Findings from the Money and Credit data of the Central Bank of Nigeria has shown that commercial banks’ credit to the economy rose by 2.17 percent to N61.2 trillion in August from N59.9 trillion in July, even as currency-in-circulation.

This increased by 0.9 percent to N3.24 trillion in August, from N3.21 trillion in July 2022.

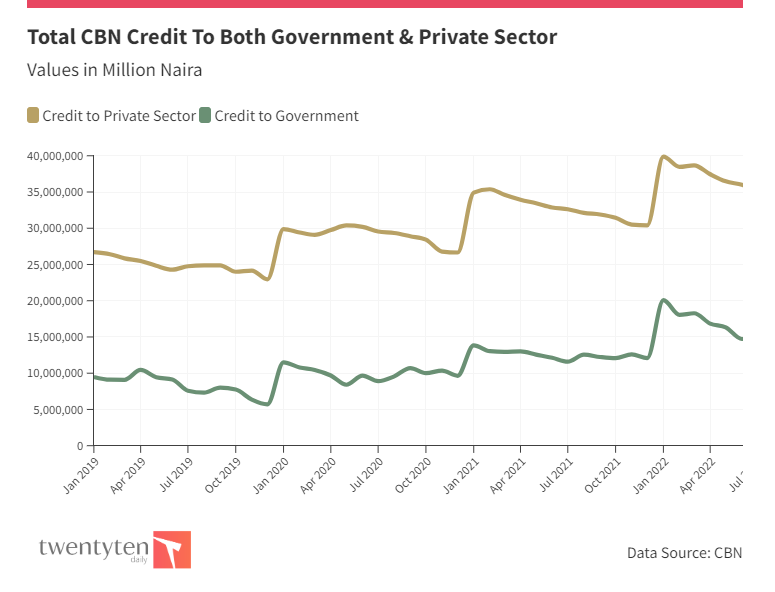

CBN said for August 2022 also shows that N61.2 trillion credit to the economy comprised N21 trillion credit to government which grew by 4.4 percent from N20.1 trillion in July and N40.2 trillion credit to the private sector, representing a 1.0 percent month-on-month (MoM) rise when compared to N39.8 trillion in July.

Meanwhile, Moody’s Credit Ratings has noted that the higher inflation rates being witnessed in Nigeria today would result in increase in interest rates on loans which will add to borrowers’ burdens and diminish repayment capacity.

This was contained in its Investors Service report titled, “Banks – Africa: Higher inflation will weigh on African banks’ profitability”.

It said: “We expect a bank’s exposure to sectors most vulnerable to inflation, such as households, will be a key factor impacting their provisioning costs. Higher inflation will diminish the borrowers’ repayment capacity because income will be needed to meet other competing and rising costs. Higher interest rates will also add to borrowers’ debt burdens by increasing the nominal repayments.

“We expect high inflation and interest rates to increase provisioning needs in all systems.

“For Nigeria, there will be large volumes of variable-rates loans that will reprice at higher interest rates, diminishing borrowers’ repayment capacity.

“Higher inflation tends to coincide with weaker naira, harming unhedged foreign-currency borrowers and increasing corporate debt. High interest rates will increase borrowing costs for sovereigns, weakening their fiscal positions.

“In Africa, this has a direct effect on banks’ credit profiles because the majority of African banks hold large volumes of government securities”.