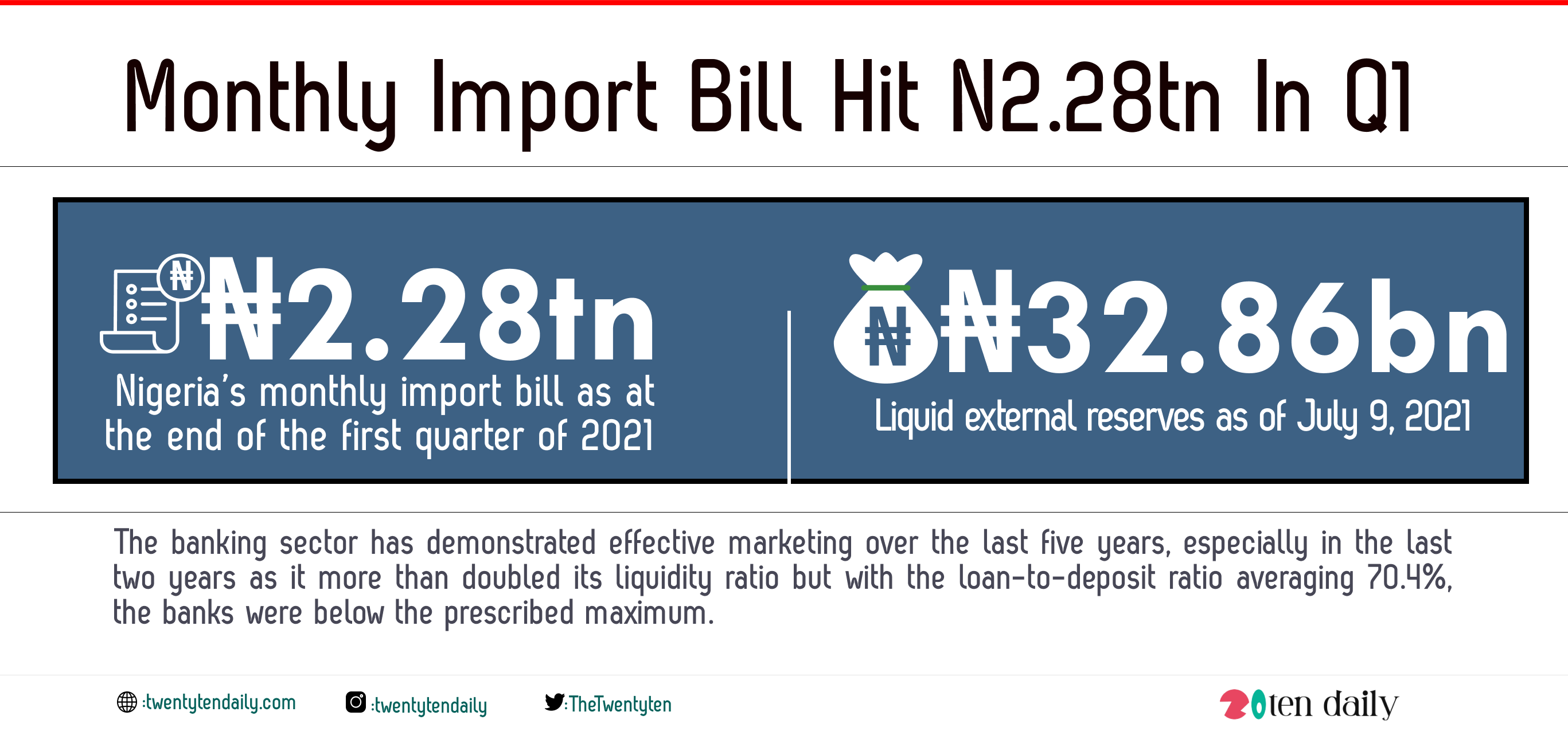

According to a report by a management and financial consulting company, Nigeria’s monthly import bill hit a record of N2.28tn at the end of the first quarter of 2021.

The report was presented by the Chief Consultant, B. Adedipe Associates Limited, Dr. Biodun Adedipe, during a forum organised with the theme ‘Nigerian banking sector in retrospect and outlook for second half 2021.’

The report said, “With a monthly import bill of N2.28tn (6.02bn) in Q1 2021, liquid external reserves of N32.85bn (July 9, 2021) represents 5.45 months, which is below the minimum threshold of six months for stability (twice below benchmark ’11 month’ required for an economy in crisis). Reserves dampened by -6.43 percent as of July 9, 2021.”

According to the report, the banking sector demonstrated effective marketing over the last five years, especially in the last two years as it more than doubled its liquidity ratio.

It said with the loan-to-deposit ratio averaging 70.4 percent, the banks were below the prescribed maximum.

Also, the banks have the room to expand lending, but it has a challenge on how the lending environment can be de-risked, especially lending to small and medium enterprises.

It said Nigerian banks had proved to be at the forefront of technology leverage, as the banks were almost as sophisticated as could be found anywhere else in the world.

This, it noted, was supported by deepening Internet penetration; a large, youthful and rapidly growing population; rapid urbanisation; strengthening innovation culture, driven by the survival instinct and increasing attention to competitive strategy.

According to the statement, it is important for the banks to respond to the most critical needs such as poverty, unemployment and insecurity.