The latest data from the debt management office shows that 12 states were able to reduce their local debt in the last 12 months with Kogi reducing its domestic debt stock by 59.15 billion Naira.

The decline from these states couldn’t affect the total domestic debt from all 36 states including the FCT as the total domestic debt burden increased by 84 billion Naira. Lagos, Benue, Taraba, Anambra were among the state which domestic debt stock increased in the last 12 months.

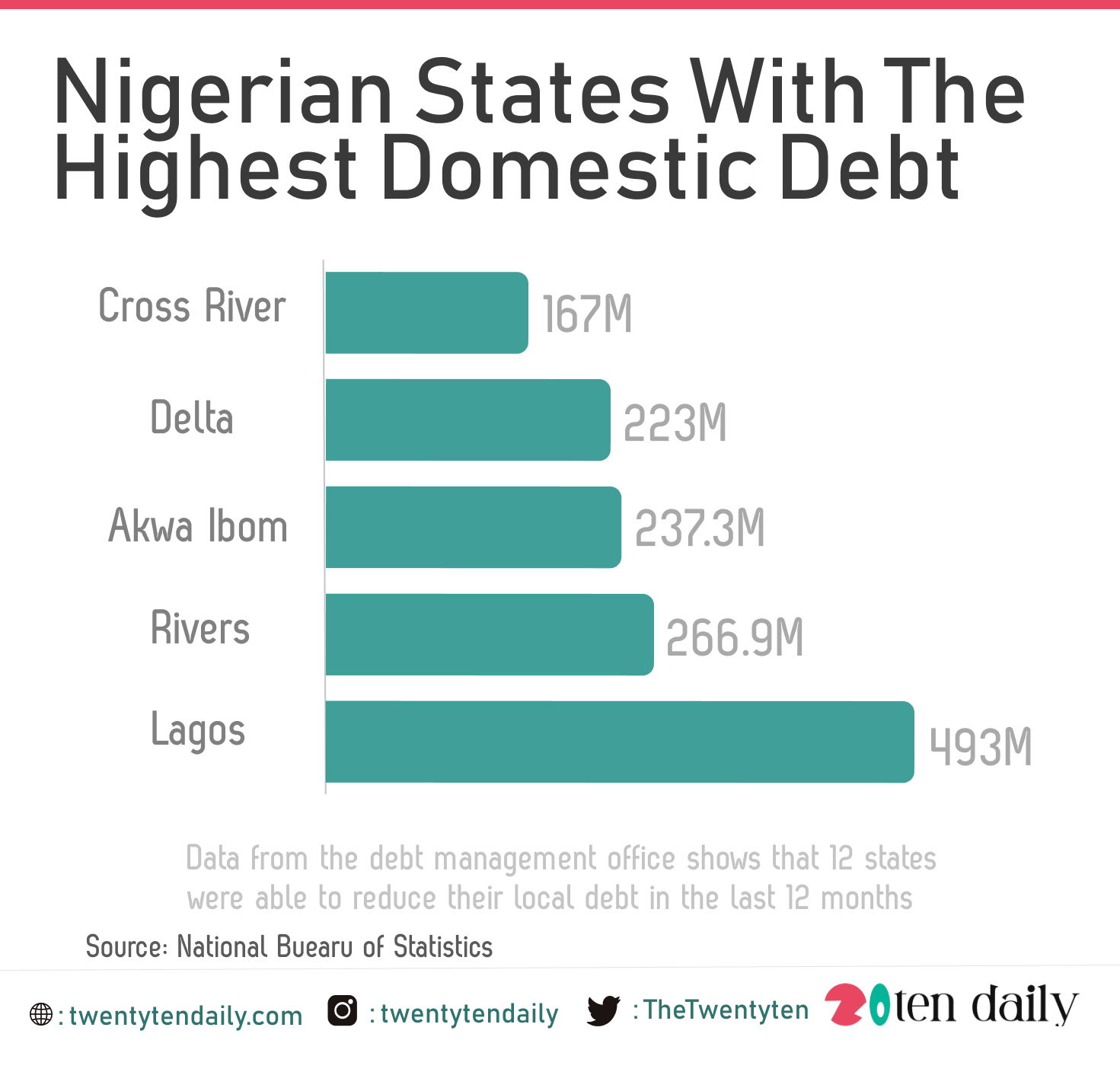

Lagos State still remains the most indebted state among the 36 states increasing its domestic debt profile by 49 billion Naira with a total of 493 billion naira. Rivers state with N266.9 billion, Akwa Ibom N237.3 billion, Delta N233.9 billion, and Cross River with N167 billion were among the top 5 with the highest debt profile.

Based on the Geo-political zone, the South West region takes up 24.5% of the total domestic debt. The Niger Delta region accounted for 27 per cent where 4 out of the 5 states in the region are among the top 5 most indebted states in Nigeria.

Government at both national and sub-national levels revenues have depended majorly on the oil sector. States’ Internally Generated Revenue (IGR) is only a fraction of revenue, meaning state governments are heavily reliant on the federation revenue to effectively perform their constitutional functions.

The fluctuation in oil prices has pushed states in Nigeria into debt financing in order to carry out developmental projects. Even though the debt is one of the ways to finance much-needed investments in infrastructure, human capital, or public works. However, good debt management is critical for these investments to be successful. High debts always serve as barriers to economic growth and welfare in this part of the world.