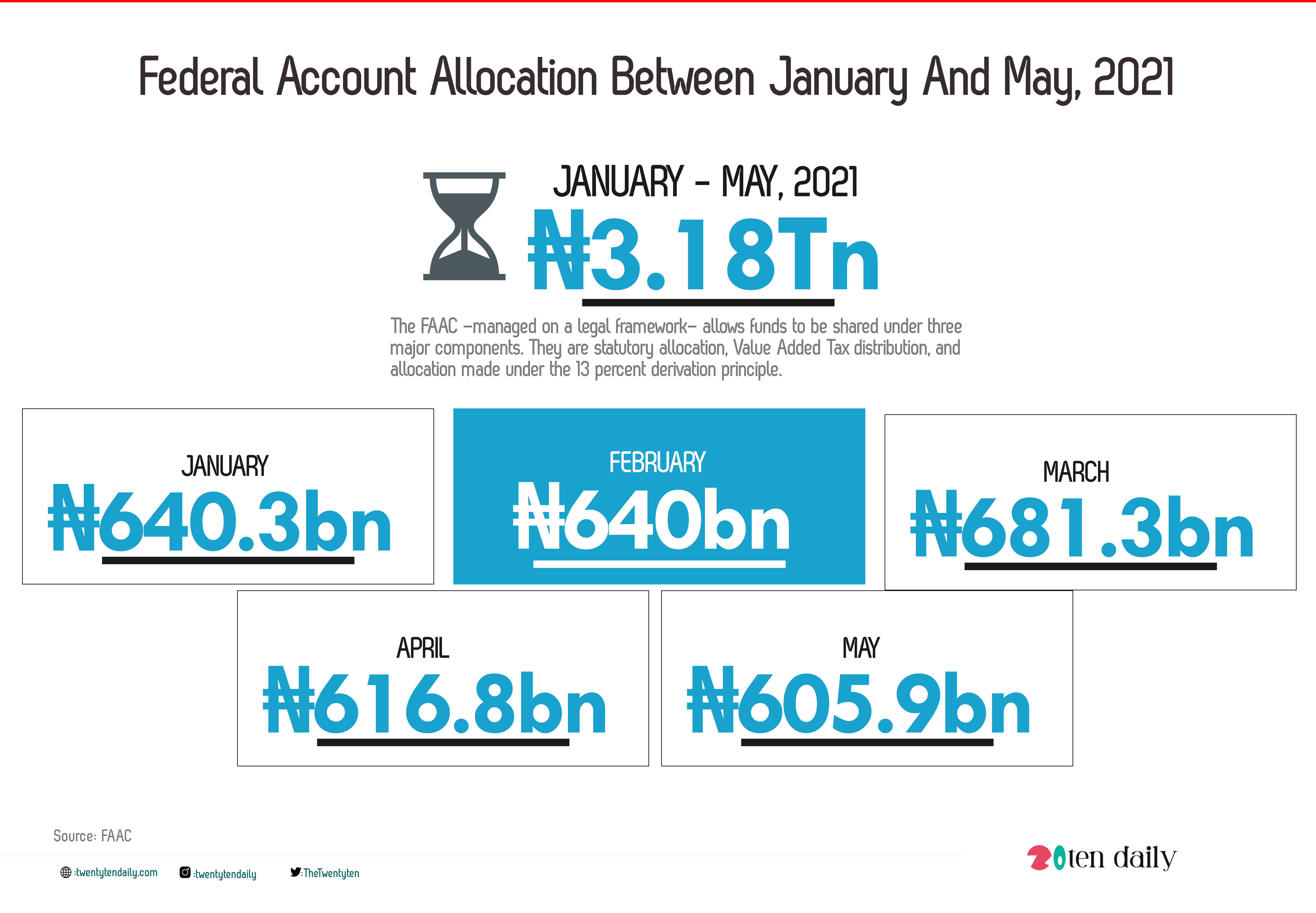

The Federation Account Allocation Committee shared the sum of N3.18tn to the three tiers of government between January and May this year.

The FAAC –managed on a legal framework– allows funds to be shared under three major components. They are statutory allocation, Value Added Tax distribution; and allocation made under the 13 percent derivation principle.

Under statutory allocation, the Federal Government gets 52.68 percent of the revenue shared; states, 26.72 percent; and local governments 20.60 percent.

For Value Added Tax revenue be shared thus: FG, 15 percent; states, 50 percent; and LGs, 35 percent.

While an extra allocation is given to the nine oil producing states based on the 13 percent derivation principle.

However, data from the Medium-Term Expenditure Framework and Fiscal Strategy Paper for 2022 to 2024 showed that the prorated amount budgeted to be disbursed to the three tiers of government was N3.5tn.

This resulted in an allocation shortfall of N329.6bn during the period under review.

Breakdown Analysis

A breakdown of actual allocation showed that the sum of N640.3bn was shared in January.

Of this, the Federal Government received N226.998bn; states received N177.17bn; the local government councils got N131.4bn, while the oil producing states received N26.78bn as 13 percent derivation.

Cost of collection/transfer and refunds accounted for N75.97bn. The sum of N640.3bn shared in January showed an estimated monthly shortfall of N62.4bn.

In February, N640bn was disbursed, indicating a shortfall of about N62.7bn. The figure constitutes a gross statutory distribution of N483bn and a VAT pool of N157bn according to a report by FBNQUEST.

According to a communiqué issued at the end of a virtual meeting of the FAAC, N681.3bn was shared in March. This amount represents a N21.47bn shortfall with regards to the budgeted monthly allocation.

It indicated that the Federal Government received N212.15bn, state governments got N179.24bn, and the Local Government Councils received N132.19bn.

For the oil producing states, the sum of N40.24bn was shared as 13 percent derivation revenue, while the cost of revenue collection, transfers and refunds was N87.51bn.

“The N30bn augmentation was also shared as appropriate,” the communique stated.

For April, the sum of N244.01bn was disbursed to the federal government, out of which states received N193.43bn, LGCs received N143.29bn while oil-producing states received the sum of N36.14bn, bringing the total allocation to N616.87bn.

This sum was N85.9bn lower than the budgeted monthly allocation of N702.77bn.

In May, a total of N605.96bn was shared as revenue to the Federal, States and Local Governments as well as other relevant agencies.

Out of this amount, the Federal Government received N242.12bn; the states got N194.19bn while the LGs received N143.74bn.

For May, oil producing states received N26.9bn as derivation revenue.

The total amount shared in May was N96.82bn lower than the budgeted monthly allocation of N702.77bn.

The N3.2tn allocated for the first five months of this year represents a decrease of N149.9bn when compared to the amount allocated within the corresponding period of last year.