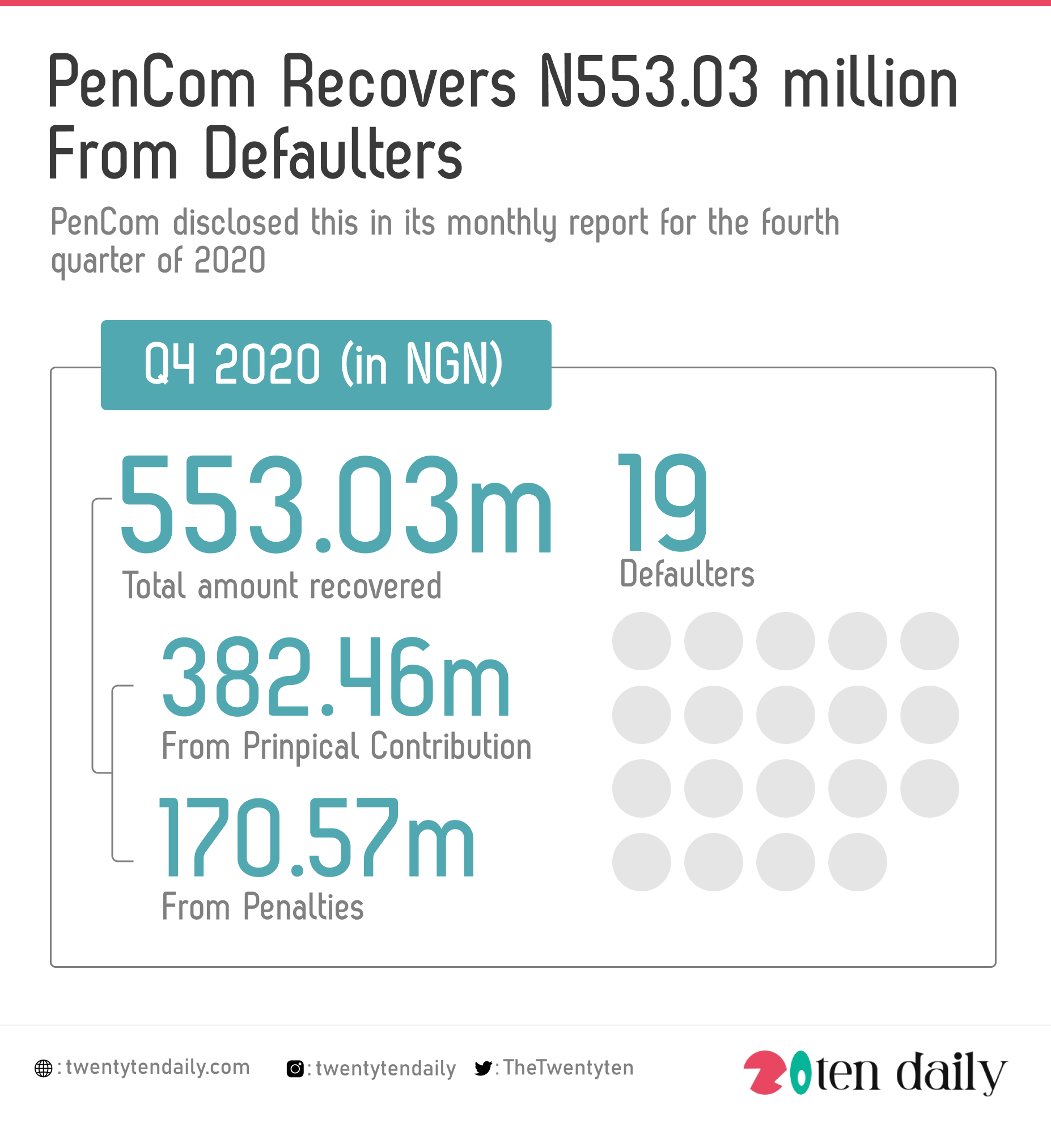

The National Pension Commission has said it recovered ₦553.03 million from defaulting employers who deducted their workers monthly emoluments but failed to remit to their Retirement Savings Accounts with their respe ctive pension fund administrators.

PenCom disclosed this in its monthly report for the fourth quarter of 2020 saying that out of this amount, the principal contribution of the workers was ₦382.46 million, while penalties of ₦170.57 million were recovered through recovery agents.

Part of the report read, “Following the issuance of demand notices to defaulting employers whose pension liabilities had been established by the recovery agents, the sum of ₦553.03 million representing a principal contribution of ₦382.46 million and penalties of ₦170.57 million were recovered from 19 defaulting employers during the quarter under review.”

2020 4th Quarter Review

During this period, the pension industry recorded a net marginal growth of 0.72 percent (66,704) in scheme membership during the quarter.

This is a rise from 9.20 million contributors as at the end of the preceding quarter to 9.27 million as at Q4 2020.

The growth in the industry membership was driven by the RSA Scheme, which had an increase of 68,749 registered contributors.

Similarly, membership of the Closed Pension Fund Administrator Schemes declined by 2,045 to 14,926 while the Approved Existing Schemes membership remained unchanged at 40,951.

The cumulative RSA registrations grew from the 9,147,039 recorded in Q3 2020 to 9,215,788 as at Q4 2020, representing a 0.75 percent growth.

This was mainly attributed to increased levels of compliance by the public and private sectors.