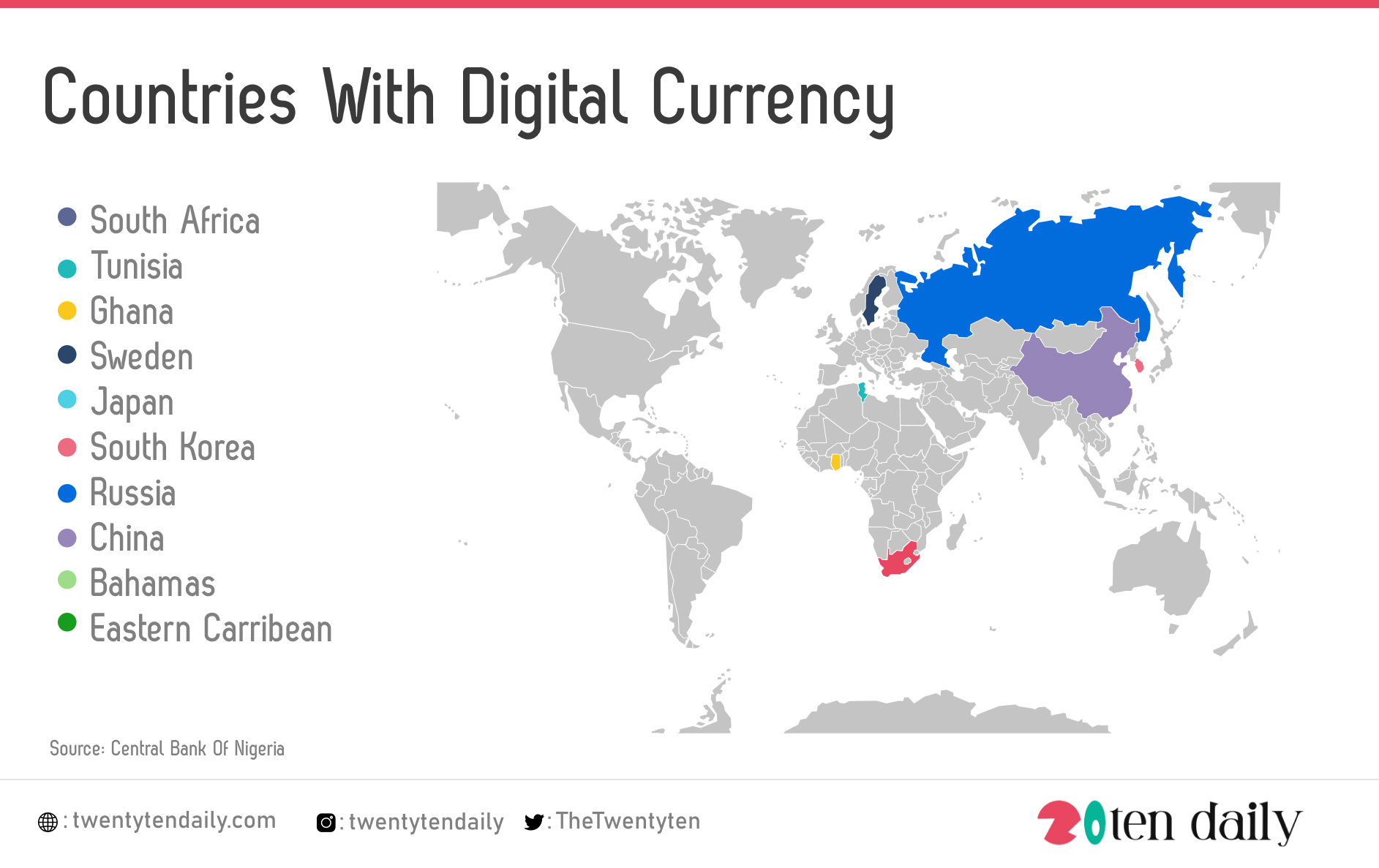

Some of these countries include South Africa (digital Rand), Tunisia (eDinar), Ghana (e-cedi), Sweden, Japan, South Korea, and Russia.

Meanwhile China (digital yuan), Bahamas (sand dollar), Eastern Caribbean (DCash) are among the few countries that have officially launched their own national digital currency.

Earlier this year, CBN banned cryptocurrency transactions in the country and warned that cryptocurrencies posed a great risk of loss of investments, money laundering, terrorism financing, illicit fund flows and other criminal activities.