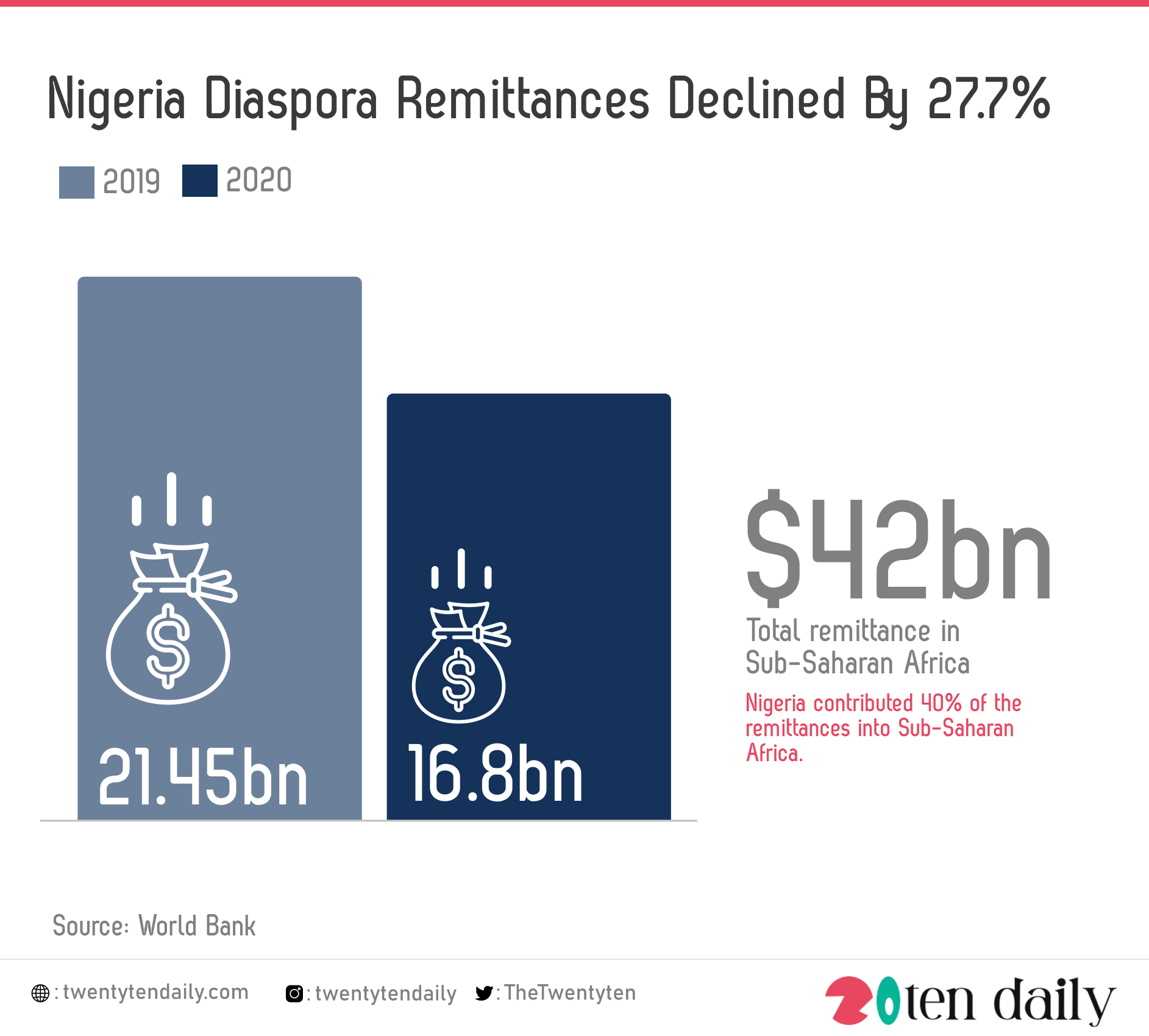

Remittances by Nigerians in the Diaspora has declined by 27.7 percent in 2020, the World Bank has said.

A report by the World Bank titled ‘Defying predictions, remittance flows remain strong during COVID-19 crisis’ said Nigeria contributed 40 per cent of the remittances into Sub-Saharan Africa.

The report put remittances to Sub-Saharan Africa at $42bn. 40 percent contribution of Nigeria to this means that remittances to Nigeria was $16.8bn in 2020.A decline of 27.7 percent also put remittances into the country in 2019 at $21.45bn.

The report said remittances to Sub-Saharan Africa declined by an estimated 12.5 percent due to a decline in the remittances to Nigeria that contributes the largest amount in the region.

Diaspora remittances is the second major source of foreign exchange for the country. Drying forex remittances recently pushed the Central Bank of Nigeria to offer an incentive of N5 for every dollar remitted through official channels.

Differing exchange rates often push Nigerians in the diaspora to explore alternative ways of remitting money into the country so that they can enjoy higher value.

The report stated that the decline in flows to Sub-Saharan Africa was almost entirely due to a 27.7 percent decline in remittance flows to Nigeria.

Excluding flows to Nigeria, it stated, remittances to Sub-Saharan Africa increased by 2.3 per cent, demonstrating resilience.

Part of the report read, “Remittances to Sub-Saharan Africa declined by an estimated 12.5 per cent in 2020 to $42bn.

“The decline was almost entirely due to a 27.7 per cent decline in remittance flows to Nigeria, which alone accounted for over 40 per cent of remittance flows to the region.

“Excluding Nigeria, remittance flows to Sub-Saharan African increased by 2.3 per cent.

“Remittance growth was reported in Zambia (37 per cent), Mozambique (16 per cent), Kenya (nine per cent) and Ghana (five per cent).”

On the remittance costs for Sub-Saharan Africa, the report said it remained the most expensive region to send money to, where sending $200 costs an average of 8.2 per cent in the fourth quarter of 2020.

“Within the region, which experiences high intra-regional migration, it is expensive to send money from South Africa to Botswana (19.6 per cent), Zimbabwe (14 per cent), and to Malawi (16 per cent),” it stated.

The report said in 2021, remittance flows to the region were projected to rise by 2.6 per cent, supported by improving prospects for growth in high-income countries.

However, data on remittance flows to Sub-Saharan Africa were sparse and of uneven quality, with some countries still using the outdated fourth IMF balance of payments manual, rather than the sixth, while several other countries did not report data at all, it stated.

The report said the relatively strong performance of remittance flows during the COVID-19 crisis had also highlighted the importance of timely availability of data.