Member states of the Organization of Petroleum Exporting Countries (OPEC) are struggling to meet up with the rising global demand following the de facto embargo on Russian supplies by many refiners.

Last year, OPEC agreed to boost global oil production by 400,000 barrels per day, after cutting production by a record 10 million barrels per day (BPD) during the Covid-19 pandemic. The group agreed to extend the supply deal until the end of 2022 from an earlier planned date of April 2022.

Unfortunately, operational disruptions and loyalties to member state Russia by some member states are driving shortages in oil production and supply, despite prices rising to US$139 per barrel.

According to a survey by Bloomberg, OPEC pumped 28.58 million barrels per day (BPD) in April, up 40,000 BPD from the previous month and short of the 254,000 BPD increase called for under the supply deal.

OPEC’s failure to boost oil production outputs in April was majorly driven by the underperformance of its African allies due to capacity restraints, driven by insufficient investments.

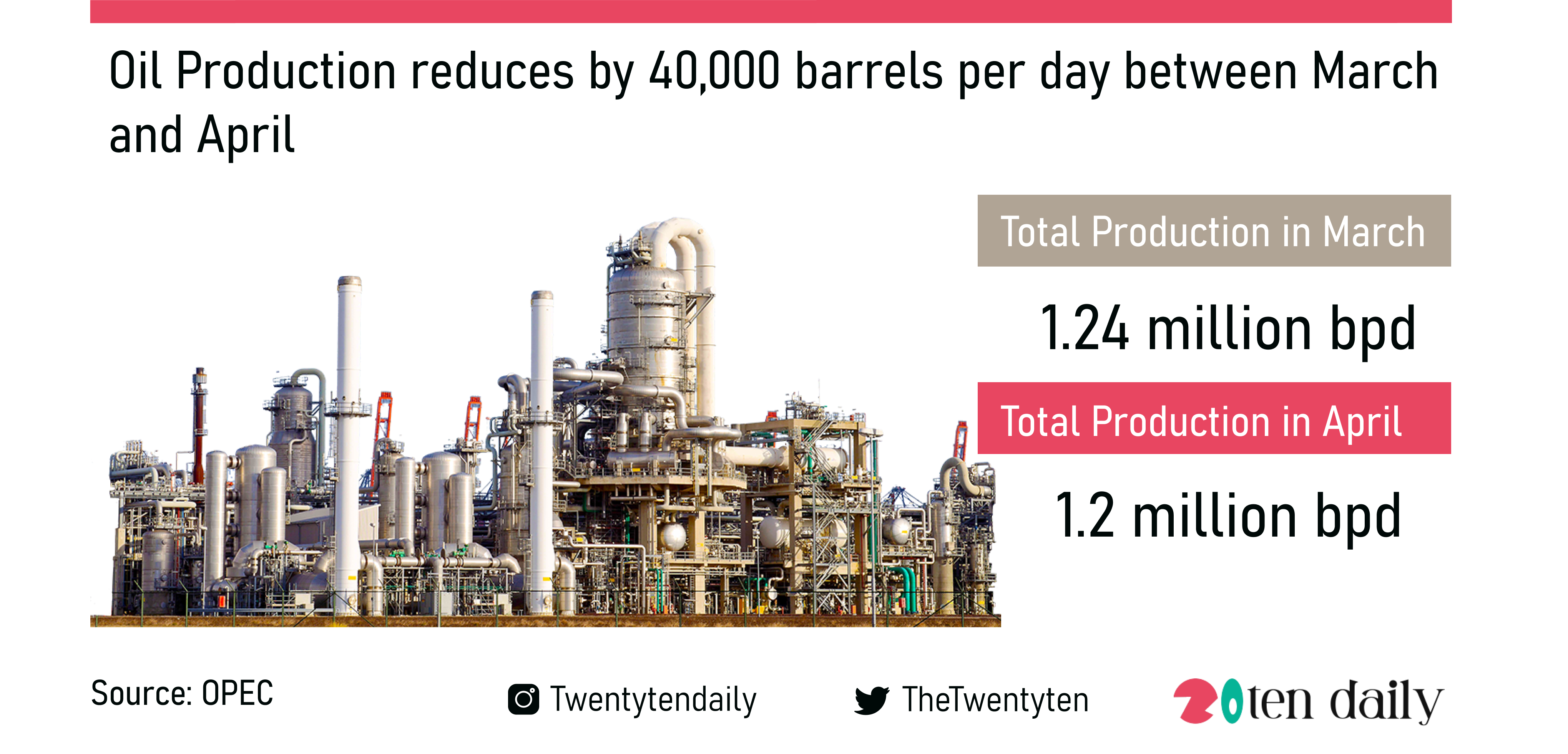

Nigeria’s production output in April was 1.2 million BPD, from 1.24 million barrels per day (BPD) in March 2022. Meaning production in Nigeria dropped by 40,000 barrels per day.

Oil production in Libya had the lowest turnout with an output shortage of up to 600,000 barrels per day. Other countries with zero or low turnouts include Angola, Equatorial Guinea and Gabon.

On the other hand, Iraq’s production output rose from 4.370 million b/d in March to 4.414 million b/d in April, pushing total federal exports to 3.380 million b/d in April. Saudi Arabia topped Iraq’s OPEC contribution by boosting output with 100,000 BPD.

The United Arab Emirates followed through with an output hike by 40,000 BPD, while Kuwait’s output edged up by 10,000 BPD.