Despite IMF Appeal and Supreme Court interim injunction, the February 10 deadline for old ₦1000, ₦500 and ₦200 notes to stop being legal tender approach as the federal government seeks dismissal of the injunction and more Nigerians are getting frustrated due to the inability to access cash for their regular transactions.

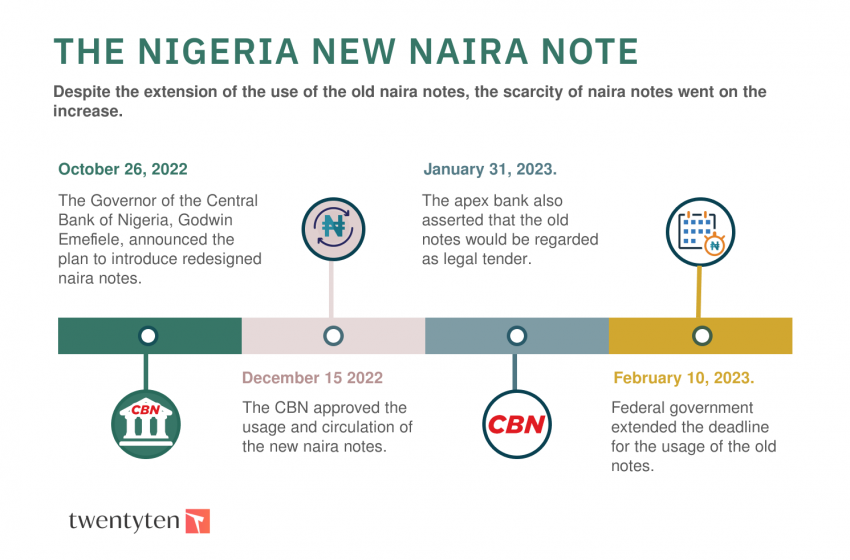

On October 26, 2022, the Governor of the Central Bank of Nigeria, Godwin Emefiele, Central Bank of Nigeria governor, announced the plan to introduce redesigned 200, 500, and 1,000 naira notes. According to Emefiele, this change was made to control the money supply and aid security agencies in tackling illicit spending of money.

On December 15 2022, the CBN approved the usage and circulation of the new naira notes. The apex bank also asserted that the old notes would be regarded as legal tender from January 31, 2023.

However, before the January 31 deadline, the new notes were not yet circulated and banks were not able to disburse these notes to customers. When the FG saw that the new notes were not yet circulated and Nigerians could not use the old notes either, it extended the deadline for the usage of the old notes to February 10, 2023.

The new naira note scarcity has made some banks direct their staff to stay at home while POS operators in the neighbourhood are folding up.

Also, the inability to get cash has caused a decrease in the purchase of goods and services as most market women won’t take transfers for transactions.

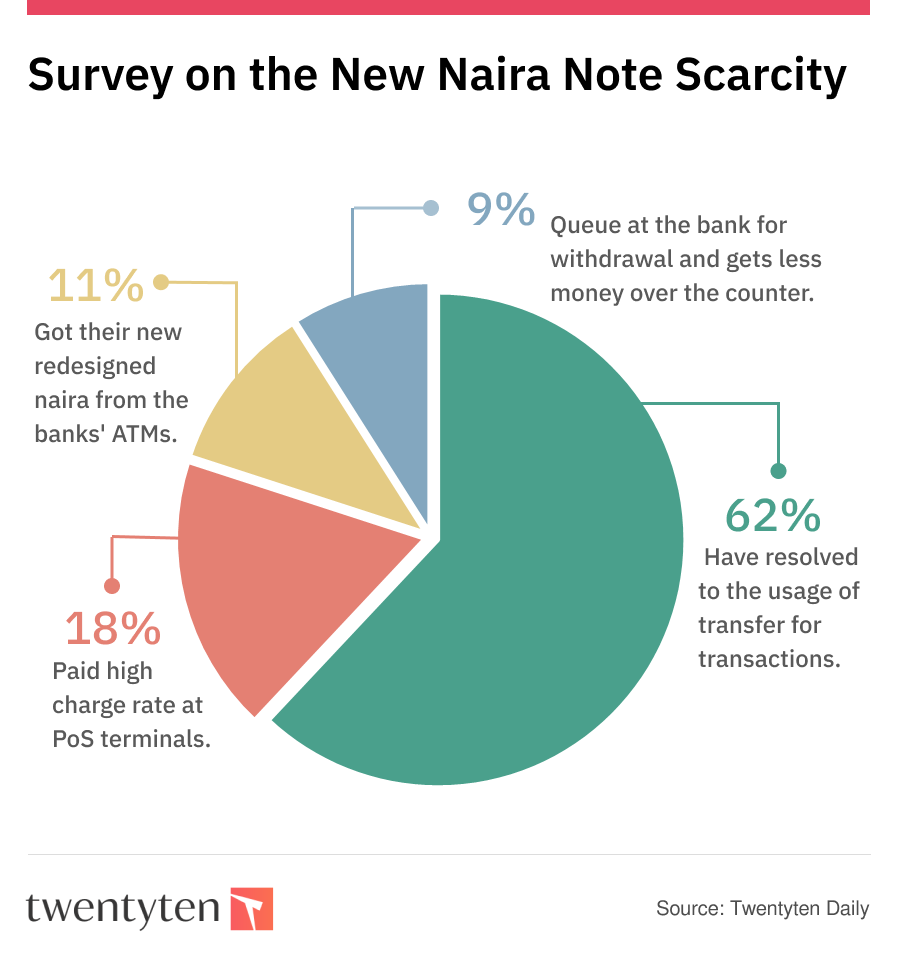

Twentyten Daily created a survey to understand the situation better and how Nigerians are surviving to get cash for daily businesses. It was gathered that of 45 people who responded to the survey, 62 percent have resolved to the usage of transfer for transactions – despite the challenge in the Nigerian financial challenges while 18 percent got stuck to paying high charge rates at PoS terminals, 11 percent got their new redesigned naira from the banks’ ATMs and only 9 percent queue at the bank for withdrawal and yet had less money collected over the counter.

Using money to buy money

Despite the extension of the use of the old naira notes, the scarcity of naira notes went on the increase. Nigerians could no longer go to the banks to withdraw money and some banks only dispensed a maximum of ₦1,000 per customer.

Before the introduction of the new naira notes, Point of Sales owners (PoS) used to charge ₦200 per ₦10,000. But since the introduction of the new notes, the charges, the prices have gone outrageously high.

Speaking with Kingsley Ndimele, an economic expert, noted that Nigerians are frustrated which makes it the psychological effects of the scarcity.

“In several locations, charges on withdrawals at PoS stands are now a minimum of 10 percent. This is a result of high demand and low supply.

“A lot of people in the banks and ATM stands are PoS business people. They would have to wait at the ATM stands to get money for their business

“We hope that the government and those in power find a solution to this so quickly to reduce frustration,” he concluded.

Twentyten Daily research shows that PoS operators hiked the charges collected over withdrawal and it varies.

Kalu Aja, a financial analyst who is in favour of the cash withdrawal limit said in a tweet that CBN should not rescind the decision on the naira swap but cap withdrawal at ₦200,000 for each account till March while making the online transactions easier by paying for the transaction fees.

‘It is not easy, our sales have dropped’ – Business owners

Mojisola Adebola is a grocery store owner in the Oye-Ekiti area of Ekiti State. Before the introduction of the redesigned naira notes, Adebola makes between ₦10,000–₦15,000 daily.

“This is a school area and these students would always buy goods daily. Sometimes, I even make ₦20,000. But since FG introduced these naira notes, it has been difficult to sell. Sometimes, some of them would want to make a transfer but the network connection would not allow them.

In many instances, the students have made transfers of their payments to me which I did not get. When I try to use the PoS machine to make transactions, the network becomes slow too. It seems like the redesigned naira notes also caused a change in digital transactions,” Adebola lamented.

For Moses Okechukwu who is a motorcycle rider, the change in naira notes has caused a setback for his business.

“All I get these days is transfer. Even when the place is not far and I am to collect N100, these students make transfers. And most times, I would have to wait till I get the money before I continue working”

On most days, Okechukwu would have to go and queue at the bank to withdraw the money that was transferred to him for this regular use.

“These banks would not even give you what you want. The highest money I have withdrawn from the bank is ₦2,000. We are not getting these new notes. Things are hard,” said Okechukwu.

Blessing Osugbor sells bags, shoes, and female dresses in the Ijaye area of Lagos State. Osugbor used to make ₦80,000 – ₦150,000 daily in her shop. But the scarcity of the new naira notes caused a break in her sales.

“It is past 12 noon at the moment. On a normal day, I would have made up to ₦30,000 because this location is a good one. But I have not made any sales today.

“Customers would come and tell me they want to make transfers but the network issues wouldn’t allow them. One of my customers has been trying to make payment to me yesterday through transfer but she has not been able to,” Osugbor said.

The businesswoman noted that her business would stop booming if the challenge continues.