Nigeria recently announced the launch of its first-ever, locally assembled electric vehicle, the Hyundai Kona. This to many might seem like Nigeria’s way of expressing her readiness to pick up the pace towards addressing the problems of climate change like the rest of the world.

However, the reality is that this seeming giant stride leaves the following questions to be asked:

- How the market for electric vehicles can be sustained in a country with poor electricity

- The affordability of the product to allow for availability to up to 60% of Nigeria’s working class

- In the long run, how would electric cars affect Nigeria’s economy that is largely sustained primarily by the petroleum industry?

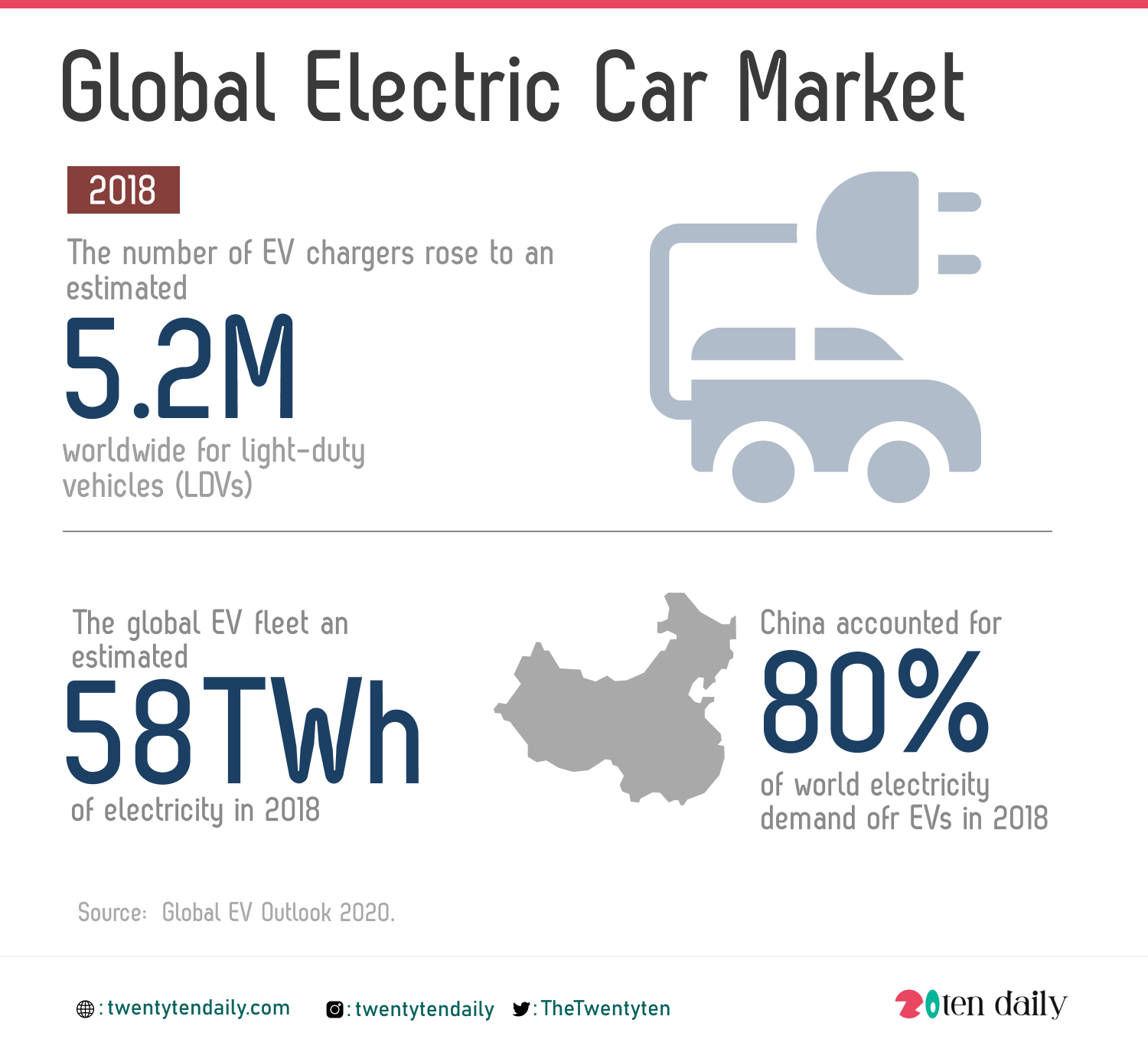

Global Electric Vehicle Market

The global electric vehicle market was valued at $162.34 billion in 2019, and is projected to reach $802.81 billion by 2027.

In 2018, the global electric car fleet exceeded 5.1 million, up 2 million from the previous year and almost doubled the number of new electric car registrations. China remained the world’s largest electric car market, followed by the United States in 2019, according to the Global EV Outlook 2020.

Africa is non-existent on the chart. South Africa which is said to be the largest EV market on the continent, only sold 1,000 EVs in 2019 – out of more than 12 million vehicles on South Africa’s roads.

Majority of vehicles on African roads have one thing in common: they are at least a decade old. Brand new cars are a rare sight and electric vehicles (EVs) are nearly unheard of.

40% of the global exports of used light-duty vehicles (cars, vans, SUVs and pickup trucks) go to Africa, compared with only 2% of new vehicles. An estimated 80–90% of vehicles imported to Kenya, Ethiopia and Nigeria are used – and this proportion may be even higher in lower-income African countries.

In Ethiopia and Nigeria, most imported vehicles are more than 11 years old; a quarter of vehicles imported to Nigeria are more than 19 years old. Only South Africa, Egypt and Sudan have banned used car imports entirely and the numbers go higher every year.

Electricity Mobility in Nigeria

Globally, electricity mobility keeps thriving on a daily to accommodate the new technology. The number of EV chargers rose to an estimated 5.2 million worldwide for light-duty vehicles (LDVs) in 2018. Most are slow chargers (levels 1 and 2 at homes and workplaces), complemented by almost 540 000 publicly accessible chargers (including 150 000 fast chargers, 78% of which are in China). With the 156 000 fast chargers for buses, by the end of 2018, there were about 300 000 fast chargers installed globally.

The global EV fleet consumed an estimated 58 terawatt-hours (TWh) of electricity in 2018, similar to the total electricity demand of Switzerland in 2017. China accounted for 80% of world electricity demand for EVs in 2018. The global EV stock in 2018 emitted about 38 million tonnes of carbon dioxide equivalent (Mt CO2-eq) on a well-to-wheel basis.

Meanwhile, on March 1st, 2021, the Transmission Company of Nigeria (TCN), disclosed the attainment of new peak transmission. The company in a statement revealed that it successfully transmitted an enhanced peak generation of 5,801.60Megawatts, MW. The peak generation was transmitted at a frequency of 50.09Hz. With this frequency, Nigeria is still unable to generate 24-hours electricity for its population let alone meet the transmission demand for electric vehicles.

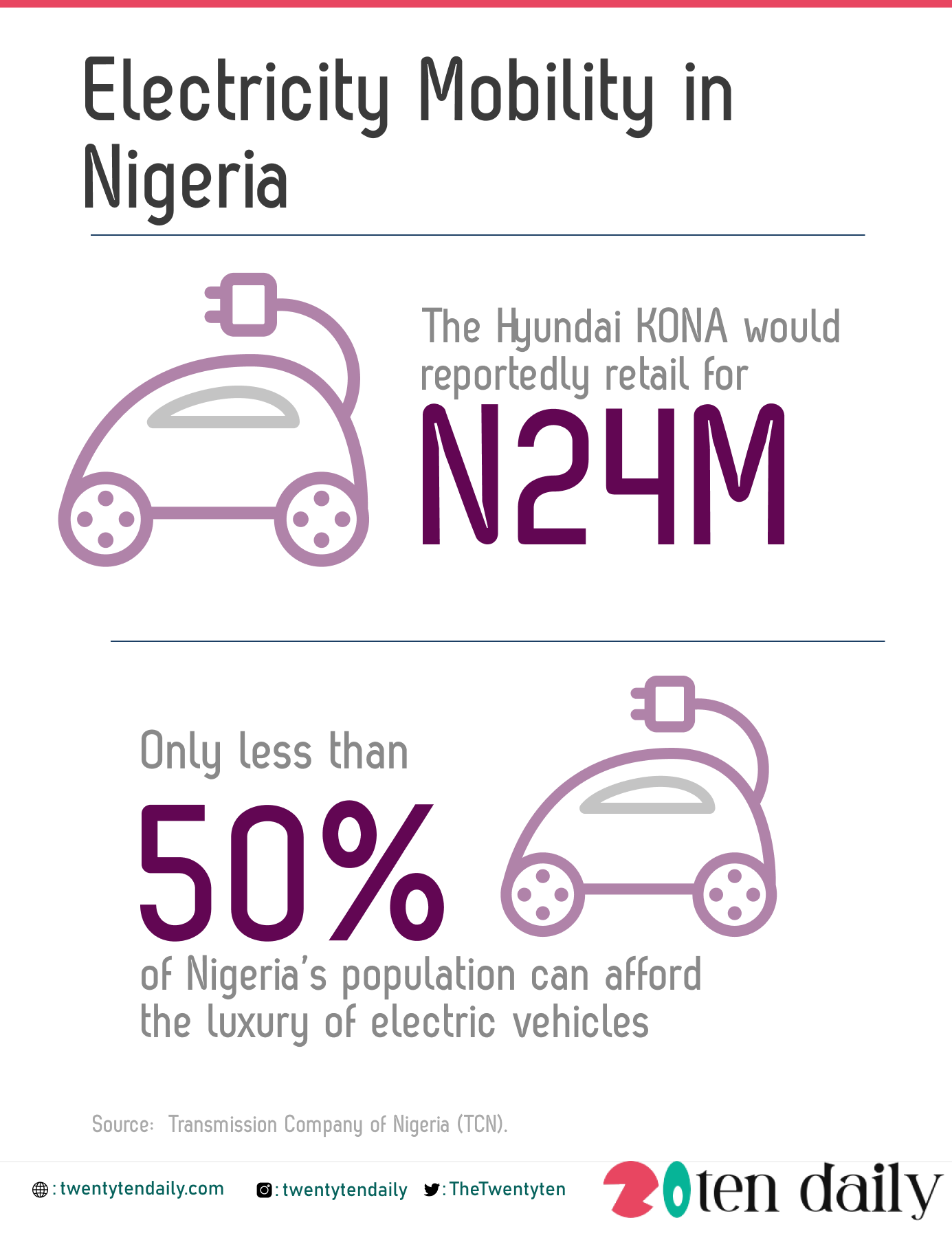

Affordability and Availability

Another reason to question the growth of the EV market in Nigeria and Africa is the issue of affordability.

The newly launched Hyundai Kona would reportedly retail at N24 million while the cheapest Tesla available, the Model 3 starts at $38,190.

Nigeria currently stands as one of the poorest countries in the world with up to 50 percent (estimated 102 million people) of its population currently living in extreme poverty. These statistics only prove that less than 50% of the country’s population can afford the luxury of electric vehicles.

Death Of The Oil Market

A recent report has shown that the drive to the decarbonization of energy supplies through a shift to green energy could cost oil and gas producing countries $13 Trillion by 2040. It says some countries like Nigeria which derive a major part of its revenue through oil sale could lose at least 40% of total government revenue.

The EV technology might be great for the climate but not such a good idea for the already struggling economy in Nigeria.

If truly Nigeria’s intent is the join the rest of the world to ensure sustainable changes that positively impact the ecosystem, one can only assert that the intentions must surely be good but the truth still remains that the country is definitely not ready for the Change.