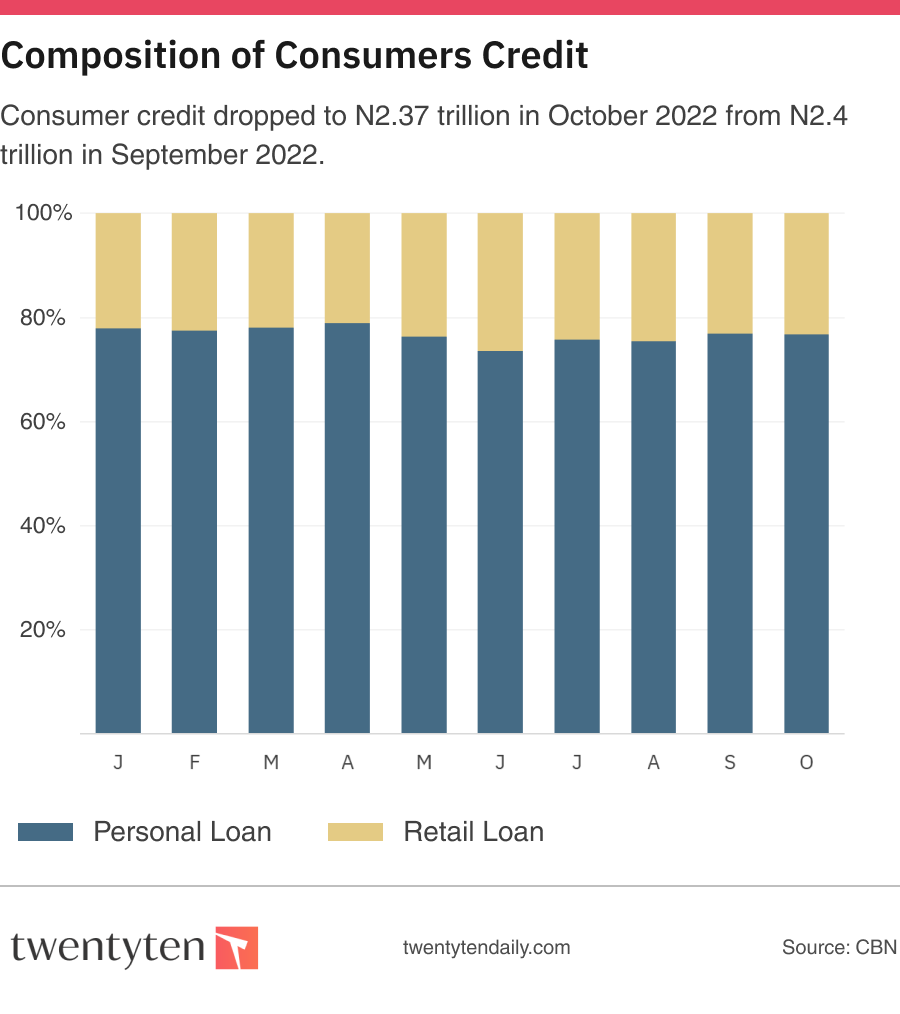

The Central Bank of Nigeria has disclosed that consumer credit fell Month-on-Month by 1.3 per cent.

This, according to the bank, is a drop to N2.37 trillion in October 2022 from N2.4 trillion in September 2022.

CBN disclosed this in its October 2022 Economic Report, noting that the development in consumer credit was a result of a 0.2 per cent decline in personal loans during the period.

This reflects the effect of the CBN monetary policy tightening during the period.

In September, the regulator raised the Monetary Policy Rate (MPR) to 15.5 per cent, from 14 per cent in an aggressive move to fight inflation in the country.

The Cash Reserve Ratio (CRR) was also increased to a minimum of 32.5 per cent from 22.5 per cent, while Liquidity Ratio was retained at 30 per cent.

CBN said that the N2.37 trillion credit consists of personal loans of N1.82 trillion and retail loans of N553.46 billion.

The CBN said: “Consumer credit outstanding declined, owing to the tight monetary policy stance of the bank, aimed at taming inflationary pressures in the economy.

“Consumer credit outstanding declined by 1.3 per cent to N2.37 trillion from the level at end-September.

“As a share of total claims on the private sector, consumer credit fell by 0.2 percentage point to 8.5 per cent, from 8.7 percent at end-September.

“A disaggregation of consumer credit shows that personal loans stood at N1.82 trillion, accounting for 76.7 percent, while retail loans stood at N553.46 billion, and accounted for 23.3 per cent.

“The decline in personal loans by 0.2 percentage point drove the fall in consumer credit outstanding.”