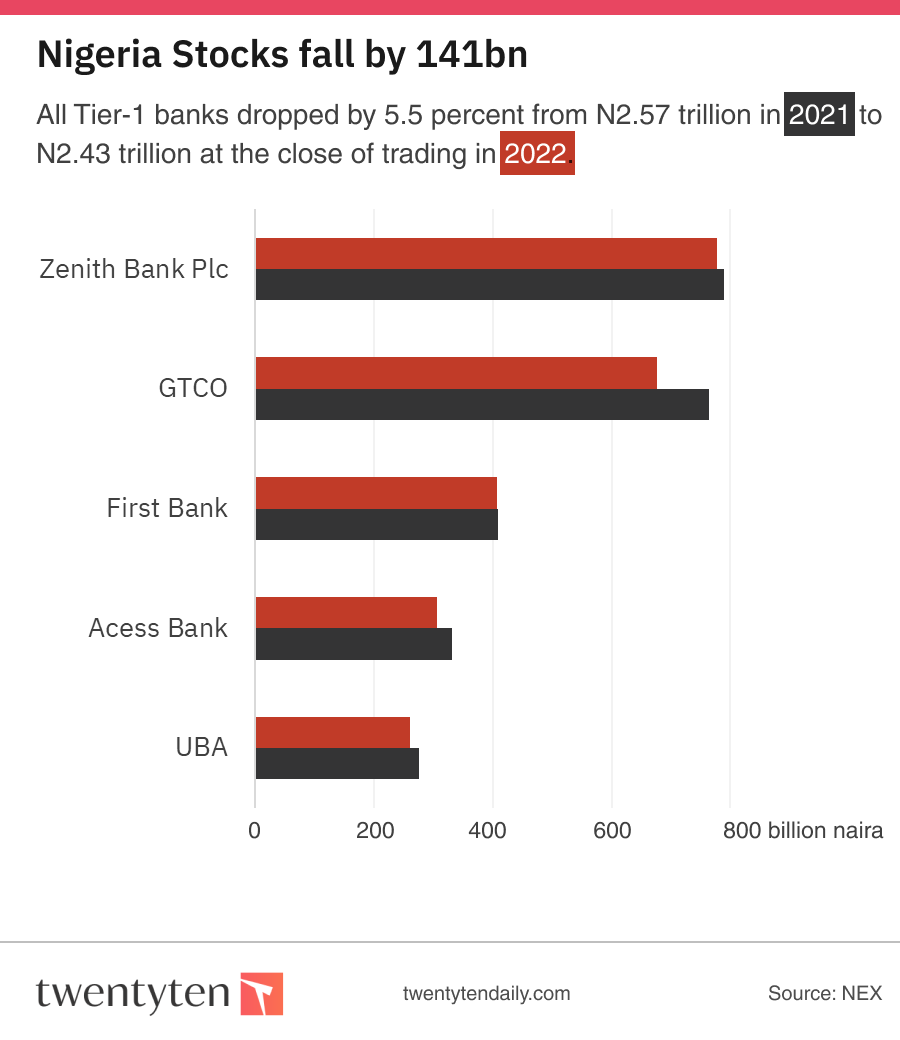

According to data available on the Nigerian Exchange Limited, banking sector performance ended the year out of the loop as five banks saw their value downed by 5.5 per cent

This is coming despite the Nigerian capital market closing the year on a bullish trend. The drop is from N2.57 trillion in 2021 to N2.43 trillion at the close of trading in 2022.

All five banks commonly referred to as Tier-1 banks had their share price fall at the end of 2022 compared to what they recorded in 2021.

Data by the NGX showed that GTCO led with an 11.54 per cent depreciation from N765bn in 2021 to N676.9bn in 2022. The bank also had its share price dropped from N26 to N23 per share. The bank lost 88.3bn in valuation in the 2022 trading year.

Access Bank closely followed with 7.5 per cent value depreciation. At the close of trading in 2022, its valuation slumped from N330.6bn in 2021 to N305.7bn. The bank’s share price also dipped from N9.3 to N8.5 kobo per share.

The United Bank for Africa also lost N13.7bn in market value in the 2022 trading year from N275bn in 2021 to N261bn in the corresponding year. Its share price also fell from N8.05 to N7.6 kobo per share.

Meanwhile, Zenith bank Plc lost 1.6 per cent market value from N789bn in 2021 to N777bn in 2022. The bank’s market share price shed N1.15 kobo per share.

First Bank Nigeria’s market valuation depreciated by 0.44 per cent to N407 bn in 2022 from N409bn in 2021. The bank’s share price also dropped to N10.9 kobo per share from N11.4 kobo per share.