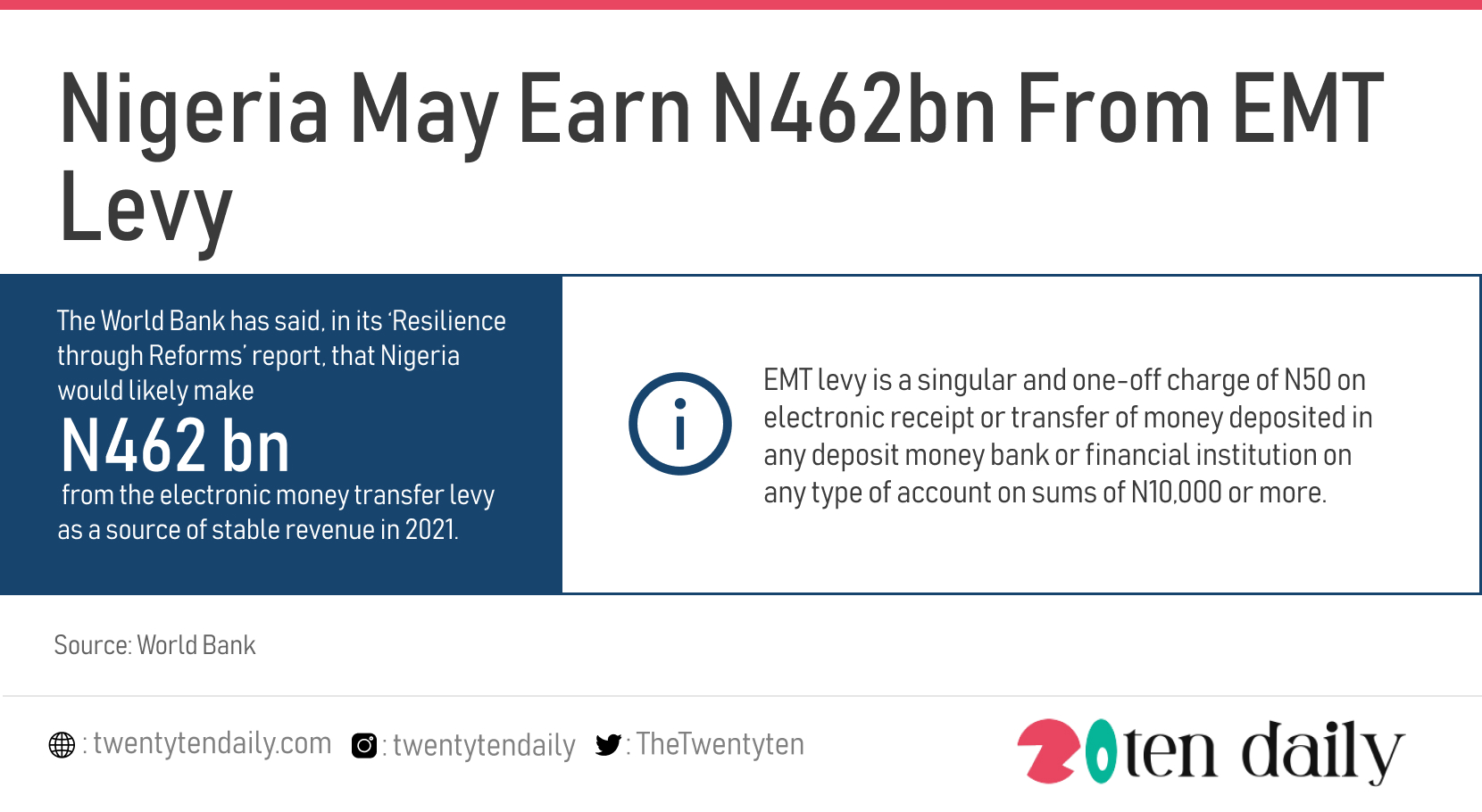

The World Bank has said, in its ‘Resilience through Reforms’ report, that Nigeria would likely make N462 billion from the electronic money transfer levy as a source of stable revenue in 2021.

According to the report, the EMT levy was introduced in the Finance Act 2020, which amended the Stamp Duty Act and taps into the growth in electronic funds transfer in Nigeria, and can be administered at low cost.

EMT levy is a singular and one-off charge of N50 on electronic receipt or transfer of money deposited in any deposit money bank or financial institution on any type of account on sums of N10,000 or more.

The revenue derived from the EMT levy is shared based on derivation and distributed at 15 percent to the Federal Government and Federal Capital Territory, and 85 per cent to the state governments.

The Chairman of the Foundation for Economic Research and Training, Akpan Ekpo, who spoke with PUNCH Newspaper, said the levy on users of formal financial services was worrisome.

He said, “The levy is remitted to the government, which is fine. But I think the savers, the people who use the transfer channels, are over-levied. You pay maintenance fee, transfer fee, and I think if this level of levying continues, it will discourage people from using electronic channels.

“Personally, I think the EMT levy should be out of the Finance Act. There is too much burden on the citizens, although the government is making great money from it. Let us hope they use the money wisely, but it shouldn’t have been put there in the first place.

“It is a law now; there is nothing that can be done about it. But I hope it is used wisely, and they would be transparent about how the money is being used.”

He said, “With the EMT levy, more people are discouraged from using the banks and its services. A lot of Nigerians sell in rural areas, and are outside the financial system net.

“With the EMT, more people are further excluded. There really was no need to introduce the EMT; it will discourage those who are not already in the formal banking sector from even coming into it. It is likely to further deepen the financial exclusion of many Nigerians.”