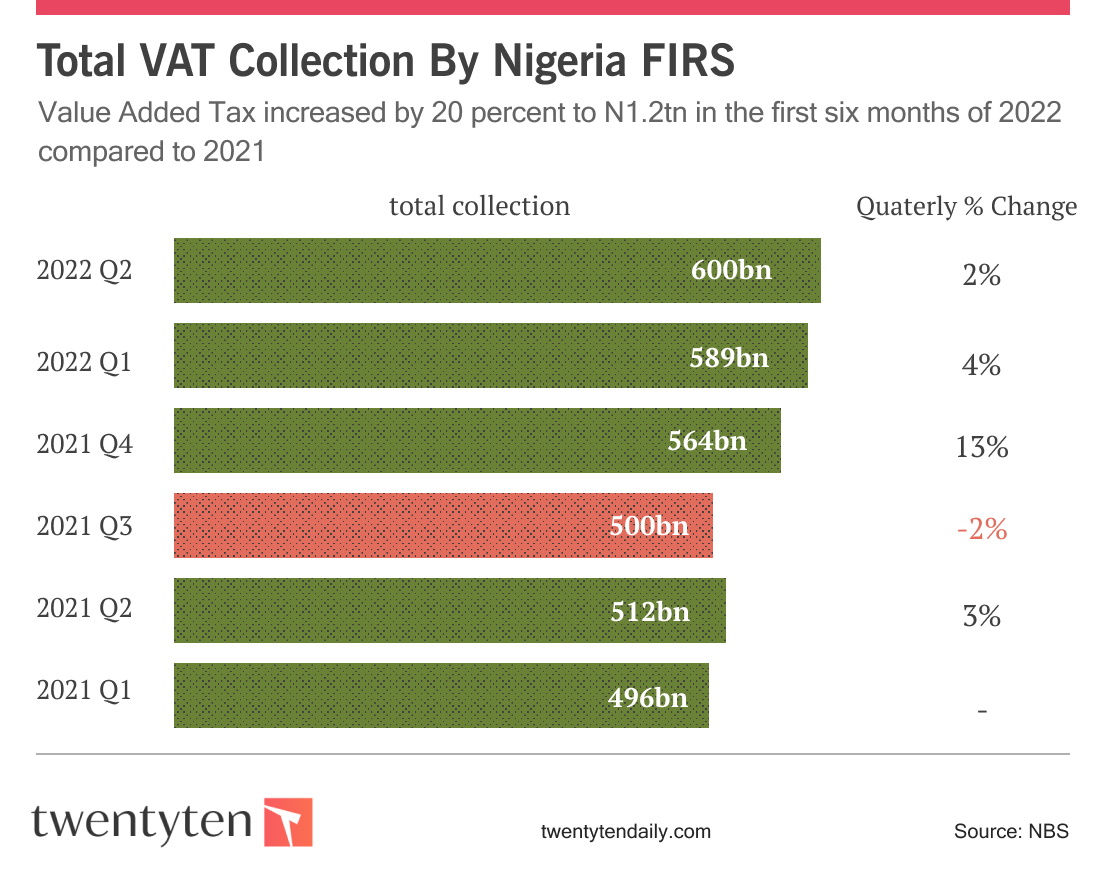

The Federal Inland Revenue Service has grown its proceeds of Value of Added Tax by 20 percent to N1.2tn in the first six months of 2022.

According to different reports by the National Bureau of Statistics, the total sum generated through VAT stood at N1.008tn in the first two quarters of 2021.

NBS data also showed that in the corresponding period of 2022, the sum of N1.188 was generated through VAT, indicating a 20 percent growth within the last year.

The significant increase in VAT collection in the past two years is not unconnected with the decision by the Federal Government in 2020 to increase the VAT rate from five per cent to 7.5 percent due to a significant decline in oil prices that had impacted government revenue.

Recall that the Federal Government’s had planned to retain the collection of Value Added Tax despite a Federal High Court ruling, hit a brick wall as the National Assembly rejected a proposal seeking to shift the collection of VAT from the concurrent to the exclusive legislative list, effectively leaving the decision to the Supreme Court which is hearing the matter.

Last year, a Federal High Court had ruled that states had the powers to collect VAT.

However, the Federal Government opposed the ruling and continued to collect VAT while it projected that it will collect N2.2tn in 2022 through the Federal Inland Revenue Service.