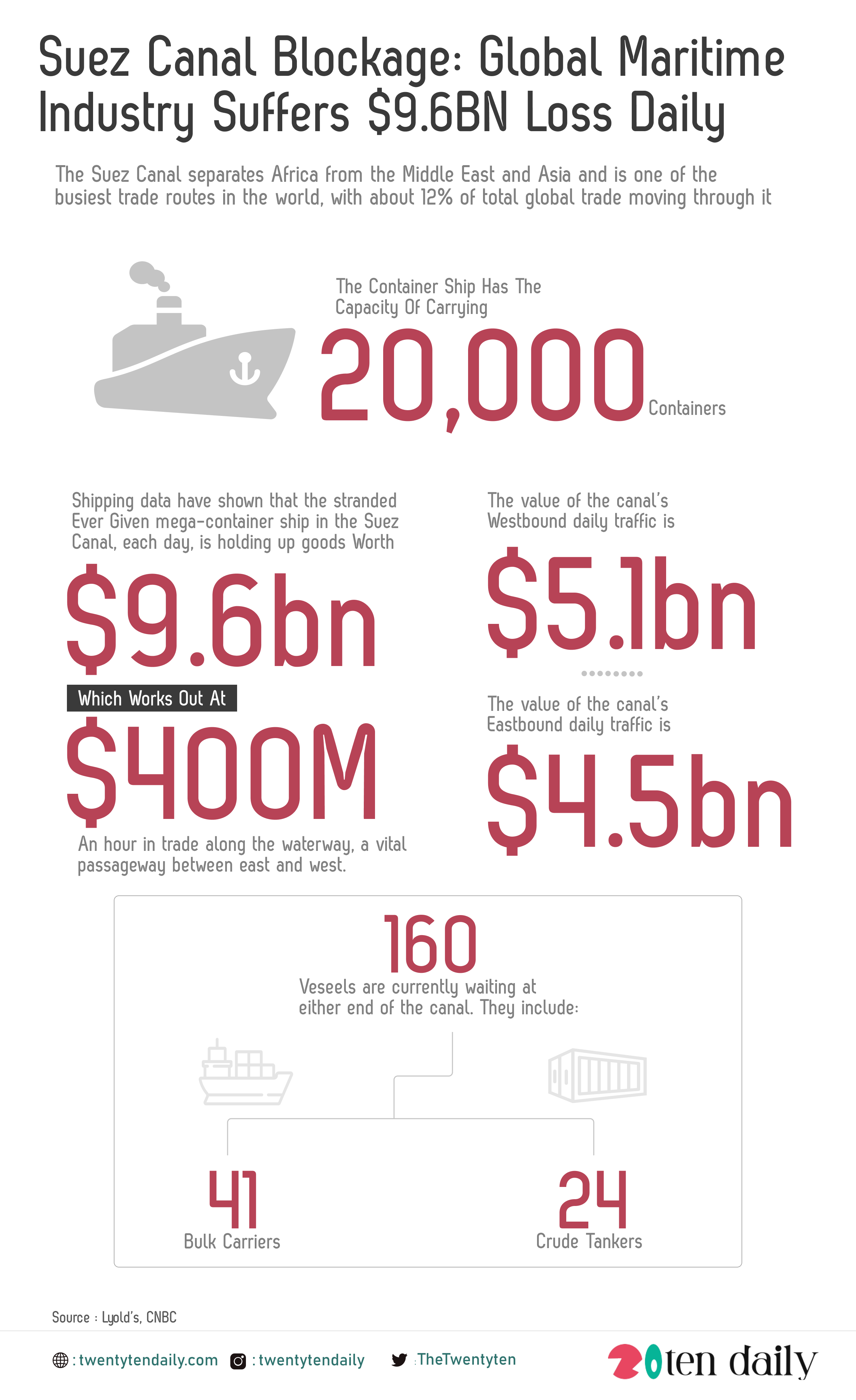

Shipping data have shown that the stranded Ever Given mega-container ship in the Suez Canal is holding up an estimated $9.6bn (£7bn) of goods each day which works out at $400 million an hour in trade along the waterway, a vital passageway between east and west.

The Suez Canal separates Africa from the Middle East and Asia and is one of the busiest trade routes in the world, with about 12% of total global trade moving through it.

Being the shortest maritime route, the canal allows passage of vessels ranging from containers carrying consumer products such as clothing, furniture, manufacturing components and car parts to oil carrying vessels to and from Africa, Asia and Europe.

Recently the blockage caused by a giant ship that broke down in the canal is causing huge tailbacks of other ships trying to pass through the Suez Canal.

Data from shipping expert Lloyd’s List values the canal’s westbound traffic at roughly $5.1bn a day, and eastbound daily traffic at around $4.5bn.

It also showed that not less than 160 vessels are currently waiting at either end of the canal. These include 41 bulk carriers, 24 crude tankers and empty containers needed for exports.

The Ever Given, operated by the Taiwanese company Evergreen Marine, is a large-sized ship likened to the length of four football pitches and one of the world’s biggest container vessels.

The 400m-long (1,300ft), 200,000-tonne vessel with the capacity of carrying 20,000 containers became wedged across the Suez Canal amid high winds and a dust storm.

An Alternative Route For Shipping Companies?

Guy Platten, the secretary-general of the International Chamber of Shipping, told BBC reporters that shipping companies were starting to divert their ships around the southern tip of Africa, the Cape of Good Hope but this route would add about 3,500 miles to the journey, causing a 12-day delay for importers.

Platten said the Ever Given ship appeared to be “hard fast aground”, adding that freeing the vessel from the bank was taking much longer and was more complicated than had been initially expected.

Mr Platten added there would be “some major real-world effects on the supply chain”, explaining that consumers would ultimately bear the cost.

Some shipping companies plan on absorbing the extra delay in transit times. But salvage officials said the congestion could last days or even weeks, in a blow to global supply chains already strained by the Covid-19 pandemic.

Some companies will be considering flying replacement merchandise for higher value products, or transporting them via trains.

Two major shipping companies, Maersk and Hapag-Lloyd, said they are looking into options to avoid the Suez Canal.

Egypt’s Suez Canal Authority (SCA) said it was doing all it could to refloat the ship with tug boats, dredgers and heavy earth-moving equipment.

What This Means For Nigerian Importers

Currently, Nigerian importers might feel the brunt of the blockage more because of the countries failed system.

TwentyTen gathered that importers at the Apapa Wharf in Lagos have little to no information about the blockage as port officials have been allegedly accused of looking for ways to milk unsuspecting importers.

The TwentyTen team took reporting to the Apapa Wharf in Lagos earlier today to get first-hand information from importers we could find.

We interviewed 62-year-old Nnaemeka Modistus Abiama, an importer who has been stranded in Lagos for the past week, waiting on his container that was due to arrive soon.

The 40ft container carrying auto parts from Europe and several other goods to be marketed is likely on one of the ships stranded on the Suez Canal.

He arrived at the wharf hoping to start the process of clearing to find out the vessel carrying his container has not arrived.

Uncomfortable with the idea of returning to Onitsha without his goods, Mr Nnaemeka would have to shoulder the extra expense of hotel bills and feeding while he waits.

Like Mr Nnaemeka, many importers would ultimately bare the cost of the blockage, coupled with unknown costs that a longer route might incur.