The Federal Government borrowed N4.2 trillion from local investors in the first half of the year , representing 21 per cent, year-on-year.

This is an increase from N3.89 trillion borrowed in the first half of 2021 (H1’21).

The increased borrowing was driven by a 30 per cent increase in FGN Bond sales, 49 percent increase in FGN Savings Bonds sales and about 14 per cent increase in borrowing through the Nigeria Treasury Bills, NTBs during the six months period.

Findings from bond auctions results showed that the amount of FGN bonds sold in H1’22, rose to N1.84 trillion from N1.42 trillion in H1’21. This represents a 30 per cent, YoY increase.

Further analysis showed that the amounts of FGN bonds offered by the Debt Management Office rose by 25 per cent YoY to N1.13 trillion in H1’22 from N900 billion in H1’21.

Similarly, total subscription, representing demand by investors, rose by 69 per cent YoY to N3.02 trillion in H1’22 from N1.79 trillion in H1’21. This resulted in 168 per cent oversubscription up from 99 per cent recorded in H1’21.

Total allotment rose by 38 per cent to N1.56 trillion in H1’22 from N1.12 trillion in H1’21.

During the six months period (H1’22) the DMO sold two tenors of FGN Bonds namely 10-years bonds and 20-years bonds.

Breakdown Analysis

The DMO offered N675 billion worth of 10-years bonds which attracted public subscription of N1.312 trillion, resulting in 94 per cent over subscription, while the total amount sold stood at N919.45 trillion.

Furthermore, the DMO offered N450 billion worth of 20-years bonds which attracted public subscription of N1.71 trillion resulting in oversubscription of 280 per cent while the amount sold stood at N916.31 billion.

Findings from the quarterly results of FGN bond auctions showed a rising trend in the amount offered by the DMO and demand by the investing public.

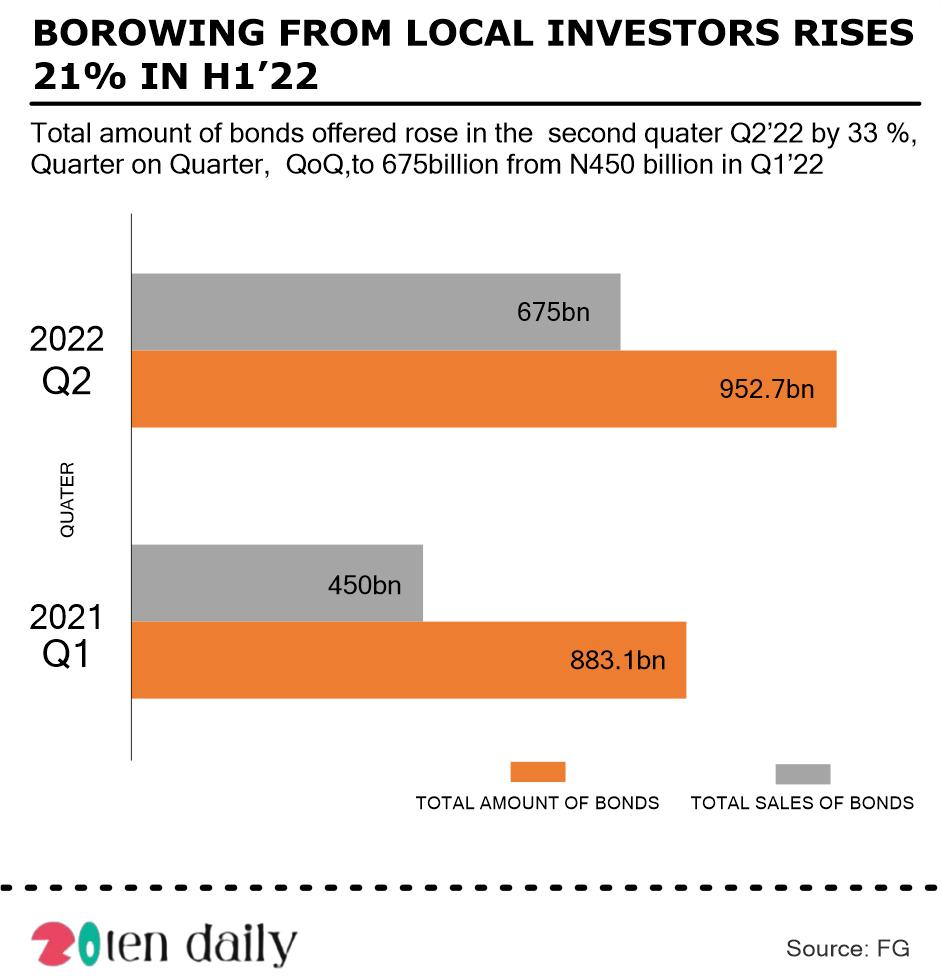

Total amount of bonds offered rose in the second quarter Q2’22 by 33 per cent, quarter-on-quarter, QoQ, to N675 billion from N450 billion in Q1’22.

Similarly, total public subscription rose by 3.8 per cent QoQ to N1.64 trillion in Q2’22 from N148 trillion in Q1’21, resulting in oversubscription of 128 per cent down from 229 per cent in Q1’21. Total sales rose by 7.9 per cent QoQ to N952.7 billion in Q2’22 from N883.1 billion in Q’22.

The amount of 10-years FGN bonds offered by the DMO in Q2’22 rose by 100 per cent, QoQ to N450 billion from N225 billion in Q1’22 but total public subscription dropped by 3.5 per cent QoQ to N644.5 billion resulting 43 per cent oversubscription, down from 197 per cent in Q1’21.

While the DMO offered N225 billion worth of 20-years bonds in Q2’22, same as in and Q1’22, it however reduced the amount sold by 24 per cent to N396 billion from N520.31 billion in Q1’22. This was in spite of a 9.8 percent increase in total public subscription to N892.9 billion in Q2’22 from N813 billion in Q1’22.