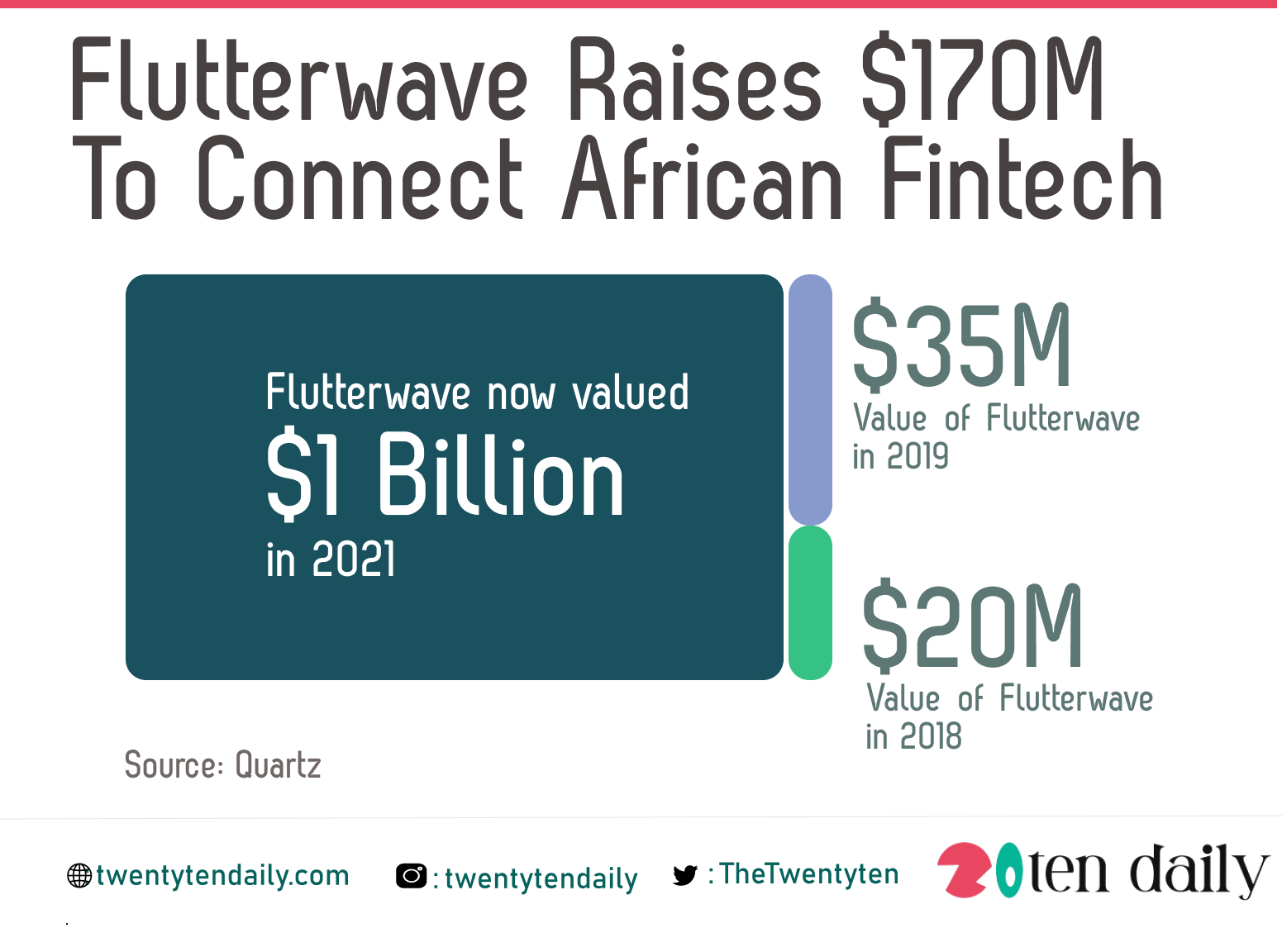

Flutterwave has raised $170 million in a Series C round, positioning itself to further connect and capitalize on Africa’s highly fragmented digital payment landscape. The Nigeria tech payment company is now valued at more than $1 billion.

The Series C round was led by the US-based investment firms Avenir Growth Capital and Tiger Global Management, with participation from new and existing investors including DST Global, Early Capital Berrywood, Green Visor Capital, Greycroft Capital, Insight Partners, Salesforce Ventures, Tiger Management, Worldpay FIS and 9yards Capital.

The Series C round comes a year after Flutterwave closed its $35 million Series B and $20 million Series A in 2018.

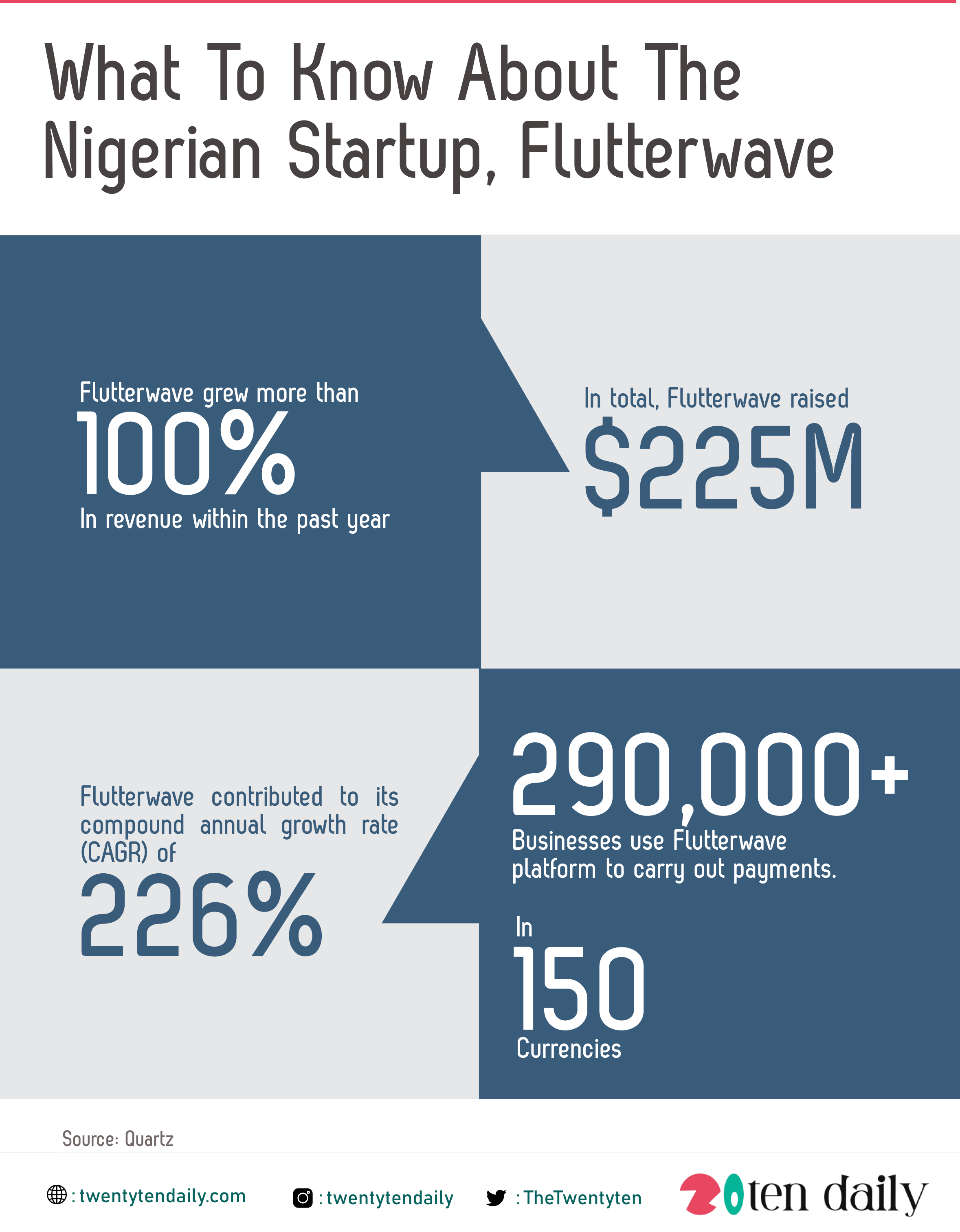

In total, Flutterwave has raised $225 million and is one of the few African startups to have secured more than $200 million in funding. Launched in 2016 as a Nigerian and U.S.-based payments company with offices in Lagos and San Francisco, Flutterwave helps businesses build customizable payments applications through its APIs.

Flutterwave says more than 290,000 businesses use its platform to carry out payments. And according to the company’s statement, they can do so “in 150 currencies and multiple payment modes including local and international cards, mobile wallets, bank transfers, Barter by Flutterwave.”

While its website shows an active presence in 11 African countries, Flutterwave CEO Olugbenga Agboola, also known as GB, told TechCrunch the company is live in 20 African countries with an infrastructure reach in over 33 countries on the continent.

Last year was a pivotal one for the five-year-old company. Its second investment came just in time before the COVID-19 pandemic hit Africa, negatively impacting some businesses but not payments companies like Flutterwave.

Agboola says his company grew more than 100% in revenue within the past year due to the pandemic without giving specifics on numbers. It also contributed to its compound annual growth rate (CAGR) of 226% from 2018.