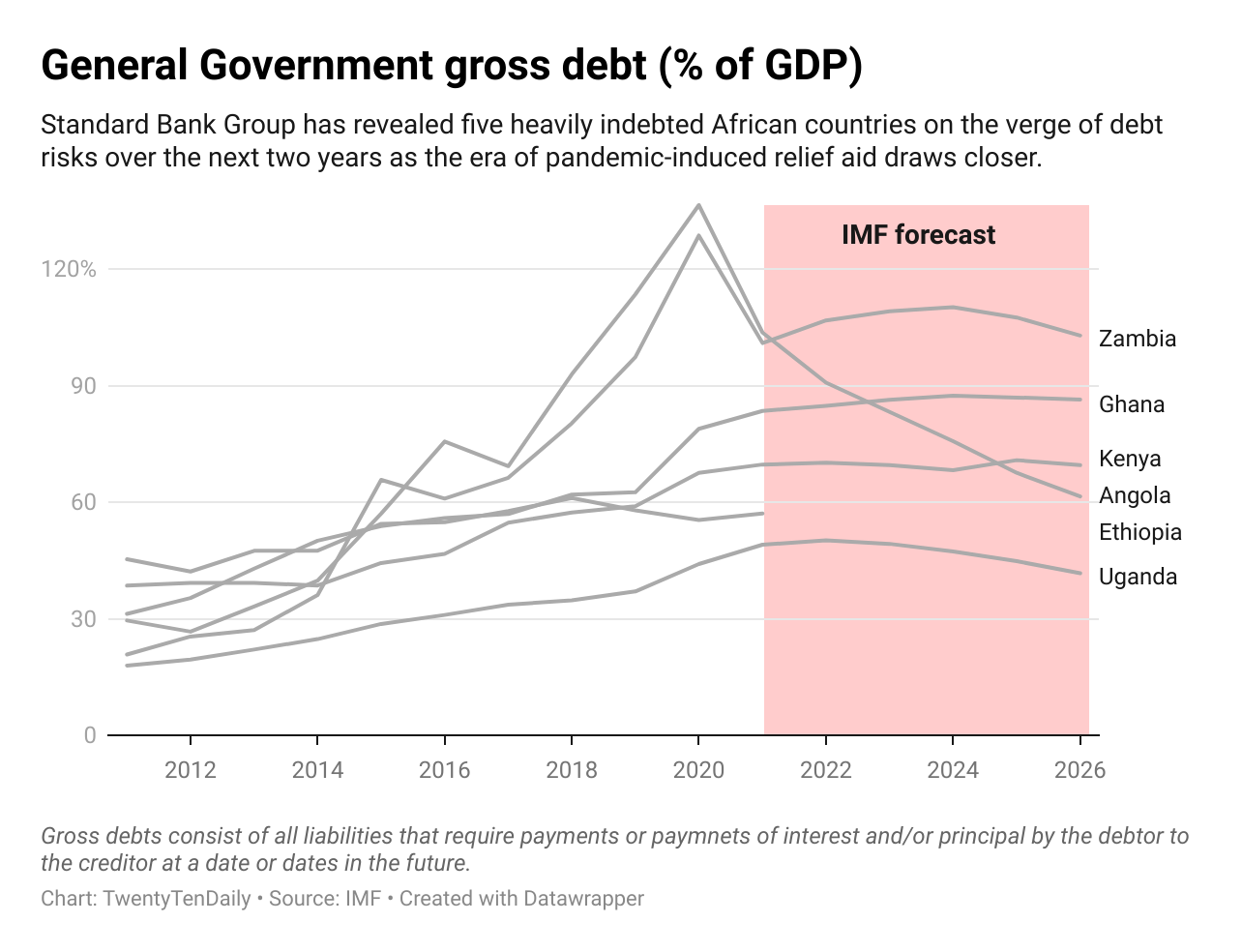

A recent report by the Standard Bank Group has revealed five heavily indebted African countries on the verge of debt risks over the next two years as the era of pandemic-induced relief aid draws closer.

According to the leading lending institution, the five countries categorized as the ‘Fragile Five’ risk loan denials from global lenders and investors if a fiscal reconstruction does not happen soon.

Ghana, Kenya, Angola, Ethiopia and Zambia are listed as the “fragile five” of 18 countries covered in the report, while Uganda is listed amongst the continent’s brightest stars in 2022.

Ghana

According to the report, Ghana’s debt risk is made worse by the country’s deteriorating public finances. In an interview with Bloomberg, Jibran Qureishi, the head of African research at Standard Bank Group shared that Ghana would likely depend on an IMF loan to regain investments from foreign investors.

With an external debt of 70.53 billion dollars in 2022, according to data from Statista, analysts have opined that lenders may not be keen on refinancing the West African country’s Eurobonds once the US Federal Reserve Bank finally increases interest rates.

Kenya

With external debt of roughly 35.3 billion dollars, Kenya’s debt servicing cost the country a third of its foreign reserves which is 35% of the country’s forex and 43% of its tax revenue.

The report shares that the country can still afford to refinance its debts, even though the upcoming presidential election in the East African country slated for August is a cause for concern as the elections may halt efforts to reduce borrowings and narrow the budget deficit.

Angola

A major beneficiary of the G-20 nations’ Debt Service Suspension Initiative during the pandemic, the crude-rich nation was allowed to delay almost $3 billion of payments last year. Unfortunately, the IMF program is coming to an end and the country would be expected to service a part of its staggering 68.9 billion U.S. dollars debt.

The lending institution however shared that Angola still has the potential for credit-rating upgrades in 2022 unlike Ghana.

Ethiopia

Qureshi described the country as being on the brink of loan defaults if a deliberate reprofiling of its loans is not effected immediately. The second most populous country in Africa has been able to sustain its debts due to its relatively low proportion of loans. However, prolonged internal conflict as well as foreign-exchange shortages made worse by the pandemic is driving the possible debt default, according to the bank.

“When you look at the short-term debt service as a function of foreign-exchange reserves, it is much more concerning in Ethiopia than it is in Ghana,” said Qureishi.

The low foreign-exchange reserves, last reported at $2.3 billion in May, also continues to remain a problem, he said.

Zambia and Uganda

With an external debt of up to 14.48 billion US dollars which gulps up to 60% of its gross domestic product, Zambia was Africa’s first pandemic-era defaulter in 2020. However, the mineral-rich country has been able to secure staff-level agreement for a $1.4 billion IMF facility that’s partly subject to progress on debt restructuring under the Common Framework. Unfortunately, loan advances may be limited as the role of China remains unclear, Qureishi said.

With a public debt of over 17 billion US dollars, Uganda’s economy is expected to rebound strongly as the government lifts its strict Covid-19 restrictions. Significant investments in oil and the construction of a pipeline will turn the East African nation into a significant crude exporter which would bolster foreign reserves and general output, according to Qureishi.