Nigerian banks have generated N620.89 billion in the third quarter of this year, Q3’22 from fees and commission income.

This represents 21.5 per cent higher than the N510.99 billion they made under the same income line in the corresponding period of 2021.

The banks include Zenith Bank Plc, Access Bank Plc, First Bank, Stanbic IBTC Holdings Plc, United Bank for Africa (UBA) Plc, GTBank Plc, Fidelity Bank Plc, Unity Bank Plc, Wema Bank Plc, Sterling Bank Plc and Union Bank of Nigeria (UBN) Plc.

Fees and commissions account for a significant percentage of non-interest income for banks and represent income from account maintenance fees, bank transfer charges, commission on transactions (COT) and other non-interest bearing income lines of banks.

Breakdown Analysis

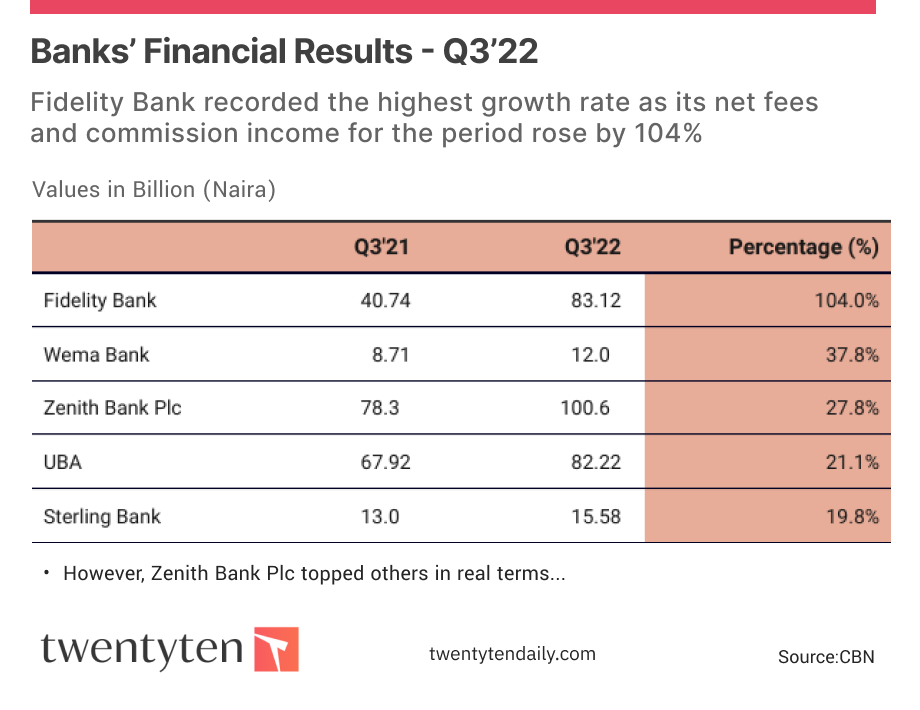

Findings from the banks’ financial results for the period show that Fidelity Bank recorded the highest growth rate as its net fees and commission income for the period rose by 104 per cent to N83.12 billion from N40.74 billion in 2021.

Wema Bank followed with a 37.8 per cent increase to N12.02 billion from N8.72 billion; Zenith Bank Plc ranked third, posting a 27.8 per cent to N100.06 billion as against N78.3 billion in 2021; UBA emerged fourth with 21.1 per cent increase to N82.22 billion from N67.92 billion, while Sterling Bank recorded the fifth biggest growth of 19.8 per cent to N15.58 billion from N13.01 billion in the corresponding period in 2021.

However, Zenith Bank Plc topped others in real terms, netting N100.06 billion in the nine months of 2022 from N78.3 billion. It was followed by Fidelity Bank and UBA at N83.12 billion and N82.22 billion respectively.