According to new industry statistics from the Nigeria Inter-Bank Settlement System, cashless transactions in Nigeria have risen by 41.75 per cent.

This is an increase to N318.66 trillion in the first 11 months of 2022.

The N318.66 trillion amounted to the total amount processed on the Nigeria Instant Payment System and Point of Sales terminals, which is how cashless transactions are monitored on the NIBSS.

In the corresponding period of 2021, the figure was N224.79tn.

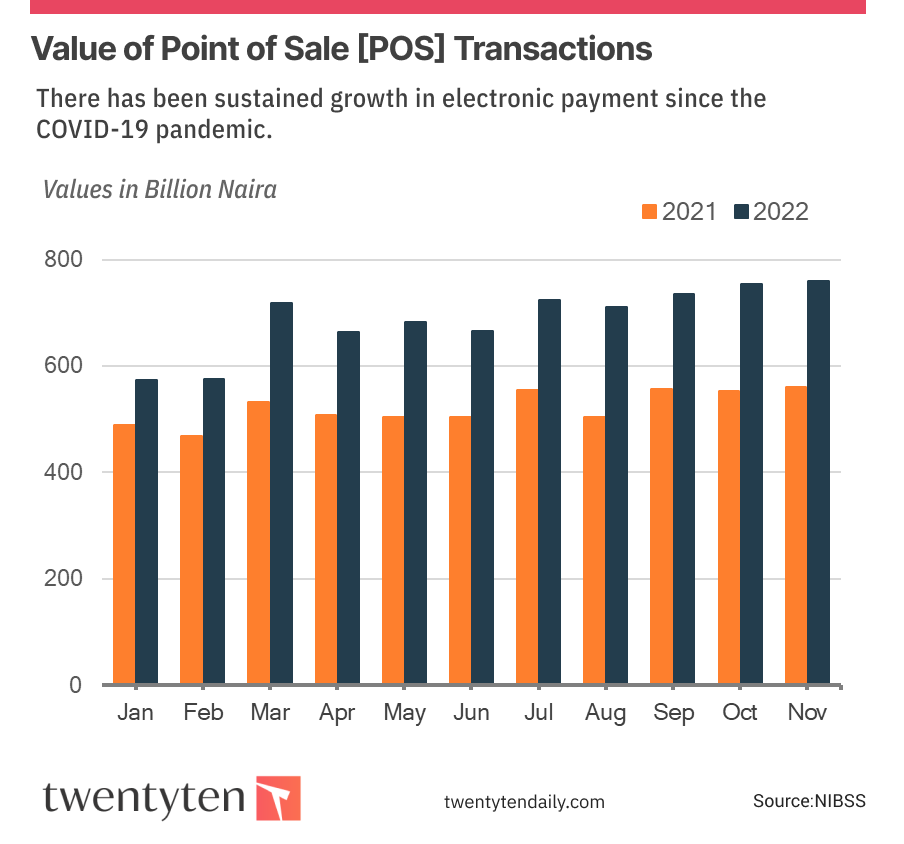

Total NIP transactions for the period was N311.81tn and PoS transactions amounted to N6.85tn, indicating a solid uptake in digital payments in the nation. There has been sustained growth in electronic payment since the COVID-19 pandemic.

In its ‘Instant Payments – 2020 Annual Statistics’ report, the NIBSS revealed that the pandemic changed the e-Payments landscape and accelerated the adoption of instant payments as more people adopted electronic channels for funds exchange.

The growth of e-payment has been recovered by the government. In the Finance Act of 2020, the Federal Government introduced an Electronic Money Transfer Levy to raise revenue from digital payments nationwide.

EMTL is defined as a single, one-off payment of N50 on electronic receipt or transfer of money deposited in any deposit money bank or financial institution in sums of N10,000 and above. The government made N111.84bn in 2021.