On Monday, the minister for finance, budget and national planning, Zainab Ahmed, announced President Buhari’s decision to suspend the removal of petrol subsidy for 18 months. This move is assumed to be the government’s attempt to lessen the bite of economic hardship and skyrocketing inflation rates on its people.

The approved 18-months suspension means that the burden of fuel subsidy which has been described as a major drain and waste of resources would be shifted to the next administration from May 29, 2023, if the National Assembly approves an extension of the Petroleum Industry Act (PIA) implementation.

While many have argued that the temporal suspension is a political move, others have reflected on the financial implications of sustaining the fuel subsidy and the strain it would cause the already suffering economy.

Understanding Fuel Subsidy In Nigeria

Fuel subsidy in Nigeria is the government’s policy of paying a part of the cost of fuel purchase so the public can buy petroleum products at a reduced amount.

According to a price template released and deleted by the Petroleum Products Pricing Regulatory Agency in 2021, the average price per ton of the commodity was put at $561.96, or N169.22 per litre, while the average freight rate cost (North-West Europe to West Africa) was put at $21.63 per ton or N6.51 per litre.

With a retailers’ margin of N6.19, the guide showed that the expected retail price would be N209.61 on the lower band and N212.61 on the upper band. An analysis by PREMIUM TIMES then showed that the difference between the N206.42/litre ex-depot price announced by the PPPRA and the N148/litre price petrol is sold to marketers by NNPC reveals the government pays a subsidy of N57.82/litre.

The analysis showed that fuel subsidy costs the Nigerian government up to N102.5 billion if Nigerians consume up to 57.2 million litres as seen in data presented by the National Bureau of Statistics in 2019.

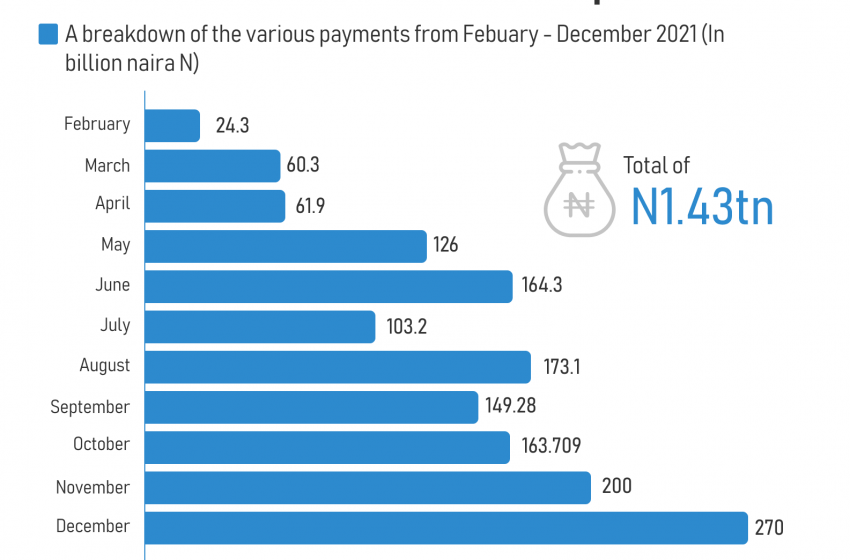

Documents obtained from the Nigerian National Petroleum Company (NNPC) showed that between January and December 2021, the federal government spent over N1.43 trillion on what it terms under-recovery on petrol.

A breakdown of the various payments last year indicated that the subsidy burden had increased progressively, growing from N24.3 billion in February 2021, to N60.3 billion in March and N61.9 billion in April 2021.

In May, the NNPC removed N126 billion as subsidy, N164.3 billion in June and N103.2 billion in July.

August had last year’s lion’s share of N173.1 billion but was overtaken by the deduction in November of N200 billion, while September’s deduction stood at N149.28 billion and the October figure was N163.709 billion, before the highest deductible amount yet of N270 billion in December.

In 2021, the IMF reiterated the need for Nigeria to remove petrol subsidies and channel such funds to the health and social development sectors. The Fund also noted that the continuity of petrol subsidy would increase the country’s Debt To GDP ratio.

Public Reactions

The National Labour Congress had initially planned a strike before calling it off after President Buhari’s new decision. The labour movement has argued that the government should focus on ensuring that local refineries are actively working before considering the removal of petroleum subsidies.

On the other hand, the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), the Lagos Chamber of Commerce and Industry (LCCI) and other industry stakeholders have proposed phased removal of the subsidy rather than an upfront removal.

Director-General of the LCCI Chinyere Almona, in a statement, said: “While we support the full implementation of the Petroleum Industry Act (PIA) 2021 and the total deregulation of the oil and gas sector, we are not insensitive to the plight of the masses that may feel the pains of some of the provisions like the removal of fuel subsidies.

“Since the announcement of the planned removal of fuel subsidies, there have been numerous reactions expressing displeasure and readiness to stage protests against the planned action.

“In the face of this dilemma, we recommend that the removal is phased and with a complement of heavy investment in critical infrastructure that supports production in the economy.”