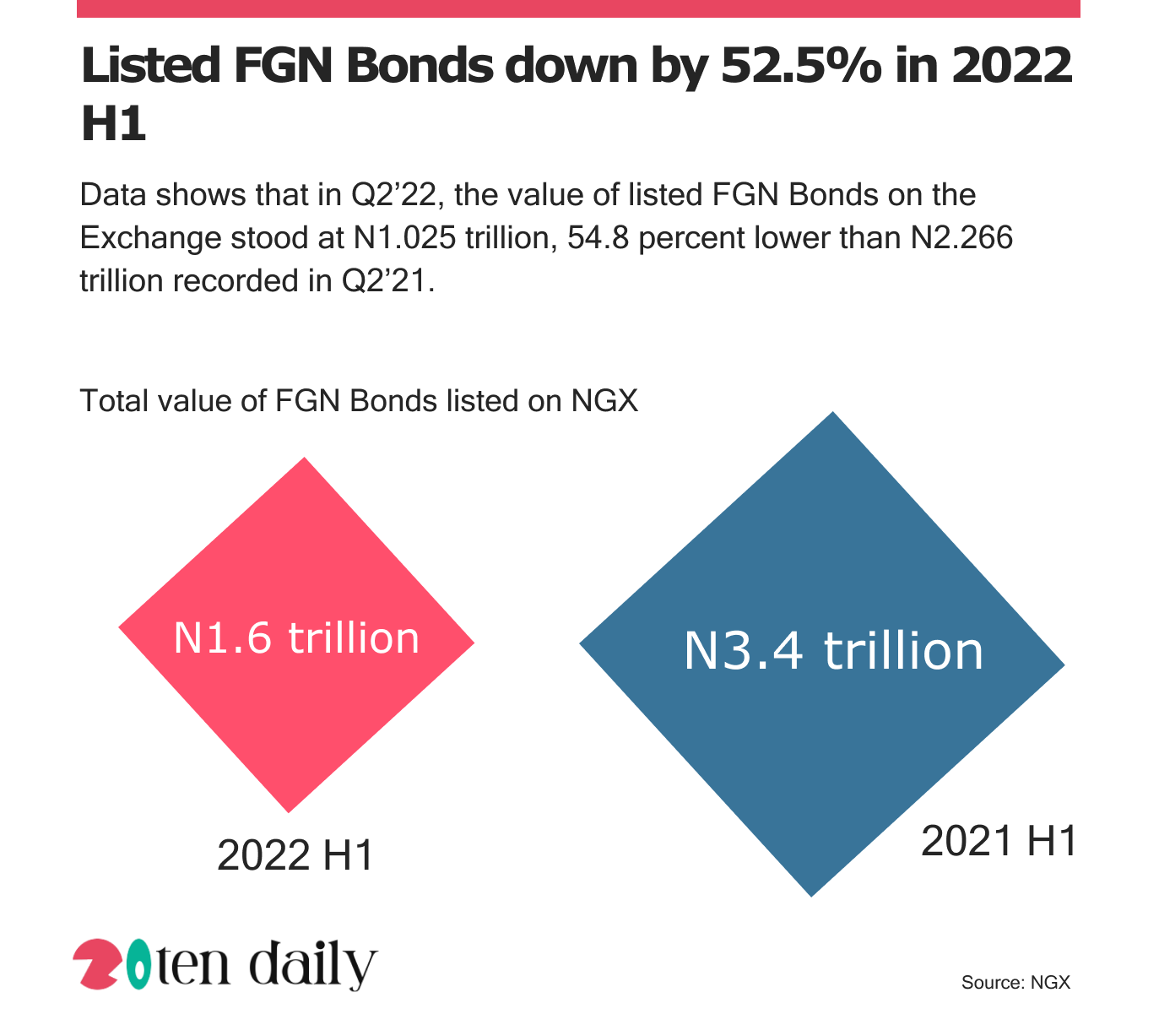

The value of listed Federal Government of Nigeria, FGN, Bonds on the Nigerian Exchange Limited in the first half of the year declined by 52.5 percent.

This is a drop to N1.6 trillion from N3.4 trillion in the corresponding period of 2021, HI’21.

Findings from the data in the NGX shows that in Q2’22 the value of listed FGN Bonds on the Exchange stood at N1.025 trillion.

This is about 54.8 percent lower than N2.266 trillion recorded in Q2’21.

But the Q2’22 figure shows a massive 70.9 percent jump higher than the N599.696 billion recorded in Q1’22, signifying that decline may be reversing going forward.

Reacting to this development, analyst and Executive Vice Chairman, HighCap Securities Limited, Mr David Adonri, said: “The reduction of FGN Bonds listing could be that the government borrowed less in the domestic market and its implication is that it could affect liquidity in the secondary market.

“Both externally and internally, the government has been borrowing a lot and is still taking more debt. This is increasing the risk of sovereign default and economic nightmares.