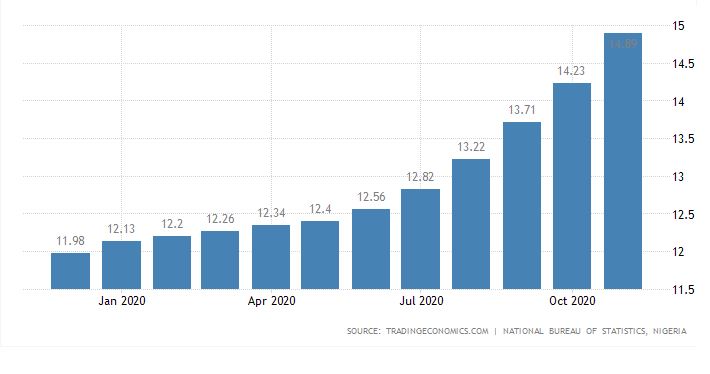

Many countries including Nigeria are currently in recession. The year 2020 has been characterized by the coronavirus (COVID-19) pandemic. Its impact has continued to have a severe impact on businesses, households, and economies globally and one of its consequences is inflation. Though inflation affects all of us; but most importantly high inflation could be hostile to economy and business especially the micro, small and medium enterprises (MSMEs).

With persistent inflation, businesses and households often perform poorly, and expectedly more money is paid for the same goods and services. This has been the troubling trend in Nigeria, where high price increases have been recorded in transportation, food cost, household needs, raw materials, pharmaceutical products, motor cars, vehicle spare parts, equipment, and in prices of services amongst others. Admittedly, inflation erodes our value of money and also erodes the purchasing power of all of us.

Purchasing Manager’s Index (PMI) a leading economic statistics indicator, has confirmed Nigeria slipped into its second recession in July, the third quarter of 2020. This was caused by dwindling oil revenues and the coronavirus pandemic. In quarter 2, Nigeria’s National Bureau of Statistics (NBS) reported that the economy contracted by 6.1 percent. An economy is said to be in a recession when output contracts for two straight quarters. The average PMI for July, August, and September- the third quarter, was 45.3 points. Whenever PMI is below 50 points, it is a sign of contraction; while a reading above 50 points signals expansion.

The consequences and impact of inflation (price instability) in Nigerian cannot be over-emphasized. Key amongst the consequences of inflationary pressure is the persistent decrease in the purchasing power of citizenries especially at a time when the economy is in recession and pandemic is ravaging.