Following severe sanctions on Russian exports since its invasion of Ukraine, Europe and the rest of the west are looking to Africa and the Middle East to make up for their energy needs. But is Africa ready to match or perhaps surpass Russia’s energy-exporting capacity within Europe and on a global scale?

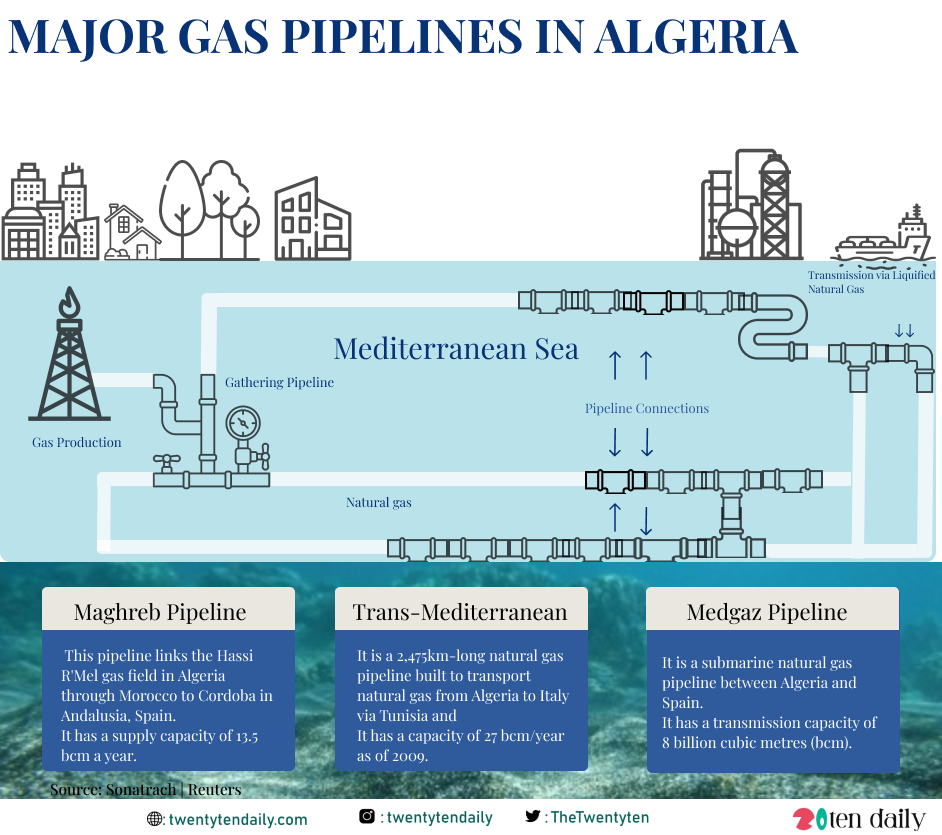

Last week, Algeria pushed into focus after the CEO of the national oil and gas company, Sonatrach, Tawfiq Hakkar, announced the institution can beef up gas supply to Europe via its Trans-Mediterranean pipeline linking Algeria and Italy.

So far, due to the average production capacity (50-60%) of gas plants in the country, Algeria can only export a maximum of 22 billion cubic metres (of gas) via the Transmed pipeline, leaving a capacity of 10 billion cubic metres. Can Algeria then adequately satisfy Europe’s gas needs with this capacity?

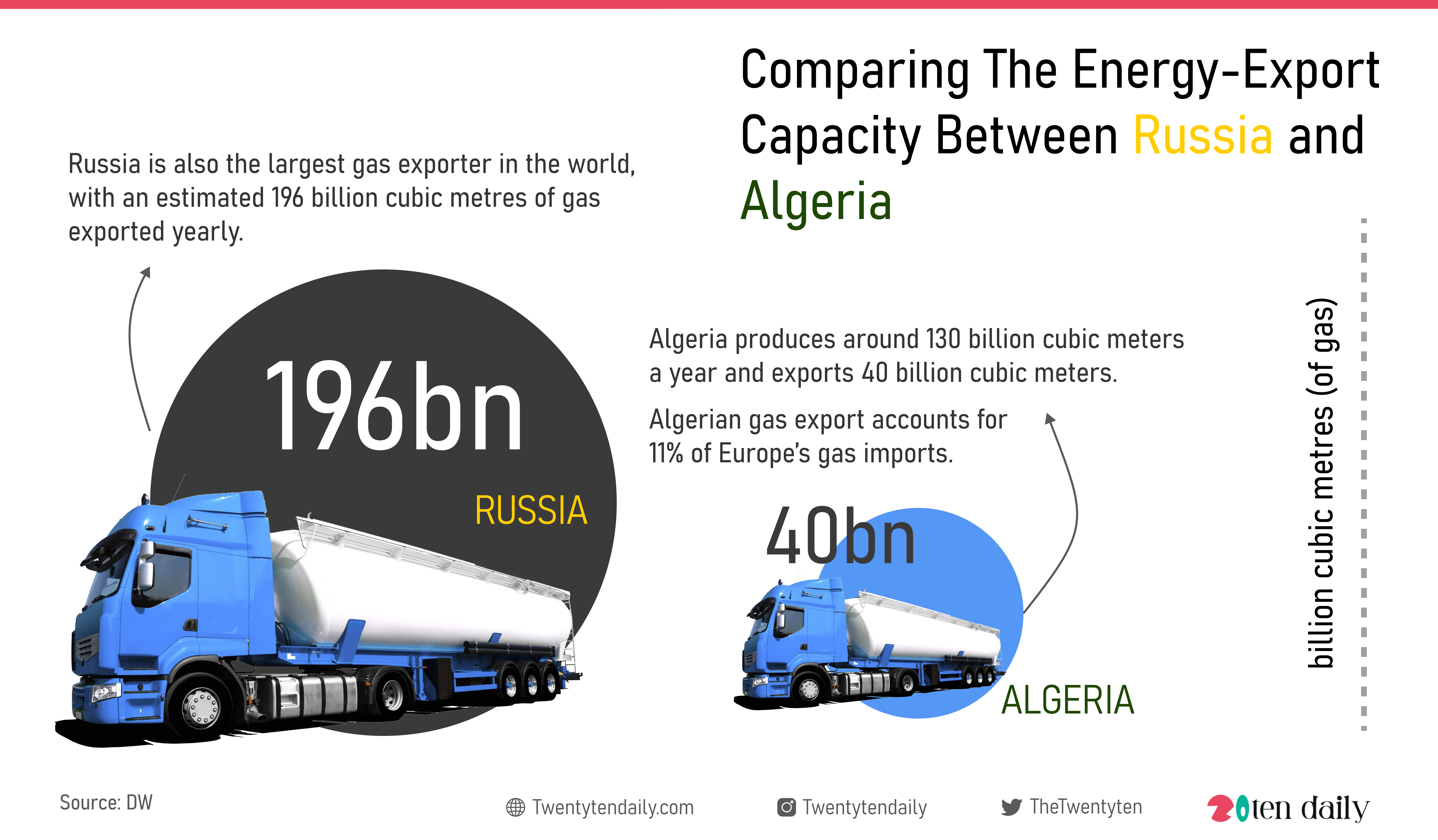

Comparing Gas Export Capacity Between Russia and Algeria

Algeria is one of the largest gas producers in the world and also doubles as one of Europe’s top five LNG exporters, with export capacity running into billions of cubic metres, but is it any match for Russia?

Russia is the world’s leading producer and exporter of gas, with its gas reserve totalling 47,805 billion cubic metres in 2021. Russia is also the largest gas exporter in the world, with an estimated 196 billion cubic metres of gas exported yearly.

On the other hand, Algeria produces around 130 billion cubic meters a year and exports 40 billion cubic meters through several operating pipelines running through Italy and Spain. Algerian gas export accounts for 11% of Europe’s gas imports.

Former Algerian energy minister Abdelmajid Attar shared that Algeria’s current production and exportation capacity can only offer a maximum of two or three million additional cubic meters and not fully compensate for Russia’s gas supply.

Political Tension And Adverse Effect On Algeria’s Gas Exports

Algeria’s export capacity has also been affected by political tensions with neighbouring Morocco. Algeria recently shut gas exportation through the high-capacity Maghreb pipeline after cutting ties with Morocco over diplomatic disagreements.

Algeria switched exports to Spain through the Medgaz pipeline that runs directly between Beni Saf in Algeria and Almería in Spain. But here is the problem, the Maghreb pipeline has a supply capacity of 13.5 bcm a year, while the Medgaz undersea line can carry only 8 billion cubic metres (bcm) a year, creating a shortage of about 5.5 billion bcm.

Looking forward, experts believe Algeria’s production and export capacity possess the potential to improve in the coming months, especially after Sonatrach announced the planned investment of $40 billion into oil exploration, production and refinement, as well as gas prospecting and extraction. However, the question of surpassing or matching Russia’s capacity seems rather unlikely.