The Central Bank of Nigeria (CBN) has granted telecommunication companies MTN and Airtel Payment Service Bank (PSB) licenses, according to separate statements by the leading companies.

Airtel will now be vying for a share of the financial market through its subsidiary, SMARTCASH Payment Service Bank Limited (Smartcash), while MTN will conduct its PSB business via the name MoMo Payment Service Bank Limited.

How Much Did The License Cost

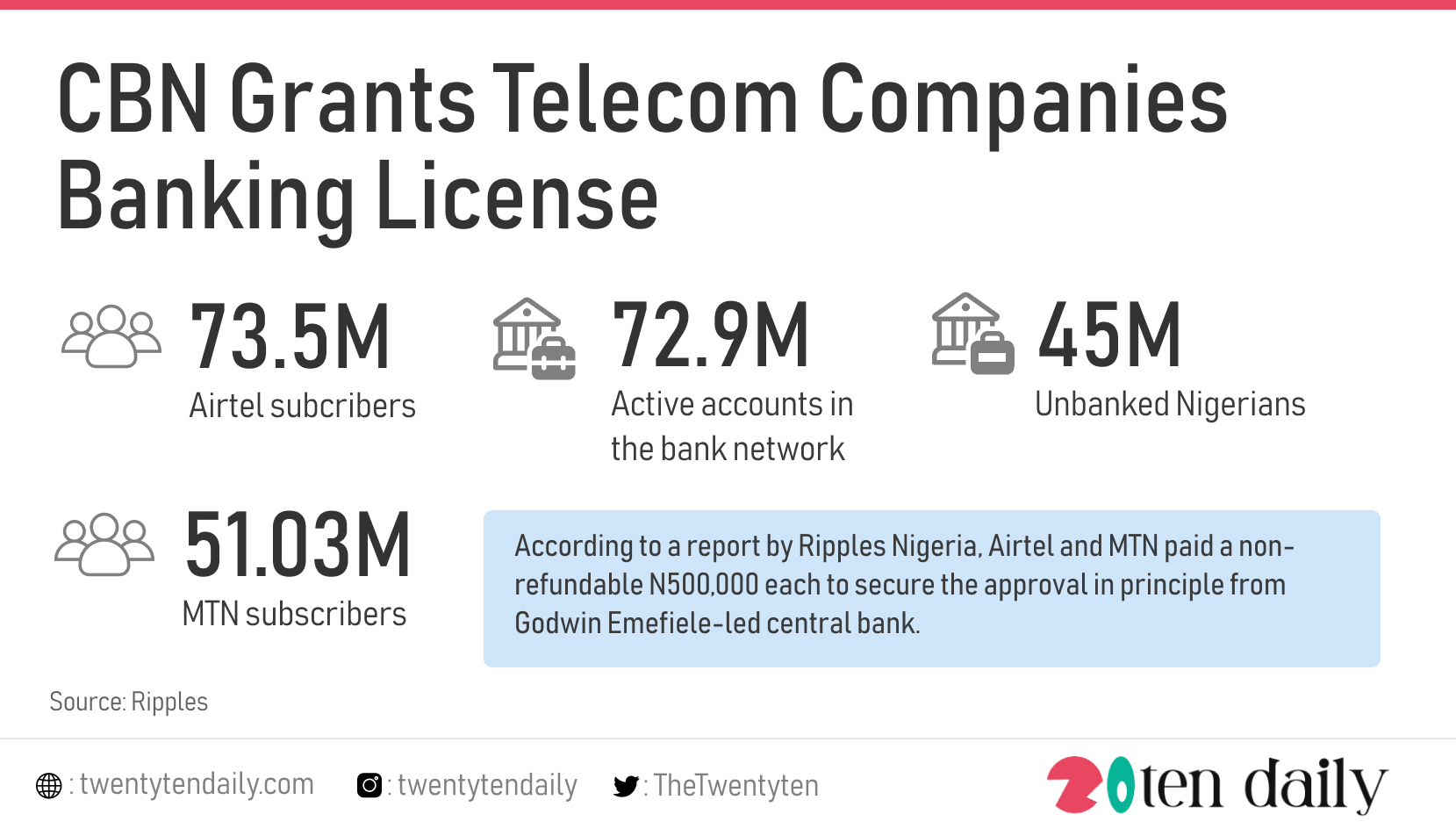

According to a report by Ripples Nigeria, Airtel and MTN paid a non-refundable N500,000 each to secure the approval in principle from Godwin Emefiele-led central bank.

In the next six months, they are expected to pay another non-refundable N2 million for the license to commence operation and will be charged N1 million in case they decide to change their names which must reflect PSB.

Also, Airtel, MTN and other PSBs are mandated to have a minimum capital of N5 billion before they can obtain the license to operate from CBN.

What Are Payment Service Banks

Payment service banks refer to banks that can run only small scale operations like current and savings accounts, payments and remittance services, issue debit and prepaid cards, deploy ATMs and other technology-enabled banking services.

The PSBs cannot oversee credit risk and foreign exchange operations, however, they are important to facilitate high volume low-value transactions in remittance services, micro-savings and withdrawal services in a secured technology-driven environment to further deepen financial inclusion.

With over 90 million subscribers between them, telecom companies, MTN and Airtel could potentially revolutionize the mobile money market and deepen financial inclusion in Africa’s largest economy but this might not portend well for existing banks.

Recently the apex bank of Nigeria has opened more doors for companies to milk the country’s financial industry, further making the position of traditional banks in Nigeria less important.

First, it was the microfinance banks that found themselves a seat, then the Agent Banking and Mobile Money Operation (MMO) joined the table; giving businesses like retailers, cyber cafes, filling stations, mom and pop stores, and roadside kiosks to profit from the financial market. Now the telecoms have received the green light to compete in the same market.

This means that with Fintech companies like Opay and Telcos now able to conduct deposit and withdrawal services, the need for traditional banks will be limited to only loan procurement and investment function, resulting in a potential loss of revenue for banks.

Furthermore, Smartcash (Airtel) and MoMo (MTN) will be tapping into the 73.5 million and 51.03 million respective subscribers, against the 72.9 million active accounts in the bank network, as well as 45 million unbanked Nigerians. It is almost predictable the leader of the financial market in Nigeria, especially with the mounting distrust for existing banks in Nigeria.