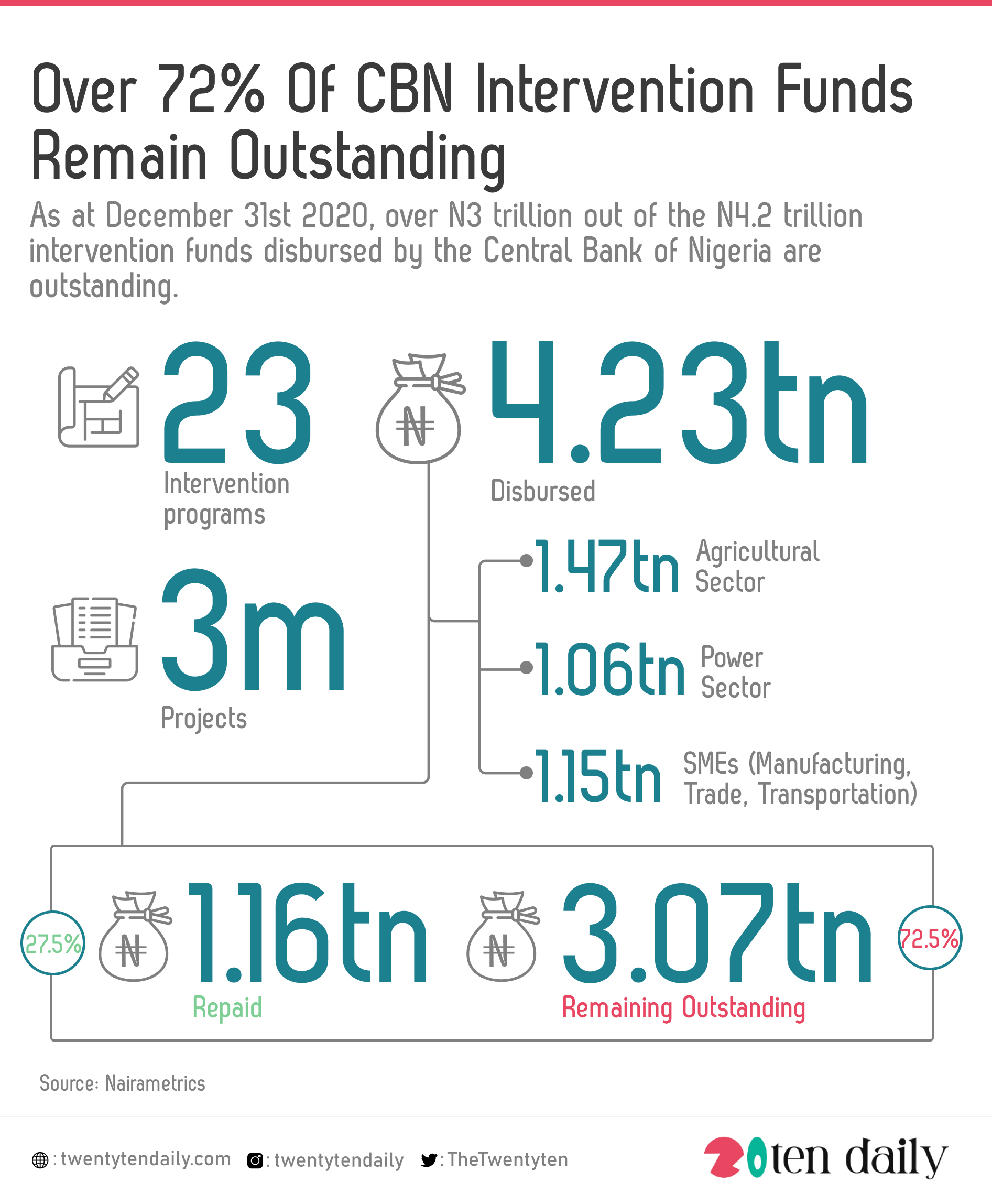

As at December 31st 2020, over N3 trillion out of the N4.2 trillion intervention funds disbursed by the Central Bank of Nigeria are outstanding.

This is a total of 72.5 percent yet to be reimbursed to the apex bank.

According to data from the recently released fourth-quarter economic report (4Q’2020) of Nigeria’s Apex bank, the intervention fund was meant to address the rising economic challenges for business including across multiple sectors.

However, at the latest report released by the National Bureau of Statistics, Inflation rate has climbed to 17.3 percent with food inflation over 21 percent; unemployment rate rose to 33.3 percent and GDP grew by mildly 0.11 percent to exit from recession.

According to the CBN, “Intervention schemes by the Bank continued to focus on enhanced credit delivery to critical sectors, in a bid to enhance productivity and stimulate the real sector of the economy.”

Analysis by Nairametrics, “Given the recent dire results for Nigeria’s unemployment, inflation rate, and GDP growth rates, we were curious to assess the Central Bank of Nigeria’s (CBN) inventory of direct intervention programs which were supposedly created to address Nigeria’s economic challenges.

“Specifically, there are 23 major intervention programs in-flight for which N4.23 trillion Naira has been disbursed by the CBN across 3 million projects.

“Remarkably, the CBN has an intervention fund for almost every single economic sector: Agriculture sector received. N1.47 trillion; Power sector received N1.06 trillion; SMEs (across Manufacturing, Trade, Transportation) received N1.15 trillion.

“Alarmingly of the N4.23 trillion disbursed, only N1.16 trillion (or 27.5%) has been repaid. Thus N3.07 trillion (or 72.5% remains outstanding).

“This suggests direct interventions in private sector initiatives that cater to the masses were a fraction of the total amounts.”