Shortly after Covid-19’s destructive impact on the global economy, the Russian invasion hit the world, further worsening the economic outlook for vulnerable economies. Africa, already drowning in debt is left with no choice but to borrow more if it must survive these challenging times.

According to the African Development Bank Group (AFDB), economic disruptions stemming from the Russia-Ukraine war could push 1.8 million people across the African continent into extreme poverty by the end of 2022. That number could swell with another 2.1 million in 2023.

The International Monetary Fund estimated Africa’s financial need to overcome the impacts of Covid-19 up until 2024 at US$285 billion. IMF’s solution? loans with longer-term maturity. While this is the help Africa needs, what happens to the pilling debt Africa owes financiers and countries like China?

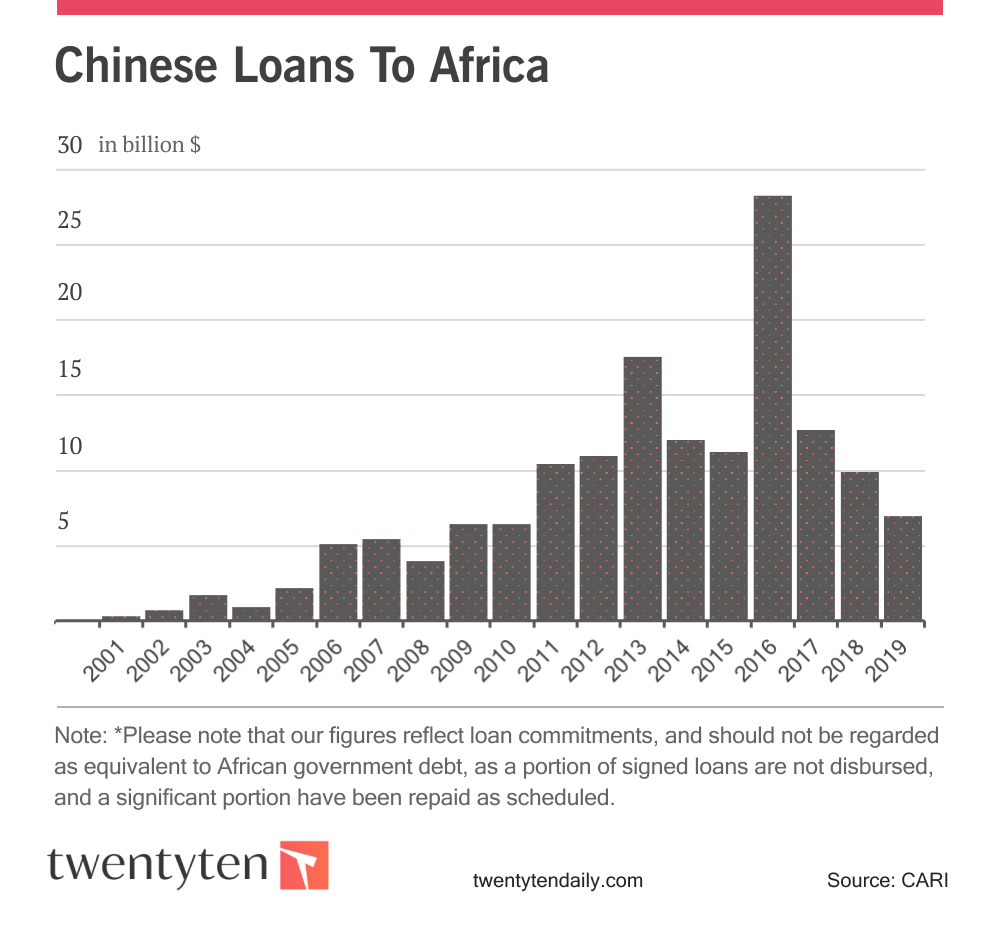

China is considered Africa’s single largest creditor, with debt running into billions of dollars. Commercial loans alone are estimated to have been $132billion (£100bn) between 2006 and 2017.

Key stakeholders, including the IMF and World Bank, have called for debt relief for Africa to encourage post-coronavirus economic recovery, and in solidarity, the IMF approved $500 million to cancel six months of debt payments for 25 countries, 19 of which are in Africa in 2020.

But the question is, what is China’s position on debt relief, seeing as the country owns the centre stage as the highest creditor to Africa?

Understanding The China-Africa Debt Relationship

The key question when it comes to debt relief by China depends on which debt is being discussed. China has in the past forgiven zero-interest loans to poor and least-developed countries in Africa. In 2005, China announced forgiveness of $10 billion in zero-interest loans for Africa.

By the first quarter of 2009, China also cancelled 150 such loans owed by 32 African countries. This year, China also agreed to forgive 23 interest-free loans for 17 African nations in addition to China’s cancellation of more than $3.4 billion in debt and restructuring of around $15 billion of debt in Africa between 2000 and 2019.

However, zero-interest loans make up only a small portion of Africa’s debt owed to China. From 2000 to 2017, China provided $143 billion in loans to African governments and their state-owned enterprises, a majority of which are concessional loans, credit lines, and development financing.

Among the $60 billion China pledged to Africa at the 2015 Forum on China-Africa Cooperation (FOCAC), concessional loans, credit lines, and African small- and mid-sized enterprise loans jointly constitute 70% of the total amount, with only 9% of the amount for zero-interest loans.

If China is to follow this pattern, the most likely loans to be forgiven will be those zero-interest ones. The same cannot be said for the concessional and other loans because of their magnitude (and, consequently, the massive financial losses) as well as the precedent the move would set for other regions and the implications for responsible borrowing by African states.

So, what would China do to help Africa survive the massive debt the continent is currently immersed in? At a minimum, as a member of the IMF and World Bank, China might participate in the collective debt relief effort as seen in its recent effort in the past month. However, China is unlikely to take a unilateral approach to debt forgiveness, especially on concessional loans and commercial loans, which constitute the majority of African debts owed to China. Rather than outright relief, postponement of loan payments, debt restructuring, and debt/equity swaps would likely be the game plan.