The Central Bank of Nigeria has said the bank deposits rose by N6.95tn between February 2019 and February 2020.

The CBN disclosed this in its report on some of the personal statements of members of the Monetary Policy Committee.

Part of the statement read, “However, there were moderate declines in returns on equity and returns on assets and a significant rise in the share of operating incomes in total interest incomes of Deposit Money Banks.

“All measures of bank size, total assets, credit and deposits significantly rose year-on-year. Over N4.56tn additional credit was created in the last one year, N300bn in the last one month and N6.95tn of additional deposits.”

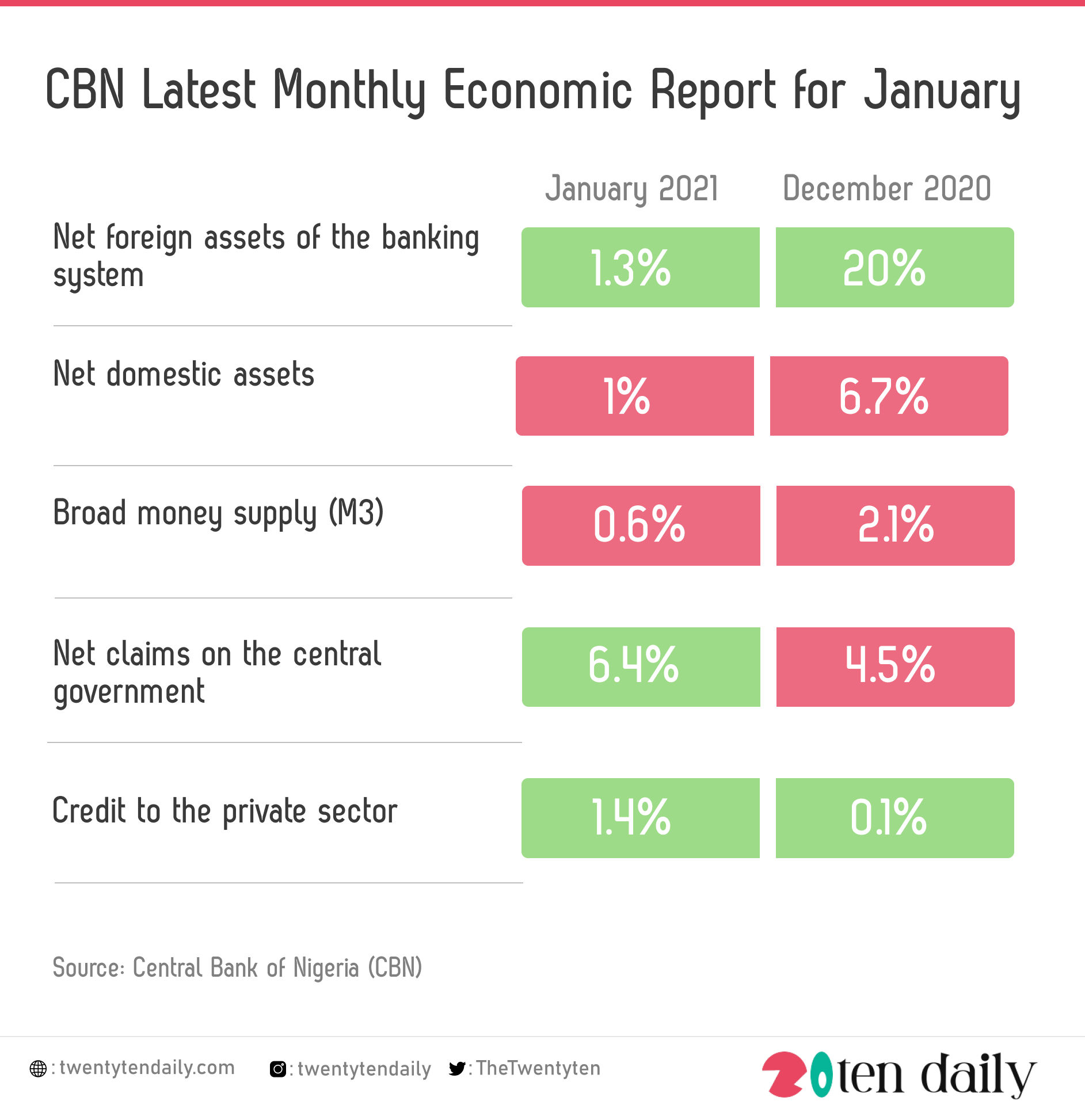

The CBN also disclosed in its latest monthly economic report for January that broad money supply (M3) declined in January 2021 due, largely, to the fall in net domestic assets of depository corporations, which more than offset the growth in net foreign assets.

CBN also stated that the net foreign assets of the banking system grew by 1.3 percent to N7.22tn at the end of January 2021, compared with the growth of 20 per cent at the end December 2020.

The report stated that net domestic assets declined by one percent, compared with a decline of 6.7 per cent in the corresponding period of 2020.

This development was due to the reduction in CBN claims on other financial corporations and state and local governments.

Consequently, it added, M3 fell by 0.6 per cent at end-January 2021, compared with the decline of 2.1 per cent at end-December 2020.

According to the report, Net claims on the central government grew by 6.4 per cent at end-January 2021, in contrast to a decline of 4.5 per cent in the corresponding period of 2020.

Credit to the private sector grew by 1.4 per cent at end-January 2021, compared with 0.1 per cent in the corresponding period of 2020, it stated.