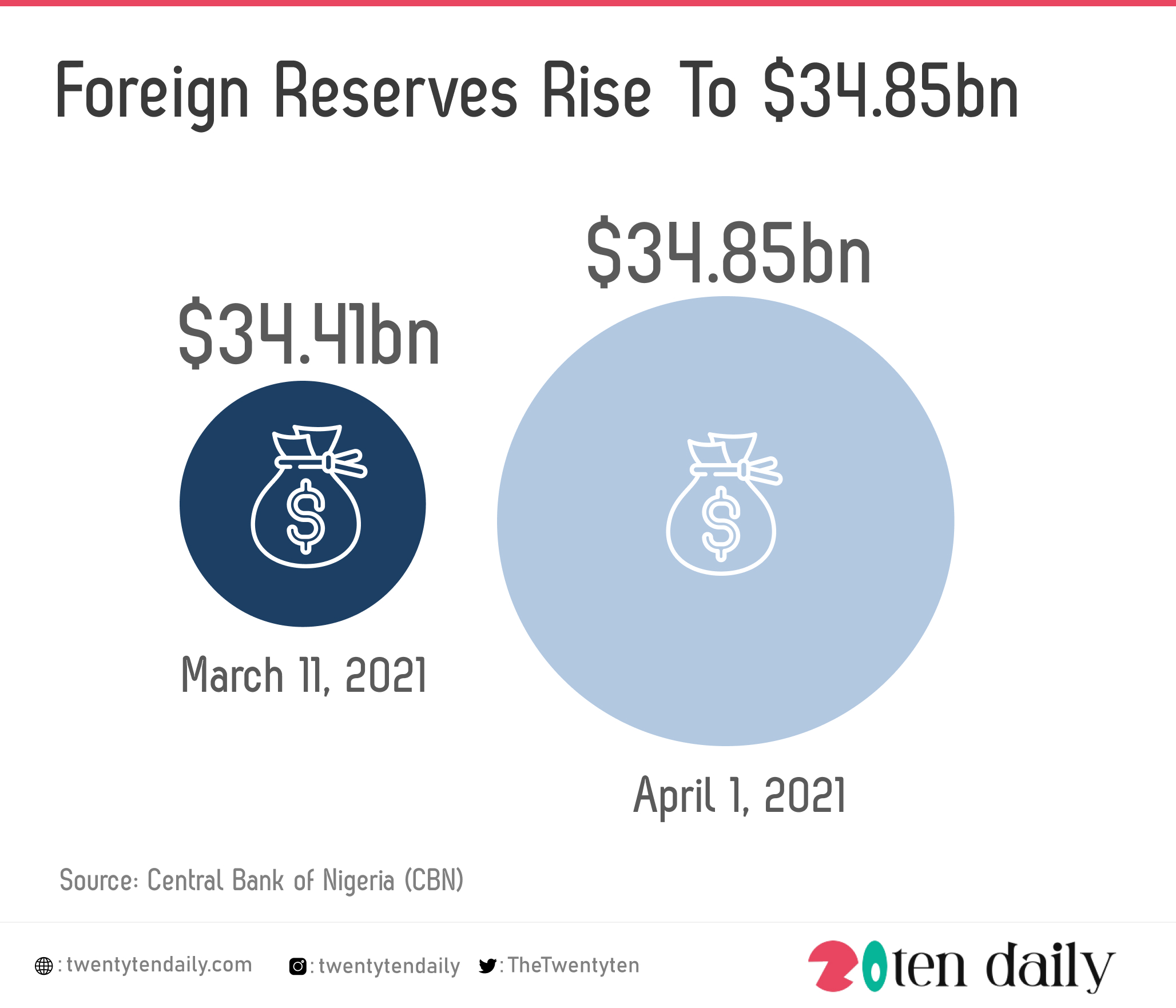

The foreign reserves, on April 1, stood at $34.85 billion, representing $404 million increase compared to $34.41 billion on March 11.

This rose has been attributed to the Central Bank of Nigeria ‘Naira for Dollar’ policy which led to positive accretion to the foreign reserves exactly one month after takeoff.

The policy has seen dollar inflows pass through commercial banks, instead of unofficial channels as well as helping reserves accretion is the continued rise in benchmark Brent crude oil price, which stood at $63.29 per barrel as at April 8, representing about $23.29 above the $40 per barrel benchmark for 2021 budget.

According to the CBN Governor, Godwin Emefiele, the ‘Naira for Dollar’ policy, gives N5 rebate for every $1 sent by Nigerians in diaspora to the country, which is paid directly to the account of the beneficiaries, following receipt of the remittance inflows.

The CBN had assured that the new policy would provide Nigerians in the Diaspora with cheaper and more convenient ways of sending remittances to Nigeria. Emefiele had also noted that the move was also to increase the transparency of remittance inflows and reduce rent-seeking activities.

He expressed optimism that the new policy measure will encourage banks and financial institutions to develop products and investment vehicles, geared towards attracting investments from Nigerians in the diaspora.

Fitch Ratings, a global rating agency predicted, on the foreign reserve, that Nigeria’s external reserves would rise to $42 billion by year-end.

In a report titled, “Depreciatory Pressures on Key Sub-Saharan African Currencies to Lessen,” Fitch Ratings had hinged the forecast on its expectation that Brent crude would average $53 per barrel, compared to the $43.1 per barrel recorded in 2020.

Moreover, the agency anticipated that the CBN would allow the official naira exchange rate to depreciate further over the course of 2021, notwithstanding improved terms of trade and foreign exchange reserves.

“Given rising oil prices in 2021, we expect forex reserves to rise to an average of around $42 billion in 2021 (around eight months of import cover), compared to $36 billion in 2020.

“However, this will not negate the impact of persistent depreciatory pressures on the naira, notably as a result of rising dollar demand driven by the domestic economic recovery,” it stated.