The Vice president of Nigeria, Professor Yemi Osibanjo, has revealed the government’s new plan to begin the taxation of all global technology companies operating in Nigeria to expand the country’s income and tax net.

Professor Osinbajo made this known during an interaction with a delegation from the Chartered Institute of Taxation of Nigeria (CITN), led by Mr Adesina Adedayo, at the Presidential Villa.

Osibanjo addressed the need for Nigeria to widen its tax net to ensure more people who are eligible to pay tax are paying. This would increase the rate of revenue gotten through non-oil taxes.

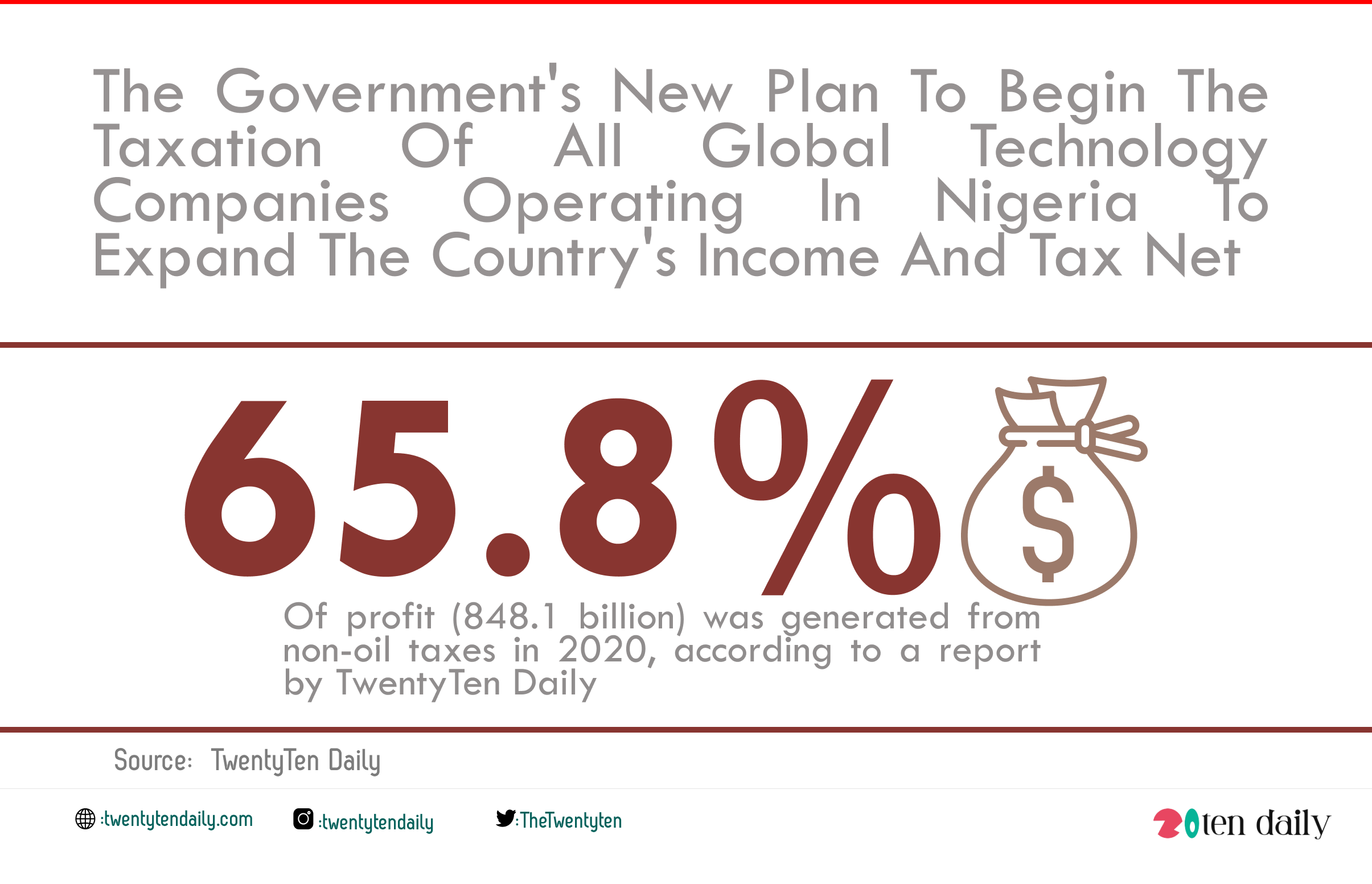

A report by TwentyTen Daily revealed that only 65.8% of profit ( 848.1 billion) was generated from non-oil taxes in 2020. With the instability of oil prices coupled with the rate of insecurity in the country, the country now struggles to create new forms of income through taxation, heavy levies and external loans.

Apart from the badly needed revenue provision for Nigeria, the vice president revealed that the new steps were targeted at ensuring that big tech companies do not escape their fair share of taxation in Nigeria.

“Many of them do incredible volumes here in Nigeria and in several other parts of the region.

“We have drawn up the regulations and we are prepared to go, and I think that we are at least in a good place to tap into some of the tax resources we can get from some of these companies.

“Besides the Federal Government, a recent Bloomberg news article reported that “Governments around the world are grappling with how to modernise their legal frameworks to account for the global reach of the digital economy, reshaping how policymakers think about issues as varied as monopoly power, taxation and workers’ rights.”

While speaking on the legal provisions of these new taxation plans, Osibanjo promised that all legal norms would be utilised to collect taxes on profits made locally by global technology and digital firms not based in Nigeria.