Value Added Tax, according to the Federal Inland Revenue Service, is a consumption tax paid when goods are purchased and services rendered. It is borne by the final consumer; that is all goods and services, both produced within or imported into the country, are taxable- except those exempted by the VAT Act.

The VAT charge rate on goods is 7.5 percent contributing significantly to the total revenue generated by the government. In 2019, the VAT accounted for 16.2 percent of the Gross Domestic Product rate.

VAT was introduced in 1993 under Decree No.102; replacing the sales tax of Decree No7 of 1986. However, the FIRS has been responsible for the collection of the VAT across 36 states.

According to Section 40 of the VAT Act, 15 percent of the pool goes to the federal government, 50 percent to the state government and 35 percent to the local government. However, there is a net of 4 percent cost of allocation by the FIRS and 20 percent of the pool shared based on the derivation.

VAT generation in Nigeria

According to the National Bureau of Statistics, the sectoral distribution of VAT data for the second quarter of 2021 reflected that the sum of N512.25 billion was generated.

This is against N496.39 billion generated in the first quarter of 2021 and N327.20 billion generated in Q2 2020.

It represents a 3.20% increase Quarter-on-Quarter and 56.56% increase Year-on-Year.

Out of the total amount generated in Q2 2021, N187.43bn was generated as Non-Import VAT locally while N207.69bn was generated as Non-Import VAT for foreign. The balance of N117.13bn was generated as NCS-Import VAT.

VAT generation grew from 324.6 billion in Q1 2020; 327.2 billion in Q2 2020; 424.7 billion in Q3 2020; 454.7 billion in Q4 2020; 496.4 billion in Q1 2021 to 512 billion in Q2 2021.

IGR generation in Nigeria

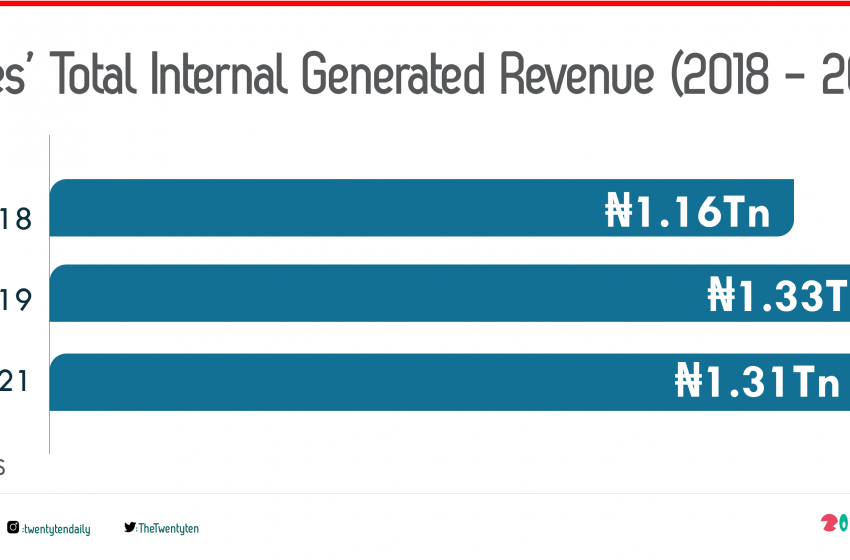

NBS also reported that the aggregate internally generated revenue of the 36 states in the country and the Federal Capital Territory Administration fell by 37 billion in two years.

As of the end of 2018, states’ IGR stood at N1.68 trillion, while by the end of 2020, the total IGR fell to N1.31trillion.

This means that the total IGR of states declined by 22.02 percent within the review period.

In 2020, Lagos led with N418.9 billion, followed by Rivers with N117.2 billion, FCT with N92.0 billion, Delta with N59.7 billion and Kaduna with N50.7 billion.

States challenge VAT collection

The Rivers state government and its counterpart Lagos state have both implemented a law empowering them to collect VAT from businesses rather than the FIRS.

In Port Harcourt, a federal high court issued an order restraining FIRS from collecting VAT in Rivers directing the state government to take charge of the collection. Following this, the Rivers state government implemented the Valued Added Tax Law No. 4 of 2021 empowering the state to collect the VAT itself.

Similarly, Lagos state directed FIRS to stop issuing demand notices for payment of VAT. The state assembly further enacted the VAT law which the governor signed into law.

In the defense of the FIRS, it has said it has the backing of the VAT Act to collect the tax in all states. In a recent development, the Court of Appeal sitting in Abuja has ordered both Rivers and Lagos States to maintain the status quo on the collection of Value Added Tax, VAT, pending the determination of an appeal that was lodged before it by the Federal Inland Revenue Service, FIRS.

Deliberation about the bill has however in Ogun state assembly has scaled both the first and second reading.

What this means for states

With Lagos and Rivers state contributing a larger share –a total of 41.05 percent IGR in 2020– to the government, this might leave over 25 states who majorly depend on FAAC shares.

On the contrary, some experts have argued that the withdrawal might boost the revenue generation and collection in states– causing an increase in commercialization and industrialization.

Another report has placed 30 states at risk of bankruptcy if the law is enacted to full effect.

A recent PWC report explains that the judgement, if upheld by a higher court, could spell doom for some states which currently do not generate enough economic activities to boost their individual VAT numbers. According to PWC, states such as Lagos, Rivers and Kano might just be the only beneficiaries of this ruling, considering the significant level of economic activity in the states that can generate high VAT revenues.

“Ironically, the biggest losers will be the states except Lagos. A few states like Kano, Rivers, Oyo, Kaduna, Delta and Katsina may experience minimal impact, while at least 30 states which account for less than 20% of VAT collection will suffer significant revenue decline. The federal government may in fact be better off, given that FCT generates the second-highest VAT (after Lagos) in addition to import and non-import foreign VAT.”

However, FIRS has been projected to lose up to N92 billion revenue to states if the law is upheld.